- South Korea

- /

- Machinery

- /

- KOSDAQ:A013030

Discover Hy-Lok And Two More Top Dividend Stocks On The KRX

Reviewed by Simply Wall St

The South Korean stock market has shown resilience over the past year, with a notable increase of 6.5% and expectations for annual earnings growth set at 29%. In this stable yet growing environment, dividend stocks like Hy-Lok offer potential for investors looking for reliable income combined with the opportunity for capital appreciation.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 4.36% | ★★★★★★ |

| NH Investment & Securities (KOSE:A005940) | 6.38% | ★★★★★☆ |

| Industrial Bank of Korea (KOSE:A024110) | 7.19% | ★★★★★☆ |

| KT (KOSE:A030200) | 5.40% | ★★★★★☆ |

| Shinhan Financial Group (KOSE:A055550) | 4.40% | ★★★★★☆ |

| LOTTE Fine Chemical (KOSE:A004000) | 4.46% | ★★★★★☆ |

| KB Financial Group (KOSE:A105560) | 3.83% | ★★★★★☆ |

| Kyung Nong (KOSE:A002100) | 4.81% | ★★★★★☆ |

| Tong Yang Life Insurance (KOSE:A082640) | 6.26% | ★★★★☆☆ |

| Samyang (KOSE:A145990) | 3.28% | ★★★★☆☆ |

Click here to see the full list of 69 stocks from our Top KRX Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Hy-Lok (KOSDAQ:A013030)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hy-Lok Corporation, with a market capitalization of approximately ₩342.48 billion, operates globally in the fluid and control system industry.

Operations: Hy-Lok Corporation's revenue streams are not detailed in the provided text.

Dividend Yield: 3.8%

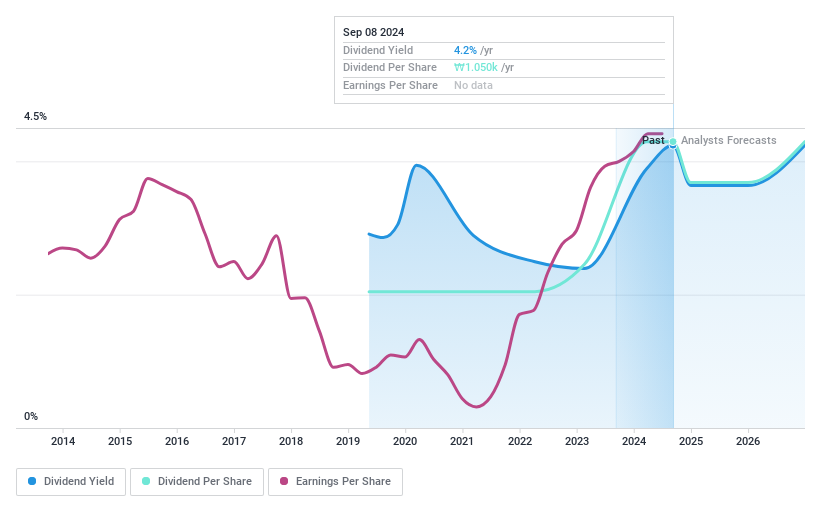

Hy-Lok, despite a short dividend history of five years, has shown promising signs with increasing dividend payments and a stable 3.76% yield, placing it in the top 25% of Korean dividend payers. The dividends are well-supported by both earnings and cash flows, with payout ratios at 26.8% and 34.7%, respectively. Additionally, the stock is trading at a significant discount to its estimated fair value and has recently completed an aggressive share buyback program totaling KRW 14.99 billion, enhancing shareholder value through reduced share count and potential earnings per share increase.

- Click here and access our complete dividend analysis report to understand the dynamics of Hy-Lok.

- Upon reviewing our latest valuation report, Hy-Lok's share price might be too pessimistic.

Industrial Bank of Korea (KOSE:A024110)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Industrial Bank of Korea is a bank focused on financing small and medium-sized enterprises (SMEs) both in Korea and internationally, with a market capitalization of approximately ₩10.77 billion.

Operations: Industrial Bank of Korea primarily generates its revenue by financing small and medium-sized enterprises in Korea and abroad.

Dividend Yield: 7.2%

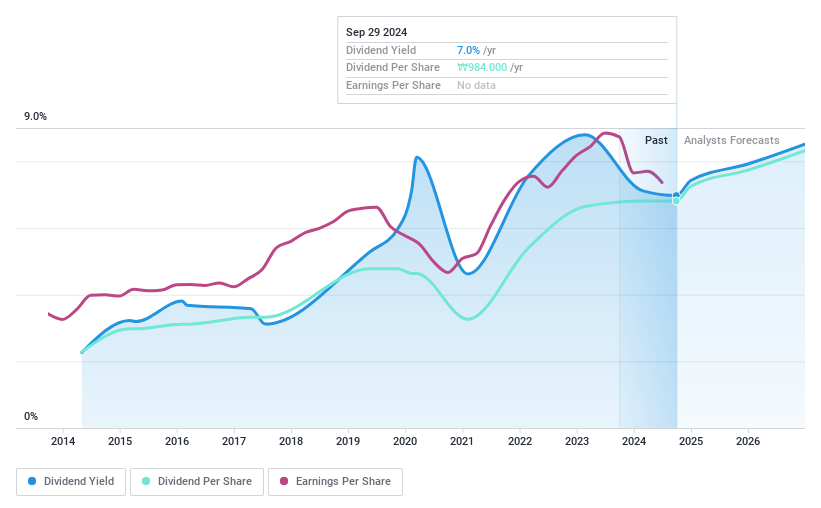

Industrial Bank of Korea's dividend performance presents a mixed scenario. While the bank offers a high yield at 7.19%, among the top 25% in South Korea, its history of dividend payments has been volatile over the past decade. Recent financials show strength, with net interest income rising to KRW 1.98 billion and net income up to KRW 780.8 million in Q1 2024, supporting current dividends with a payout ratio of 32.3%. However, concerns remain due to its reliance on higher-risk funding sources constituting 63% of liabilities.

