- South Korea

- /

- Auto Components

- /

- KOSDAQ:A126640

Hwashin Precision Engineering Co., Ltd.'s (KOSDAQ:126640) Popularity With Investors Is Clear

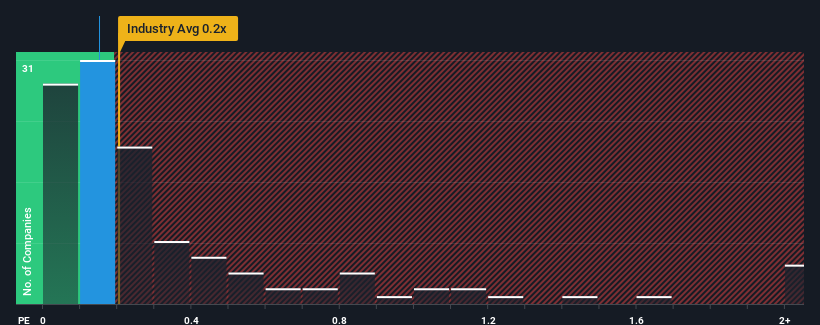

With a median price-to-sales (or "P/S") ratio of close to 0.2x in the Auto Components industry in Korea, you could be forgiven for feeling indifferent about Hwashin Precision Engineering Co., Ltd.'s (KOSDAQ:126640) P/S ratio, which comes in at about the same. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Hwashin Precision Engineering

How Has Hwashin Precision Engineering Performed Recently?

As an illustration, revenue has deteriorated at Hwashin Precision Engineering over the last year, which is not ideal at all. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Hwashin Precision Engineering will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Hwashin Precision Engineering?

In order to justify its P/S ratio, Hwashin Precision Engineering would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 7.0% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 28% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Comparing that to the industry, which is predicted to deliver 9.3% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this in consideration, it's clear to see why Hwashin Precision Engineering's P/S matches up closely to its industry peers. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

The Bottom Line On Hwashin Precision Engineering's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It appears to us that Hwashin Precision Engineering maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. With previous revenue trends that keep up with the current industry outlook, it's hard to justify the company's P/S ratio deviating much from it's current point. Given the current circumstances, it seems improbable that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Hwashin Precision Engineering that you should be aware of.

If these risks are making you reconsider your opinion on Hwashin Precision Engineering, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Hwashin Precision Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A126640

Hwashin Precision Engineering

Manufactures and supplies automobile components in South Korea.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026