- Japan

- /

- Gas Utilities

- /

- TSE:9531

Tokyo Gas (TSE:9531) Profit Margin Doubles, Reinforcing Bullish Narratives on Operational Turnaround

Reviewed by Simply Wall St

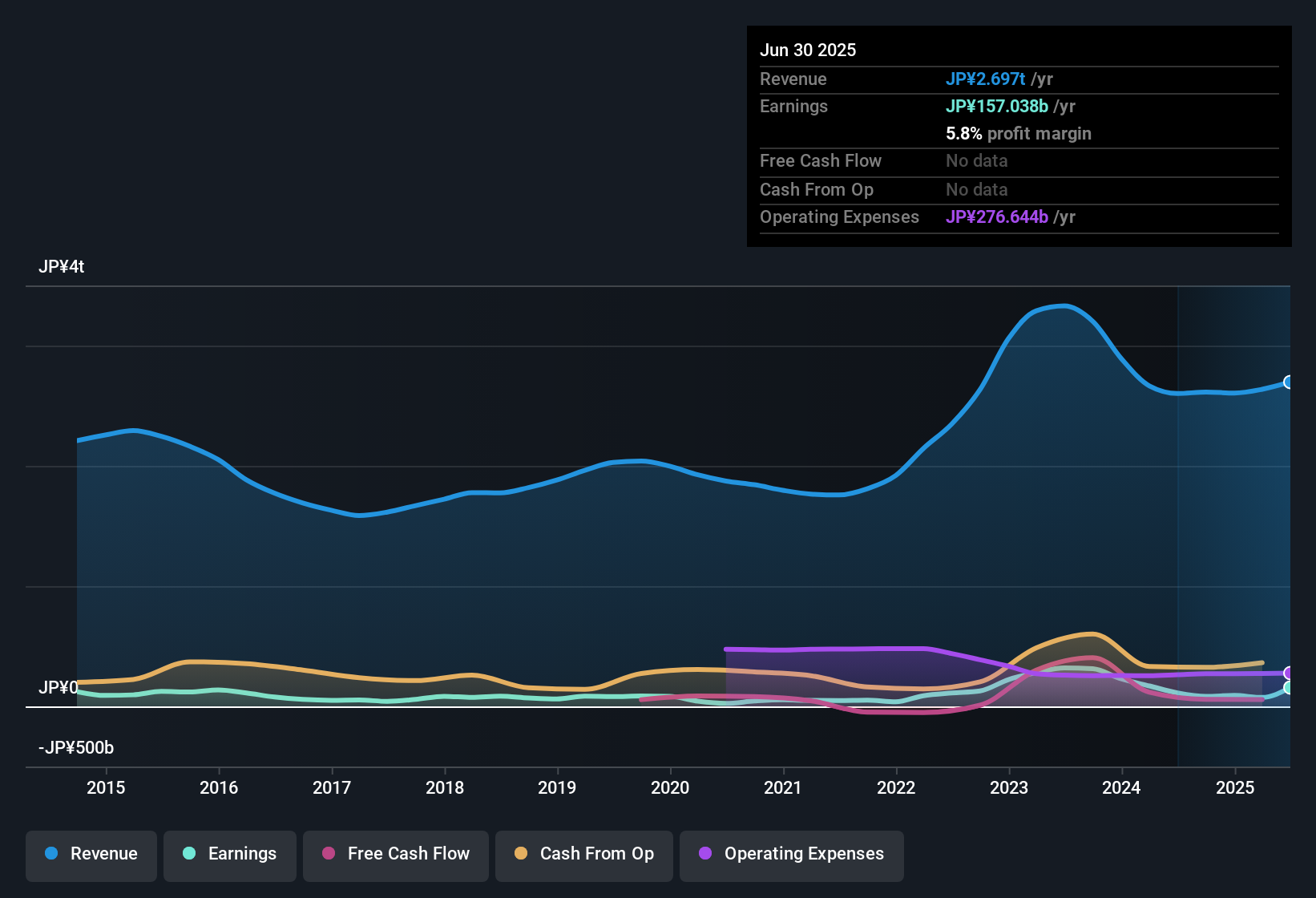

Tokyo Gas Ltd. (TSE:9531) delivered bold profit expansion last year, with earnings rising by 126% compared to its five-year average growth rate of 17.3% per year. Net profit margins surged to 6.8%, up from 3.2% in the prior year, even as the outlook suggests annual earnings could decline by 11.3% over the next three years. Despite the mixed trends, investors may find the current price-to-earnings ratio of 9.8x, well below both its peer group average of 15.5x and the broader Asian Gas Utilities industry at 13.6x, compelling, especially as shares trade below fair value based on discounted cash flow analysis. Tokyo Gas stands out for its improved profitability and value relative to peers, though analysts are keeping a close watch on risks like dividend sustainability and future growth prospects.

See our full analysis for Tokyo GasLtd.The next section compares these latest earnings against widely followed narratives for Tokyo Gas Ltd., highlighting where the fundamentals confirm or contest market expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Nearly Double Year on Year

- Net profit margins reached 6.8%, a significant jump from last year's 3.2%. This highlights a powerful turnaround in core profitability even as broader revenue growth stays largely flat.

- This surge in margin strongly supports the positive view that Tokyo Gas is strengthening its position among Japanese gas utilities.

- Profitability gains offer a potential buffer if revenue softens, as shown in the company’s above-average five-year earnings expansion of 17.3% per year.

- It is notable that, despite the structural transition in the Japanese energy sector, management has maintained a substantial leap in margins. This aligns with the prevailing optimism around utility adaptation and efficiency.

Forecasts Point to Double-Digit Profit Contraction

- Despite last year’s profit surge, the latest projections show annual earnings and revenue declining by 11.3% and 0.01% per year over the next three years, respectively. This signals a turn in the company’s profit cycle.

- Prevailing analysis stresses that, while short-term results look strong, medium-term risks are mounting.

- Analysts are watching for any indications that cost inflation or regulatory changes could unwind recent margin improvements, especially given flat revenue outlooks.

- Guidance for negative growth, even from a higher starting point, puts extra scrutiny on Tokyo Gas’s efforts to diversify amid industry policy shifts and energy transition trends.

Valuation Supports Upside Despite Growth Worries

- Tokyo Gas shares trade at a 9.8x price-to-earnings ratio and at 5324.0 yen per share. Both are below the DCF fair value of 5383.27 and well under industry and peer multiples.

- The prevailing market view highlights that, although profit growth is expected to contract, the shares’ discounted valuation relative to both peers (15.5x) and the broader sector (13.6x) may draw interest from value-focused investors.

- The share price currently sits below estimated DCF fair value and even further below broader peer benchmarks. This may offer downside protection even as fundamentals soften.

- Investors will be weighing this valuation gap alongside risk factors such as dividend sustainability and the uncertain earnings trajectory in the years ahead.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Tokyo GasLtd's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite Tokyo Gas's impressive margin recovery, earnings are projected to decline and revenue growth is expected to remain flat over the next few years.

If you prefer names that keep compounding regardless of the cycle, check out stable growth stocks screener (2112 results) to find companies showing strong, consistent performance year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tokyo GasLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9531

Tokyo GasLtd

Engages in the production, supply, and sale of city gas and LNG in Japan.

Solid track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives