- South Korea

- /

- Auto Components

- /

- KOSE:A004100

Optimistic Investors Push Taeyang Metal Industrial Co., Ltd. (KRX:004100) Shares Up 29% But Growth Is Lacking

Despite an already strong run, Taeyang Metal Industrial Co., Ltd. (KRX:004100) shares have been powering on, with a gain of 29% in the last thirty days. The annual gain comes to 119% following the latest surge, making investors sit up and take notice.

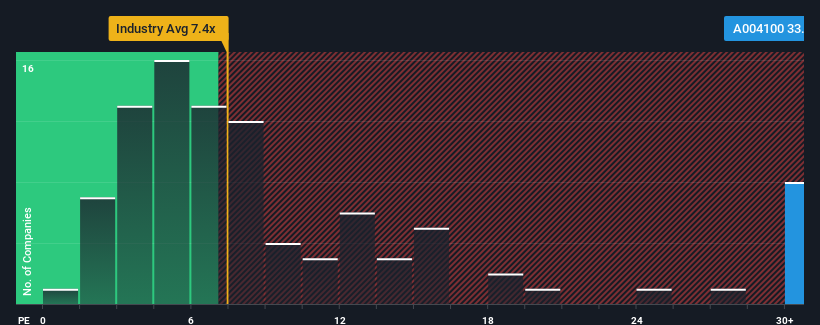

Since its price has surged higher, Taeyang Metal Industrial may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 33.7x, since almost half of all companies in Korea have P/E ratios under 12x and even P/E's lower than 6x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

With earnings growth that's exceedingly strong of late, Taeyang Metal Industrial has been doing very well. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Taeyang Metal Industrial

What Are Growth Metrics Telling Us About The High P/E?

Taeyang Metal Industrial's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered an exceptional 137% gain to the company's bottom line. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 33% shows it's noticeably less attractive on an annualised basis.

In light of this, it's alarming that Taeyang Metal Industrial's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Bottom Line On Taeyang Metal Industrial's P/E

Taeyang Metal Industrial's P/E is flying high just like its stock has during the last month. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Taeyang Metal Industrial currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Taeyang Metal Industrial (of which 2 are significant!) you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Taeyang Metal Industrial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A004100

Taeyang Metal Industrial

Produces and sells cold forging and precision machining parts for automobiles in South Korea and internationally.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives