- South Korea

- /

- Auto Components

- /

- KOSE:A089470

HDC Hyundai Engineering Plastics (KRX:089470) Seems To Use Debt Quite Sensibly

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that HDC Hyundai Engineering Plastics Co., Ltd. (KRX:089470) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for HDC Hyundai Engineering Plastics

What Is HDC Hyundai Engineering Plastics's Net Debt?

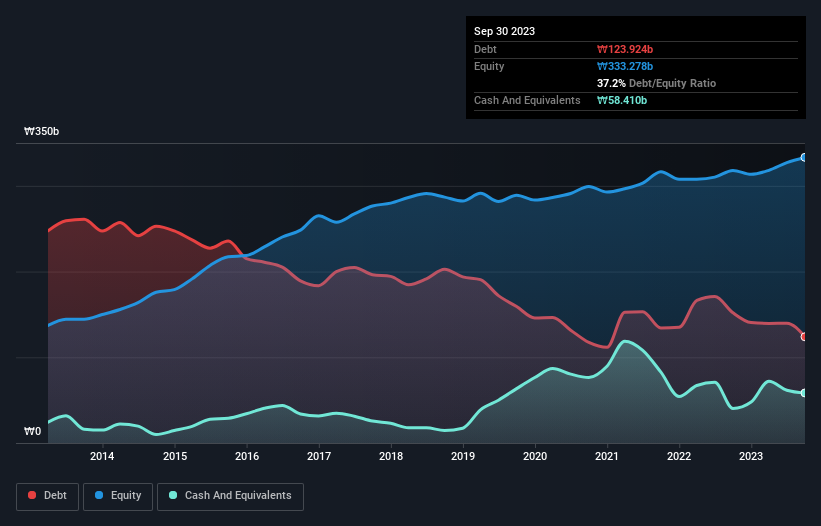

As you can see below, HDC Hyundai Engineering Plastics had ₩123.9b of debt at September 2023, down from ₩151.9b a year prior. On the flip side, it has ₩58.4b in cash leading to net debt of about ₩65.5b.

How Healthy Is HDC Hyundai Engineering Plastics' Balance Sheet?

We can see from the most recent balance sheet that HDC Hyundai Engineering Plastics had liabilities of ₩231.3b falling due within a year, and liabilities of ₩52.2b due beyond that. On the other hand, it had cash of ₩58.4b and ₩187.9b worth of receivables due within a year. So its liabilities total ₩37.1b more than the combination of its cash and short-term receivables.

This deficit isn't so bad because HDC Hyundai Engineering Plastics is worth ₩138.5b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Looking at its net debt to EBITDA of 1.4 and interest cover of 6.7 times, it seems to us that HDC Hyundai Engineering Plastics is probably using debt in a pretty reasonable way. So we'd recommend keeping a close eye on the impact financing costs are having on the business. Better yet, HDC Hyundai Engineering Plastics grew its EBIT by 152% last year, which is an impressive improvement. That boost will make it even easier to pay down debt going forward. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since HDC Hyundai Engineering Plastics will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. In the last three years, HDC Hyundai Engineering Plastics's free cash flow amounted to 36% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Our View

Happily, HDC Hyundai Engineering Plastics's impressive EBIT growth rate implies it has the upper hand on its debt. But truth be told we feel its conversion of EBIT to free cash flow does undermine this impression a bit. Looking at all the aforementioned factors together, it strikes us that HDC Hyundai Engineering Plastics can handle its debt fairly comfortably. Of course, while this leverage can enhance returns on equity, it does bring more risk, so it's worth keeping an eye on this one. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 1 warning sign with HDC Hyundai Engineering Plastics , and understanding them should be part of your investment process.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if HDC Hyundai Engineering Plastics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A089470

HDC Hyundai Engineering Plastics

HDC Hyundai Engineering Plastics Co., Ltd.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives