- Japan

- /

- Electric Utilities

- /

- TSE:9509

Hokkaido Electric (TSE:9509) Margin Decline Challenges Market Narrative on Utility Resilience

Reviewed by Simply Wall St

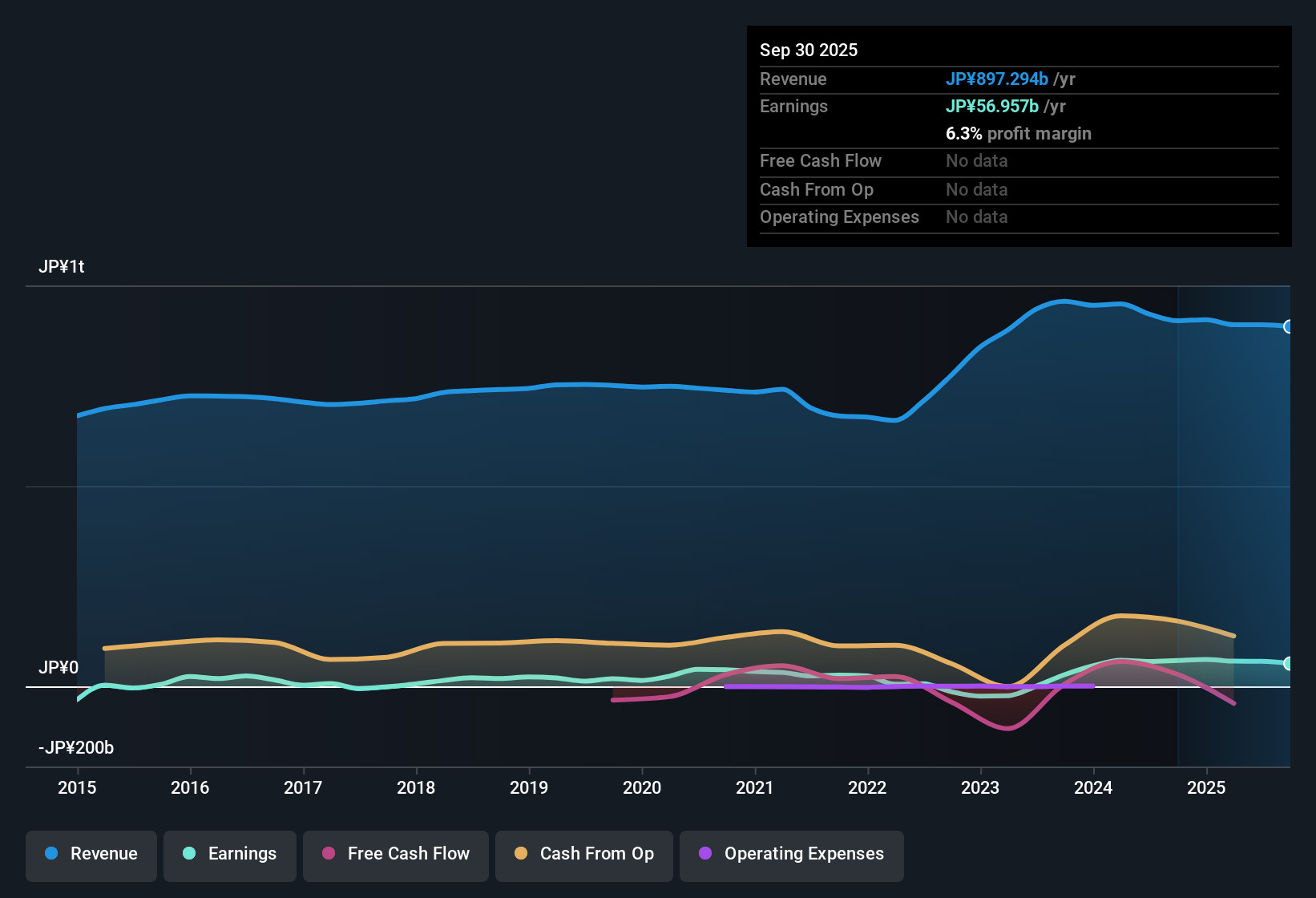

Hokkaido Electric Power Company (TSE:9509) posted a modest earnings growth forecast of 1.08% per year, with net profit margins at 6.4%, down from 7.1% in the prior period. Over the past five years, the company delivered average annual earnings growth of 24.7%, but revenue is now projected to decline slightly at a rate of -0.09% per year. As investors weigh these figures, the key question is whether Hokkaido Electric Power’s impressive track record can balance softer profit expectations and tightening margins in the periods ahead.

See our full analysis for Hokkaido Electric Power Company.The next section will break down how these results measure up to the current narratives and expectations driving sentiment on the stock. Let’s see which storylines stand up to the numbers, and which ones may need a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Narrow Despite Strong Five-Year Growth

- Net profit margins have slipped from 7.1% to 6.4% this period. Even as annual earnings growth averaged 24.7% over the past five years, this reveals that despite historical strength, profitability is now getting squeezed.

- Prevailing market analysis underscores that utility sector companies like Hokkaido Electric often get credit for past resilience. However, the pressure from margin softening tends to outweigh those gains for shareholders now.

- A slower forecasted earnings growth rate of 1.08% per year underlines the risk that previous strong performance may not be repeated.

- With margins edging lower, investors may start placing more weight on current cash flows rather than the company’s solid past record.

Revenue Trend Dips Below Peers

- Revenue is projected to decline marginally at -0.09% per year. This is notable given that the broader Japanese market expects higher utility revenue, placing Hokkaido Electric at a disadvantage on the top line.

- Current market thinking suggests this sluggish trajectory erodes the bullish thesis centered on defensive value and yield stability.

- Retail forums and recent market narrative highlight how peers with even modest revenue growth are attracting more favorable sentiment and potentially premium valuations.

- Despite historical earnings strength, the anticipated revenue shrinkage stands out, making Hokkaido Electric less compelling compared to more growth-oriented industry players.

Valuation Appeals on PE, But Risks Weigh on Sentiment

- The company’s price-to-earnings ratio screens as good value versus the broader Asian electric utilities industry. However, valuation looks less compelling against direct peers, especially amid warnings around financial position and dividend sustainability.

- Prevailing analysis points to a crucial tension. The stock’s perceived discount is only meaningful if Hokkaido Electric can address flagged risks such as its less stable balance sheet.

- Despite sector support for utility “safety,” volatility in the share price and concerns over the unsustainable dividend may limit any upside from a value-anchored strategy.

- Analysts note that investors may demand an even greater discount unless management proves future profits and dividend support are secure.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Hokkaido Electric Power Company's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Hokkaido Electric Power’s weakening profit margins, slowing earnings growth, and concerns around dividend sustainability highlight growing risks for investors seeking reliable income.

For steadier payouts and stronger fundamentals, check out these 1998 dividend stocks with yields > 3% that spotlight proven performers with yields exceeding 3% and more resilient dividend profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hokkaido Electric Power Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9509

Hokkaido Electric Power Company

Generates, transmits, and distributes electricity in Japan.

Mediocre balance sheet second-rate dividend payer.

Market Insights

Community Narratives