- Japan

- /

- Electric Utilities

- /

- TSE:9508

Kyushu Electric Power (TSE:9508) Net Margin Nearly Doubles, Reinforcing Profitability Narrative

Reviewed by Simply Wall St

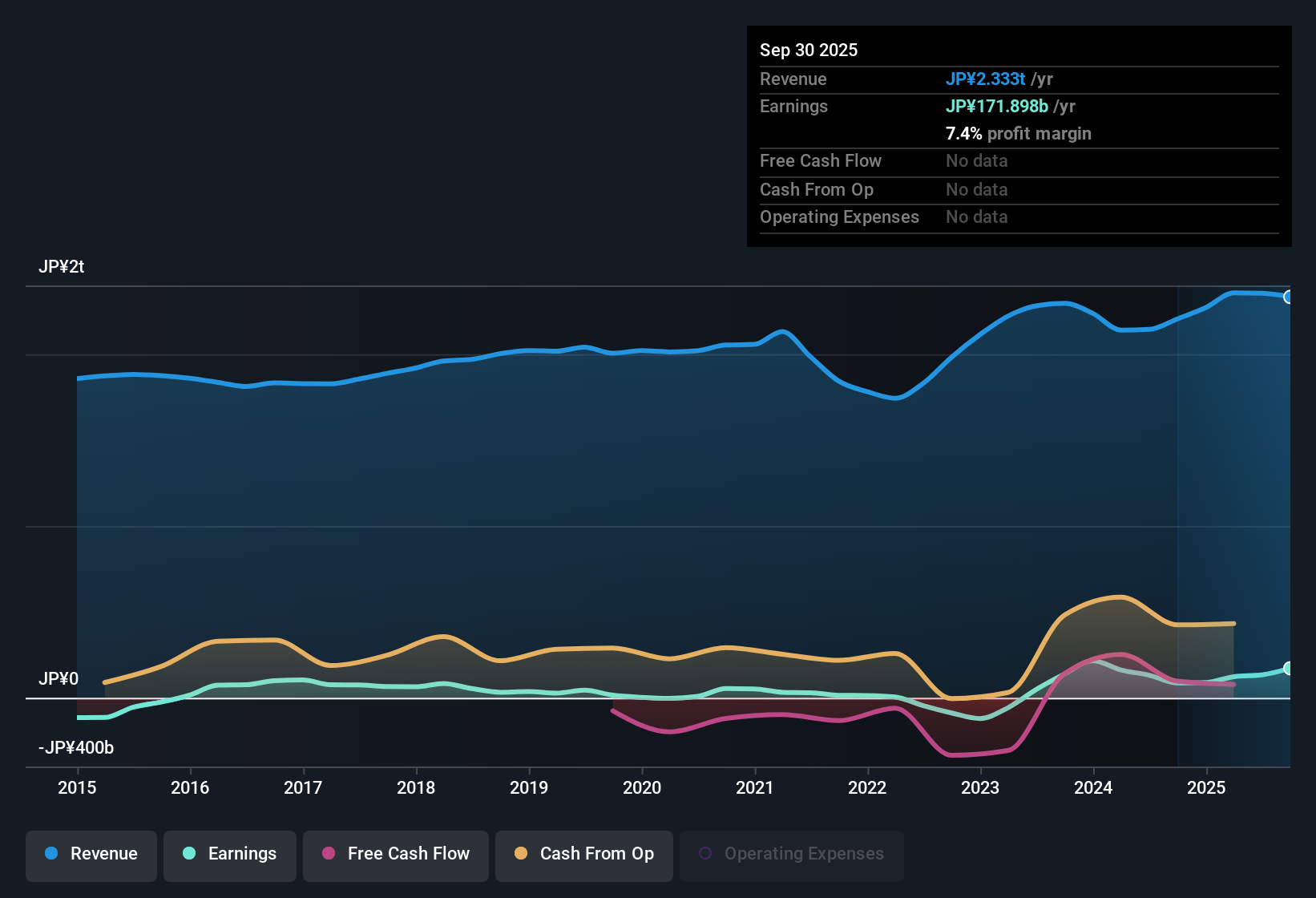

Kyushu Electric Power Company (TSE:9508) delivered a net profit margin of 7.5%, up from 3.9% previously, and achieved a remarkable 105.4% earnings growth over the past year. This far surpasses its 5-year average growth of 37% per year. The company’s track record is marked by high-quality earnings and sustained profit expansion. However, forecasts now signal pressure ahead, with revenue and earnings expected to trend lower over the coming three years. Despite these headwinds, the stock trades at a relatively low 4.1x price-to-earnings ratio, well below the industry average. This suggests attractive value but with reasons for investor caution.

See our full analysis for Kyushu Electric Power Company.The next section weighs these results against some of the most-followed narratives about Kyushu Electric Power Company, highlighting which themes are reinforced and what might need a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Improvement Signals Stability

- Kyushu Electric Power’s net profit margin improved to 7.5%, nearly doubling from 3.9%, suggesting greater operational efficiency in recent periods.

- Sustained profit growth over the last five years strongly supports the view that the company’s regulated business model and large customer base provide a stable earnings foundation.

- This margin expansion, together with a 105.4% annual earnings growth rate, strengthens arguments that government initiatives and defensive utility characteristics buffer results against sector volatility.

- However, optimistic expectations for a rapid re-rating depend on further government support, such as nuclear restarts, which are not ensured by historical profits alone.

Dividend Sustainability Concerns Remain

- Risks identified include the sustainability of current dividend payouts, with expectations for declining revenue (minus 1.6% per year) and earnings (minus 5.3% per year) over the next three years.

- Critics note that although historical payout consistency attracts income-focused investors, concerns remain regarding the financial position and future growth outlook.

- Some observers point to the projected earnings decline as a sign that maintaining dividends could pressure the company’s balance sheet if profitability trends reverse.

- These concerns are heightened by sector cost pressures and regulatory uncertainty, leading some to caution against relying solely on past dividend stability.

Valuation Discount Versus Industry Peers

- The company is trading at a price-to-earnings multiple of 4.1 times, considerably lower than the industry average of 17 times, suggesting shares are valued attractively relative to peers.

- The prevailing market view notes that while the current share price of 1,515.00 is only modestly above the DCF fair value estimate of 1,432.14, further upside depends on new policy catalysts, as sector-wide headwinds may limit near-term revaluation.

- Analysts and investors continue to debate whether sector momentum and increased policy clarity could justify a premium, or if the current discount primarily reflects ongoing uncertainty and profit headwinds.

- Low valuation metrics do not guarantee outperformance if forecast profit declines take place, so careful monitoring is warranted.

See our latest analysis for Kyushu Electric Power Company.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Kyushu Electric Power Company's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite its solid history, Kyushu Electric Power now faces uncertain earnings, declining revenue forecasts, and ongoing concerns about the sustainability of its dividend payouts.

If reliable income is a priority, check out these 1997 dividend stocks with yields > 3% to find companies that may be better positioned for dependable dividends even when sector conditions shift.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kyushu Electric Power Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9508

Kyushu Electric Power Company

Engages in the power generation, transmission, distribution, and retail in Japan and internationally.

Solid track record average dividend payer.

Market Insights

Community Narratives