- South Korea

- /

- Auto Components

- /

- KOSE:A090080

Why Investors Shouldn't Be Surprised By Pyung Hwa Industrial Co., Ltd.'s (KRX:090080) 30% Share Price Surge

Despite an already strong run, Pyung Hwa Industrial Co., Ltd. (KRX:090080) shares have been powering on, with a gain of 30% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 37% in the last year.

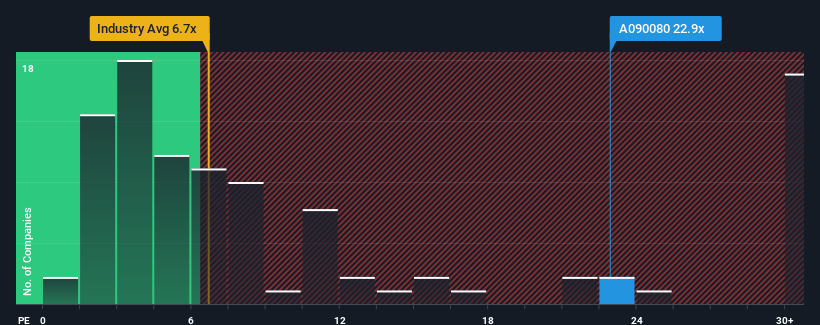

Following the firm bounce in price, Pyung Hwa Industrial's price-to-earnings (or "P/E") ratio of 22.9x might make it look like a strong sell right now compared to the market in Korea, where around half of the companies have P/E ratios below 11x and even P/E's below 6x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Earnings have risen at a steady rate over the last year for Pyung Hwa Industrial, which is generally not a bad outcome. It might be that many expect the reasonable earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Pyung Hwa Industrial

Is There Enough Growth For Pyung Hwa Industrial?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Pyung Hwa Industrial's to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 6.1%. This was backed up an excellent period prior to see EPS up by 1,769% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 22% shows it's noticeably more attractive on an annualised basis.

With this information, we can see why Pyung Hwa Industrial is trading at such a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Key Takeaway

Shares in Pyung Hwa Industrial have built up some good momentum lately, which has really inflated its P/E. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Pyung Hwa Industrial maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Pyung Hwa Industrial (at least 2 which are significant), and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Pyung Hwa Industrial, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A090080

Pyung Hwa Industrial

Produces and sells anti-vibration, air suspension, and hose auto parts for automobiles and equipment facilities in South Korea and internationally.

Solid track record and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success