- Japan

- /

- Gas Utilities

- /

- TSE:9531

Tokyo Gas (TSE:9531): Valuation in Focus as Shareholder Returns Get Major Boost with Buybacks and Higher Dividends

Reviewed by Simply Wall St

Tokyo Gas Ltd (TSE:9531) just unveiled a major package of shareholder-focused measures. On October 29, the company announced a significant share buyback, raised its dividend, and updated its shareholder return policy to boost capital efficiency.

See our latest analysis for Tokyo GasLtd.

Momentum has been building for Tokyo GasLtd, with a 30.5% year-to-date share price return and an impressive 51.3% total shareholder return over the past year. The recent surge in price, likely fueled by the newly announced buyback and progressive dividend policy, signals shareholders are optimistic about this new era of capital efficiency. Longer-term holders have also seen standout gains, with the company delivering a 149% total return over five years. This is clear evidence of steadily compounding performance even before these latest shareholder moves.

If these kinds of shareholder-focused moves caught your interest, now’s an ideal moment to widen your search and discover fast growing stocks with high insider ownership

But with shares up over 30% this year and Tokyo Gas Ltd trading close to its analyst targets, is the current price a bargain reflecting untapped value, or has the market already priced in all the good news?

Price-to-Earnings of 10.5x: Is it justified?

Tokyo GasLtd’s shares trade at a price-to-earnings (P/E) ratio of 10.5x, which looks attractive compared to its most comparable peers and the broader Japanese market. With the last close at ¥5,722, the stock appears undervalued by this measure compared to similar companies.

The P/E ratio compares a company’s current share price to its per-share earnings, highlighting how much investors are willing to pay today for a single unit of current earnings. For utility companies like Tokyo GasLtd, the P/E helps signal whether the market is pricing in steady profits and future sector prospects.

This company’s P/E of 10.5x is significantly lower than both the peer group average of 15.4x and the Japanese market average of 14.2x. This suggests investors could be underestimating Tokyo GasLtd’s recent earnings strength. However, it trades above the fair price-to-earnings ratio estimate of 7.7x, which may indicate room for realignment as sentiment shifts.

Explore the SWS fair ratio for Tokyo GasLtd

Result: Price-to-Earnings of 10.5x (UNDERVALUED)

However, weak annual net income growth or the stock exceeding analyst price targets could limit further upside for Tokyo GasLtd in the near term.

Find out about the key risks to this Tokyo GasLtd narrative.

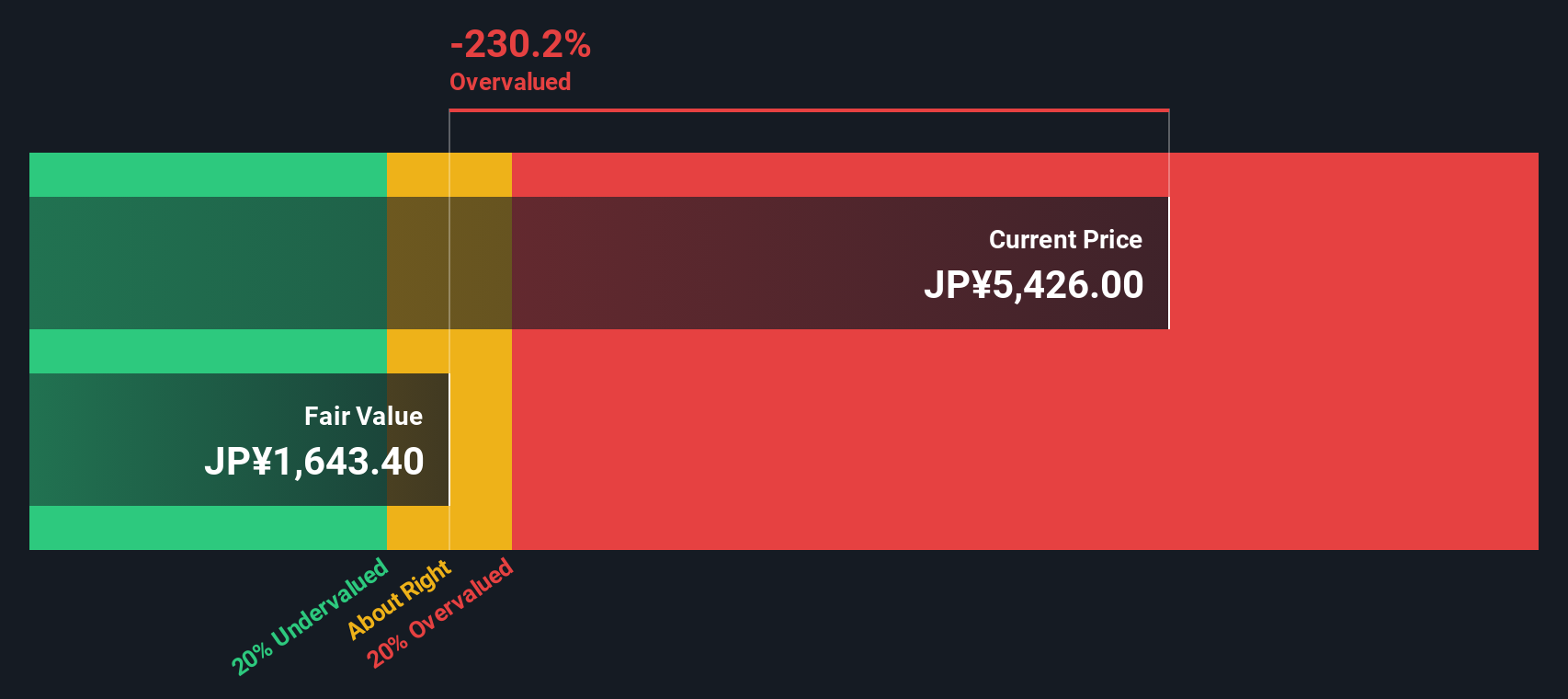

Another View: DCF Model Suggests a Different Story

Switching to our SWS DCF model changes the picture. This approach evaluates future cash flows to estimate true value and indicates that Tokyo GasLtd shares may actually be slightly overvalued, with the current price above the DCF-driven fair value. This could suggest that recent enthusiasm has pushed the shares too far, or there may be other factors supporting the outlook.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tokyo GasLtd for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 843 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tokyo GasLtd Narrative

If our analysis does not fully align with your perspective or you enjoy delving into the details yourself, take just a few minutes to assemble your own Tokyo GasLtd story in your own way with Do it your way.

A great starting point for your Tokyo GasLtd research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for Your Next Winning Idea?

Don’t let great opportunities pass by while you focus on just one story. Simply Wall St’s screener can help you uncover your next smart move today.

- Capture rising yields with these 20 dividend stocks with yields > 3% offering steady incomes well above market averages.

- Spot tomorrow’s technology leaders fast by browsing these 26 AI penny stocks packed with innovators at the forefront of artificial intelligence.

- Secure value and long-term potential from these 843 undervalued stocks based on cash flows, featuring companies priced for outperformance based on robust cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tokyo GasLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9531

Tokyo GasLtd

Engages in the production, supply, and sale of city gas and LNG in Japan.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives