- South Korea

- /

- Auto Components

- /

- KOSE:A013520

Is Now The Time To Put Hwaseung CorporationLtd (KRX:013520) On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Hwaseung CorporationLtd (KRX:013520). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Hwaseung CorporationLtd's Improving Profits

Strong earnings per share (EPS) results are an indicator of a company achieving solid profits, which investors look upon favourably and so the share price tends to reflect great EPS performance. Which is why EPS growth is looked upon so favourably. Commendations have to be given in seeing that Hwaseung CorporationLtd grew its EPS from ₩78.08 to ₩601, in one short year. Even though that growth rate may not be repeated, that looks like a breakout improvement.

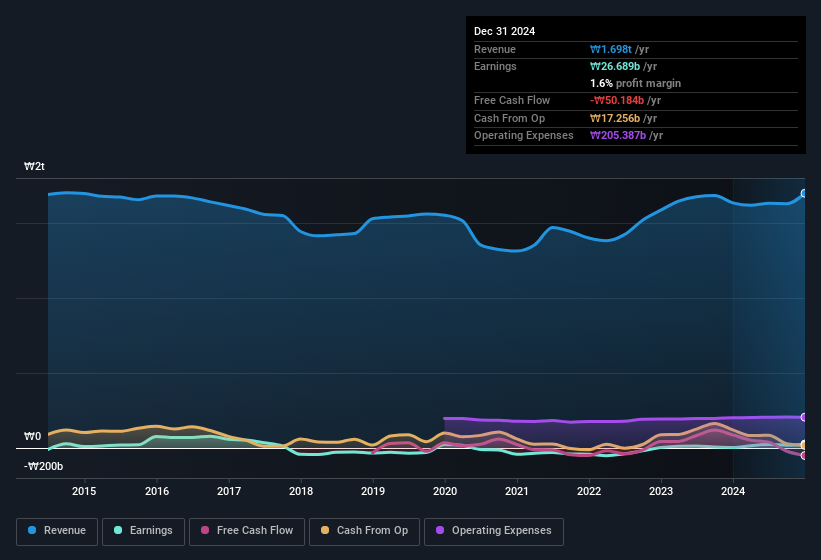

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note Hwaseung CorporationLtd achieved similar EBIT margins to last year, revenue grew by a solid 3.9% to ₩1.7t. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Check out our latest analysis for Hwaseung CorporationLtd

Since Hwaseung CorporationLtd is no giant, with a market capitalisation of ₩85b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Hwaseung CorporationLtd Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So those who are interested in Hwaseung CorporationLtd will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. Actually, with 46% of the company to their names, insiders are profoundly invested in the business. Shareholders and speculators should be reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. In terms of absolute value, insiders have ₩39b invested in the business, at the current share price. That's nothing to sneeze at!

Is Hwaseung CorporationLtd Worth Keeping An Eye On?

Hwaseung CorporationLtd's earnings per share have been soaring, with growth rates sky high. That sort of growth is nothing short of eye-catching, and the large investment held by insiders should certainly brighten the view of the company. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. Based on the sum of its parts, we definitely think its worth watching Hwaseung CorporationLtd very closely. It's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Hwaseung CorporationLtd (at least 1 which is potentially serious) , and understanding these should be part of your investment process.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of South Korean companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hwaseung CorporationLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A013520

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives