- South Korea

- /

- Auto Components

- /

- KOSDAQ:A024740

Hanil Forging Industrial Co., Ltd. (KOSDAQ:024740) Looks Just Right With A 52% Price Jump

Hanil Forging Industrial Co., Ltd. (KOSDAQ:024740) shareholders would be excited to see that the share price has had a great month, posting a 52% gain and recovering from prior weakness. Taking a wider view, although not as strong as the last month, the full year gain of 11% is also fairly reasonable.

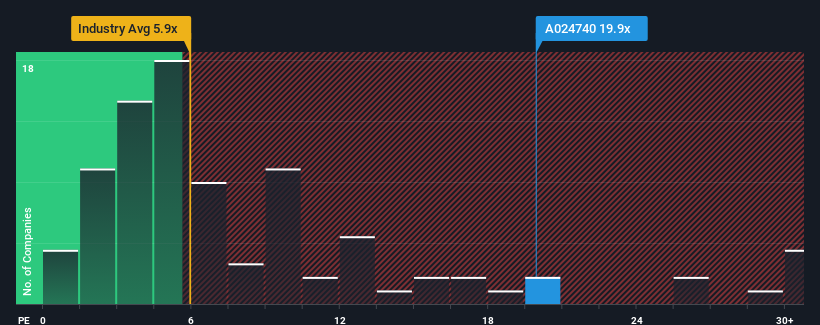

Following the firm bounce in price, Hanil Forging Industrial may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 19.9x, since almost half of all companies in Korea have P/E ratios under 11x and even P/E's lower than 6x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

For instance, Hanil Forging Industrial's receding earnings in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Hanil Forging Industrial

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Hanil Forging Industrial's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 63%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 317% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 31% shows it's noticeably more attractive on an annualised basis.

In light of this, it's understandable that Hanil Forging Industrial's P/E sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

The strong share price surge has got Hanil Forging Industrial's P/E rushing to great heights as well. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Hanil Forging Industrial maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with Hanil Forging Industrial (at least 1 which is a bit concerning), and understanding them should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Hanil Forging Industrial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A024740

Hanil Forging Industrial

Produces and supplies automobile components in South Korea and internationally.

Adequate balance sheet with very low risk.

Market Insights

Community Narratives