- South Korea

- /

- Auto Components

- /

- KOSDAQ:A118990

Motrex's (KOSDAQ:118990) Returns On Capital Are Heading Higher

If we want to find a stock that could multiply over the long term, what are the underlying trends we should look for? One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. Speaking of which, we noticed some great changes in Motrex's (KOSDAQ:118990) returns on capital, so let's have a look.

Return On Capital Employed (ROCE): What Is It?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. Analysts use this formula to calculate it for Motrex:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.073 = ₩43b ÷ (₩913b - ₩320b) (Based on the trailing twelve months to September 2025).

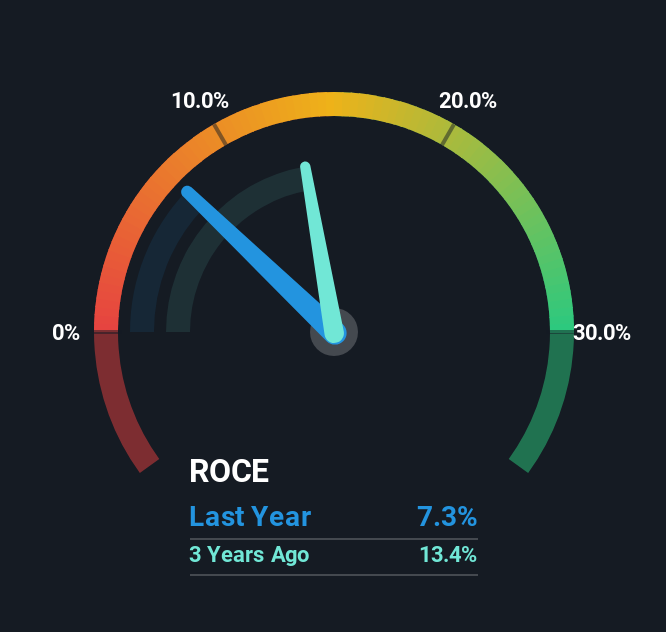

So, Motrex has an ROCE of 7.3%. On its own that's a low return on capital but it's in line with the industry's average returns of 7.3%.

Check out our latest analysis for Motrex

Historical performance is a great place to start when researching a stock so above you can see the gauge for Motrex's ROCE against it's prior returns. If you're interested in investigating Motrex's past further, check out this free graph covering Motrex's past earnings, revenue and cash flow.

How Are Returns Trending?

While in absolute terms it isn't a high ROCE, it's promising to see that it has been moving in the right direction. The numbers show that in the last five years, the returns generated on capital employed have grown considerably to 7.3%. The company is effectively making more money per dollar of capital used, and it's worth noting that the amount of capital has increased too, by 99%. This can indicate that there's plenty of opportunities to invest capital internally and at ever higher rates, a combination that's common among multi-baggers.

The Bottom Line

All in all, it's terrific to see that Motrex is reaping the rewards from prior investments and is growing its capital base. Given the stock has declined 24% in the last five years, this could be a good investment if the valuation and other metrics are also appealing. That being the case, research into the company's current valuation metrics and future prospects seems fitting.

One more thing to note, we've identified 2 warning signs with Motrex and understanding these should be part of your investment process.

While Motrex isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A118990

Motrex

Develops and manufactures vehicle infotainment products in South Korea and internationally.

Acceptable track record with mediocre balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026