- Japan

- /

- Gas Utilities

- /

- TSE:9532

Osaka Gas (TSE:9532) Earnings Surge 47.8%—Profit Spike Challenges Cautious Growth Narrative

Reviewed by Simply Wall St

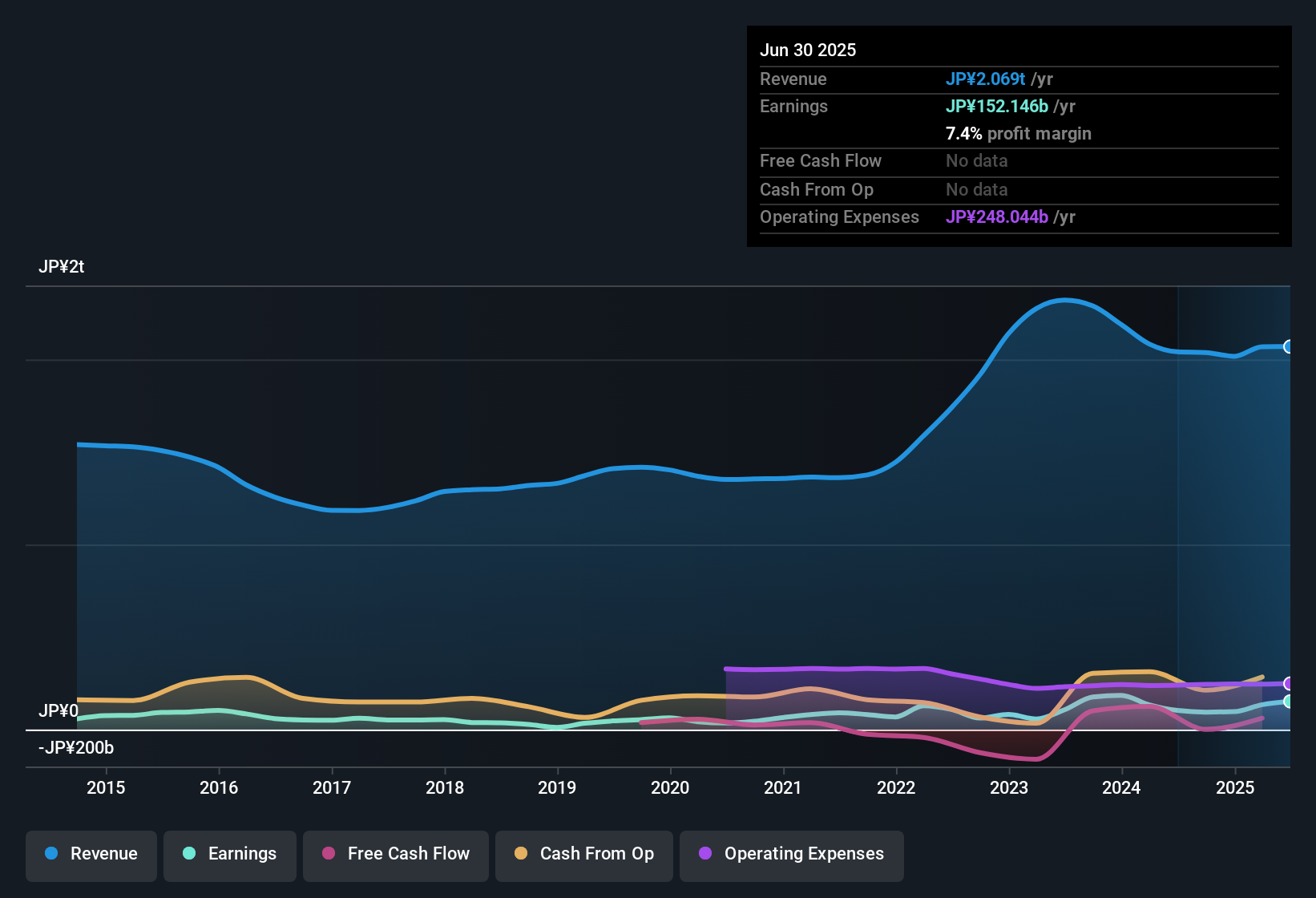

Osaka Gas (TSE:9532) posted a 47.8% jump in earnings for the past year, far outpacing its 5-year average growth rate of 15.2% per year. Net profit margins improved to 7.4% from 5% a year ago, a clear sign of stronger profitability. Investors are weighing this positive track record against guidance for declining revenue and earnings over the next three years, alongside an attractive dividend and favorable valuation metrics, even though the stock is currently trading above fair value.

See our full analysis for Osaka Gas.The question now is how these stronger results compare to the dominant market narratives. Will they reinforce or challenge the community view?

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Guidance Turns Cautious on Growth

- Forecasts call for both revenue and earnings to edge lower in the next three years, with projected average annual declines of 0.4% and 0.2% respectively. This signals that Osaka Gas is guiding for a slowdown after its standout year.

- Investors looking for steady expansion may be surprised by the projected retreat, even as recent results show improved profit margins and robust growth above the five-year trend.

- The guidance for shrinking earnings directly contrasts with Osaka Gas's 47.8% growth rate from the past year. This raises questions about whether that strength is sustainable.

- Prevailing market view emphasizes that, while the utilities sector is seen as a defensive play, these muted forecasts could put a ceiling on excitement until there is a visible growth catalyst.

Dividend Remains a Key Attraction

- Despite soft future guidance, Osaka Gas continues to be recognized for its attractive dividend. It stands out as a reliable source of return in the context of limited growth expectations.

- Prevailing market view highlights that dividend stability and the company’s defensive profile make the stock appealing to more risk-averse investors, even if near-term upside appears capped.

- Bulls might argue that consistent payouts help offset tepid growth forecasts and keep Osaka Gas interesting when other sectors face more volatility.

- However, for those seeking aggressive capital gains, the lack of projected earnings expansion may temper enthusiasm compared to more growth-oriented peers.

Valuation Discount to Industry Benchmarks

- Osaka Gas trades at a Price-to-Earnings Ratio of 12.4x, noticeably below both Asian gas utility peers at 15.3x and the broader industry at 13.7x. This suggests the stock is priced attractively by this metric even as it sits above its DCF fair value of 2104.20.

- Prevailing market view sees this valuation as a key support for investor sentiment because it offers a cushion against sector headwinds and reinforces the idea that quality and yield can warrant a premium.

- The current share price of 4,828.00 is above DCF fair value, indicating the stock is not without risk for value-conscious investors.

- However, its discount to industry multiples aligns it more with "value" than "growth" and supports the thesis that steady performance and dividends, rather than future expansion, are its main draw.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Osaka Gas's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite margin improvements and a solid dividend, Osaka Gas faces sluggish growth prospects and trades above its fair value. This situation limits its long-term upside.

Want steadier revenue and earnings growth? Check out stable growth stocks screener (2110 results) to discover companies with consistent expansion across cycles and less reliance on unpredictable forecasts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9532

Osaka Gas

Provides gas, electricity, and other energy products and services in Japan and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives