- South Korea

- /

- Auto Components

- /

- KOSE:A013520

Concerns Surrounding Hwaseung CorporationLtd's (KRX:013520) Performance

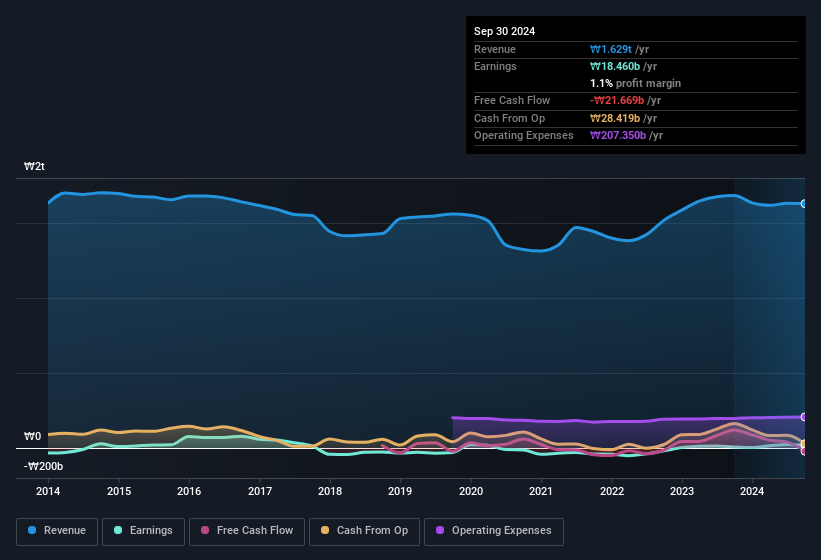

Hwaseung Corporation Co.,Ltd.'s (KRX:013520) robust recent earnings didn't do much to move the stock. However the statutory profit number doesn't tell the whole story, and we have found some factors which might be of concern to shareholders.

View our latest analysis for Hwaseung CorporationLtd

The Impact Of Unusual Items On Profit

For anyone who wants to understand Hwaseung CorporationLtd's profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit gained from ₩8.1b worth of unusual items. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And, after all, that's exactly what the accounting terminology implies. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Hwaseung CorporationLtd.

Our Take On Hwaseung CorporationLtd's Profit Performance

Arguably, Hwaseung CorporationLtd's statutory earnings have been distorted by unusual items boosting profit. Because of this, we think that it may be that Hwaseung CorporationLtd's statutory profits are better than its underlying earnings power. The silver lining is that its EPS growth over the last year has been really wonderful, even if it's not a perfect measure. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. When we did our research, we found 3 warning signs for Hwaseung CorporationLtd (1 shouldn't be ignored!) that we believe deserve your full attention.

This note has only looked at a single factor that sheds light on the nature of Hwaseung CorporationLtd's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Valuation is complex, but we're here to simplify it.

Discover if Hwaseung CorporationLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A013520

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives