- South Korea

- /

- Auto Components

- /

- KOSE:A092200

The Market Lifts DAE-IL Corporation (KRX:092200) Shares 25% But It Can Do More

DAE-IL Corporation (KRX:092200) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 25%.

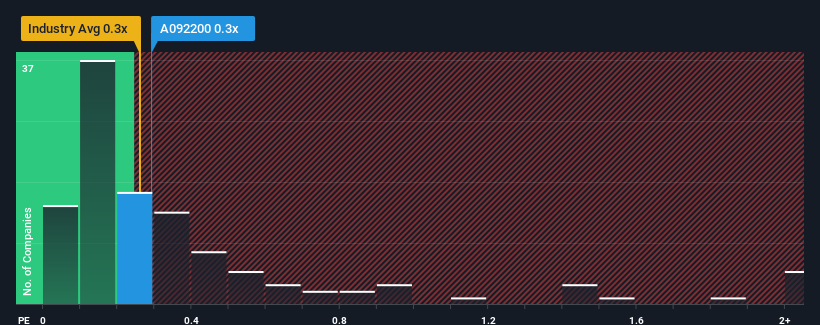

Although its price has surged higher, you could still be forgiven for feeling indifferent about DAE-IL's P/S ratio of 0.3x, since the median price-to-sales (or "P/S") ratio for the Auto Components industry in Korea is about the same. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for DAE-IL

What Does DAE-IL's P/S Mean For Shareholders?

DAE-IL has been doing a decent job lately as it's been growing revenue at a reasonable pace. It might be that many expect the respectable revenue performance to only match most other companies over the coming period, which has kept the P/S from rising. Those who are bullish on DAE-IL will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on DAE-IL will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For DAE-IL?

In order to justify its P/S ratio, DAE-IL would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 4.7% gain to the company's revenues. The latest three year period has also seen an excellent 48% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 5.4% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that DAE-IL is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Final Word

DAE-IL's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that DAE-IL currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 2 warning signs for DAE-IL you should be aware of.

If these risks are making you reconsider your opinion on DAE-IL, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A092200

DAE-IL

Produces gears and shafts for power transmission devices in South Korea and internationally.

Low risk with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success