- Japan

- /

- Electric Utilities

- /

- TSE:9508

Kyushu Electric (TSE:9508): Evaluating Valuation After Holding Company Restructuring Plans

Reviewed by Simply Wall St

Kyushu Electric Power Company (TSE:9508) has announced plans to transition to a holding company structure, aiming to optimize management and boost group competitiveness. This move reflects the company's strategy to navigate a shifting business landscape.

See our latest analysis for Kyushu Electric Power Company.

Kyushu Electric’s momentum has picked up over the past quarter with a 13.1% share price return, even though total shareholder return dipped 4% over the last year. The company’s renewed focus on governance and group flexibility could help reignite long-term performance, particularly considering its robust 125% total return over three years.

If you’re interested in seeing which other companies are showing strong growth backed by insider confidence, there’s never a better time to check out fast growing stocks with high insider ownership

With shares trading below analyst targets and mixed recent returns, the question remains: is Kyushu Electric undervalued amid its structural transformation, or is the market already pricing in the company’s next stage of growth?

Price-to-Earnings of 5.4x: Is it justified?

Kyushu Electric’s stock trades at a price-to-earnings (P/E) ratio of 5.4x, which is notably lower than that of many domestic and regional peers. This potentially suggests undervaluation against current sector norms and the company's recent closing price of ¥1,515.

The price-to-earnings ratio compares the company’s market price to its earnings per share. For utilities like Kyushu Electric, this multiple is commonly used to assess if investors are paying a reasonable price for current profits given the industry’s stable but often low-growth characteristics.

The company’s P/E of 5.4x is less than half the Japanese market’s average of 14.4x and significantly below the Asian electric utilities industry average of 17.1x. This indicates that the market may be underpricing its earnings potential. However, when compared to direct peers, Kyushu Electric appears somewhat more expensive than the peer average of 4.3x. Regression analysis also estimates a fair P/E ratio for Kyushu Electric at 8.5x, emphasizing that current market pricing remains conservative relative to what could be justified by fundamentals.

Explore the SWS fair ratio for Kyushu Electric Power Company

Result: Price-to-Earnings of 5.4x (UNDERVALUED)

However, risks remain. Recent declines in revenue and annual net income growth could limit any near-term re-rating of the stock.

Find out about the key risks to this Kyushu Electric Power Company narrative.

Another View: DCF Offers a Sharper Lens

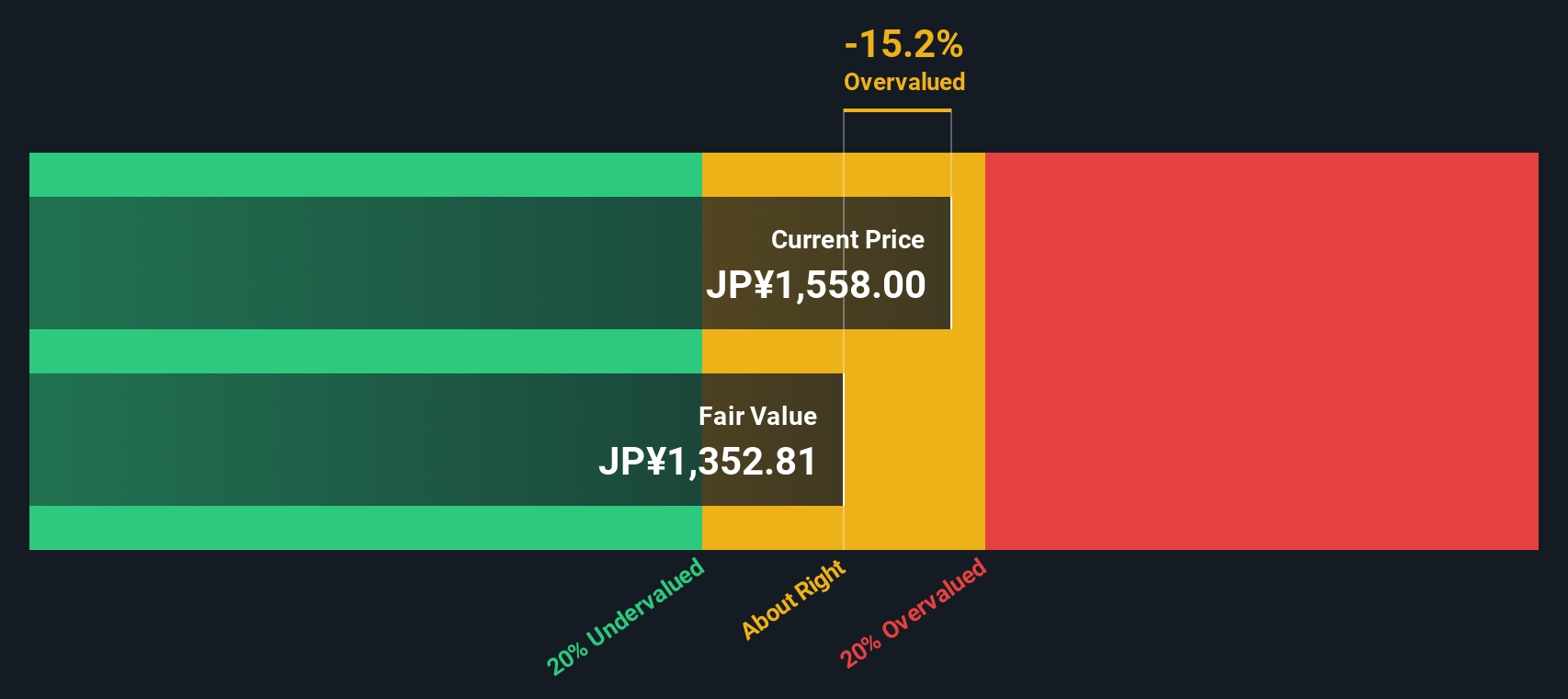

While the price-to-earnings ratio hints at undervaluation, our SWS DCF model signals a different story. With shares trading above our estimate of fair value (¥1,408.98 vs. ¥1,515.00), the model suggests Kyushu Electric may be slightly overvalued at current prices. It is worth considering whether the market is overestimating future cash flows.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kyushu Electric Power Company for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 833 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kyushu Electric Power Company Narrative

If you’d rather follow your own insights or dig deeper into the underlying numbers, it’s easy to assemble your personal view in just a few minutes with Do it your way

A great starting point for your Kyushu Electric Power Company research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Get ahead of the market with fresh stock ideas, tailored to new trends and untapped opportunities, to give your investment strategy a crucial boost.

- Tap into tomorrow’s breakthroughs by checking out these 26 AI penny stocks, where innovation is driving rapid growth and transforming entire industries.

- Boost your income strategy and enjoy steady returns through these 24 dividend stocks with yields > 3%, offering strong yields and reliable payouts for investors seeking more from their portfolio.

- Power up your portfolio with untapped value by reviewing these 833 undervalued stocks based on cash flows, featuring companies trading at attractive prices based on robust cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kyushu Electric Power Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9508

Kyushu Electric Power Company

Engages in the power generation, transmission, distribution, and retail in Japan and internationally.

Solid track record average dividend payer.

Market Insights

Community Narratives