- Unlock comprehensive insights into our analysis of Industrial Bank of Korea stock in this dividend report.

- According our valuation report, there's an indication that Industrial Bank of Korea's share price might be on the cheaper side.

Woori Financial Group (KOSE:A316140)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Woori Financial Group Inc. operates as a commercial bank in Korea, offering diverse financial services to individuals, businesses, and institutions, with a market capitalization of approximately ₩10.57 trillion.

Operations: Woori Financial Group Inc. generates its revenue primarily through banking services, which brought in ₩7.04 billion, followed by credit card operations at ₩0.42 billion, and capital-related activities contributing ₩0.26 billion.

Dividend Yield: 5%

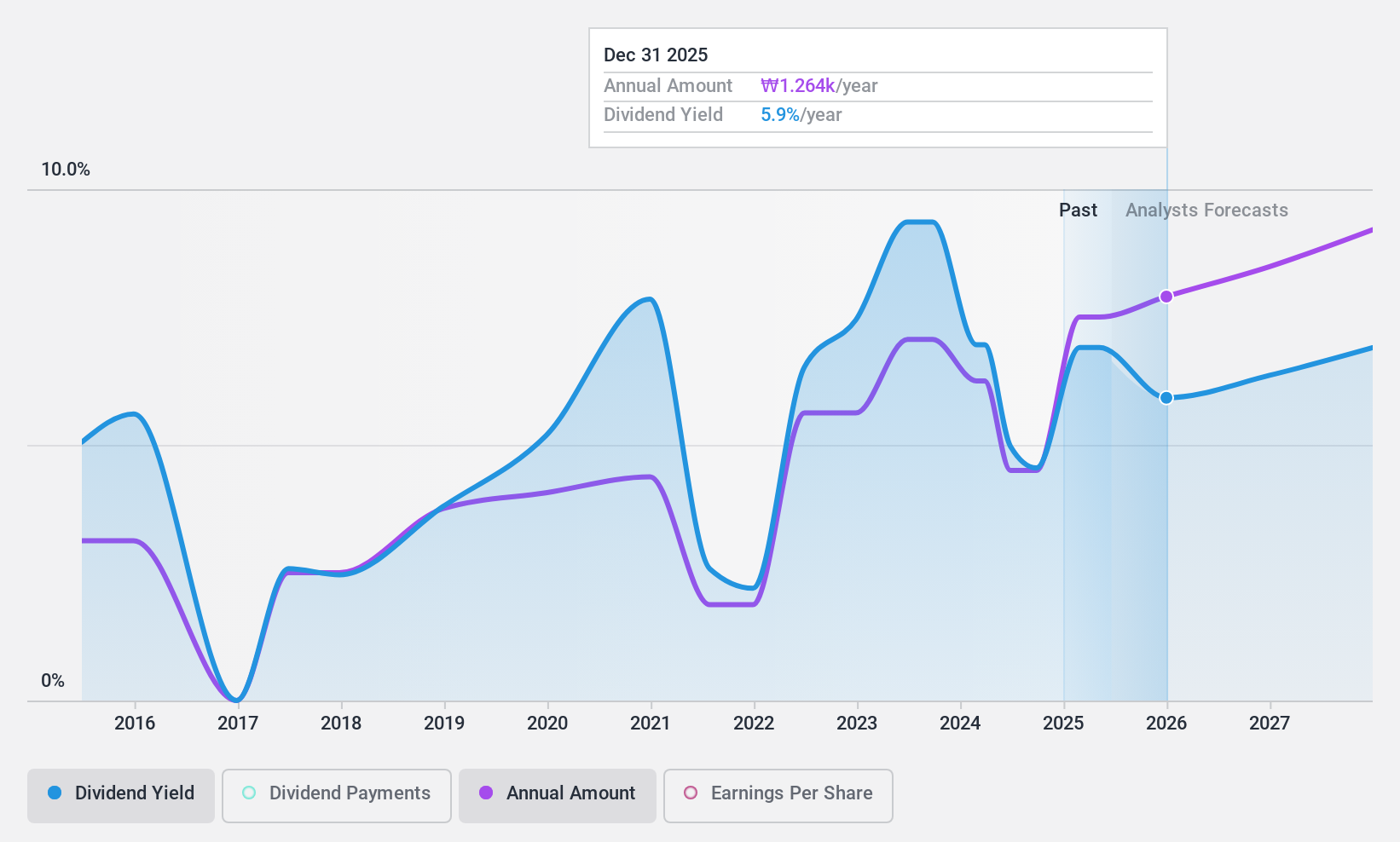

Woori Financial Group's dividend profile shows variability, with a history of unstable payments over the last 9 years. Despite this, dividends are currently well-covered by earnings at a 38.3% payout ratio and projected to remain sustainable with a forecasted payout ratio of 28.5%. Recent financial results indicate a slight decrease in net income from KRW 913.69 billion to KRW 824.49 billion in Q1 2024, but the firm continues to support its dividends, affirming a quarterly payment of KRW 180 per share as of April 2024.

- Get an in-depth perspective on Woori Financial Group's performance by reading our dividend report here.

- Our valuation report here indicates Woori Financial Group may be undervalued.

Turning Ideas Into Actions

- Take a closer look at our Top KRX Dividend Stocks list of 69 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hy-Lok might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A013030

Very undervalued with flawless balance sheet and pays a dividend.