- South Korea

- /

- Auto Components

- /

- KOSE:A010770

It Might Not Be A Great Idea To Buy Pyung Hwa Holdings Co., Ltd. (KRX:010770) For Its Next Dividend

Readers hoping to buy Pyung Hwa Holdings Co., Ltd. (KRX:010770) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. Ex-dividend means that investors that purchase the stock on or after the 29th of December will not receive this dividend, which will be paid on the 3rd of April.

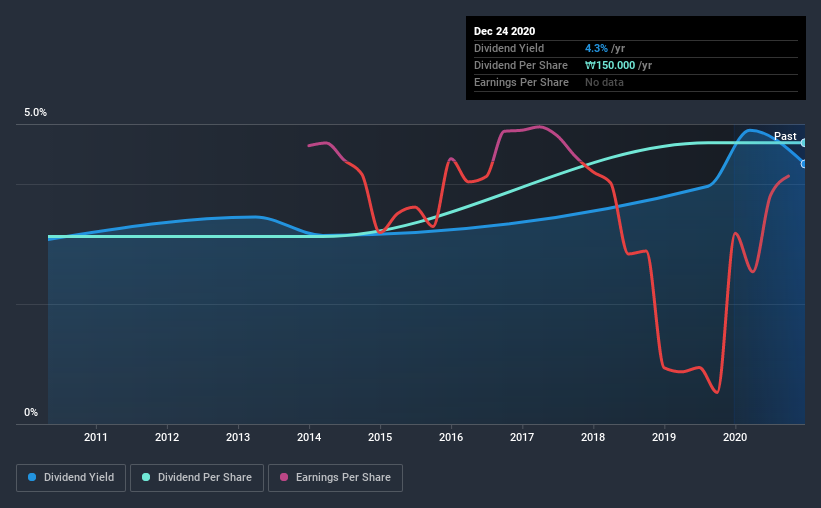

Pyung Hwa Holdings's next dividend payment will be ₩150 per share. Last year, in total, the company distributed ₩150 to shareholders. Calculating the last year's worth of payments shows that Pyung Hwa Holdings has a trailing yield of 4.3% on the current share price of ₩3460. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to investigate whether Pyung Hwa Holdings can afford its dividend, and if the dividend could grow.

See our latest analysis for Pyung Hwa Holdings

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Pyung Hwa Holdings paid a dividend last year despite being unprofitable. This might be a one-off event, but it's not a sustainable state of affairs in the long run. Given that the company reported a loss last year, we now need to see if it generated enough free cash flow to fund the dividend. If Pyung Hwa Holdings didn't generate enough cash to pay the dividend, then it must have either paid from cash in the bank or by borrowing money, neither of which is sustainable in the long term. What's good is that dividends were well covered by free cash flow, with the company paying out 21% of its cash flow last year.

Click here to see how much of its profit Pyung Hwa Holdings paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. Pyung Hwa Holdings was unprofitable last year and, unfortunately, the general trend suggests its earnings have been in decline over the last five years, making us wonder if the dividend is sustainable at all.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. In the last 10 years, Pyung Hwa Holdings has lifted its dividend by approximately 4.1% a year on average.

We update our analysis on Pyung Hwa Holdings every 24 hours, so you can always get the latest insights on its financial health, here.

To Sum It Up

Should investors buy Pyung Hwa Holdings for the upcoming dividend? It's hard to get used to Pyung Hwa Holdings paying a dividend despite reporting a loss over the past year. At least the dividend was covered by free cash flow, however. It's not an attractive combination from a dividend perspective, and we're inclined to pass on this one for the time being.

So if you're still interested in Pyung Hwa Holdings despite it's poor dividend qualities, you should be well informed on some of the risks facing this stock. Be aware that Pyung Hwa Holdings is showing 3 warning signs in our investment analysis, and 1 of those is potentially serious...

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading Pyung Hwa Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A010770

Good value average dividend payer.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026