- Japan

- /

- Electric Utilities

- /

- TSE:9507

Investors Appear Satisfied With Shikoku Electric Power Company, Incorporated's (TSE:9507) Prospects

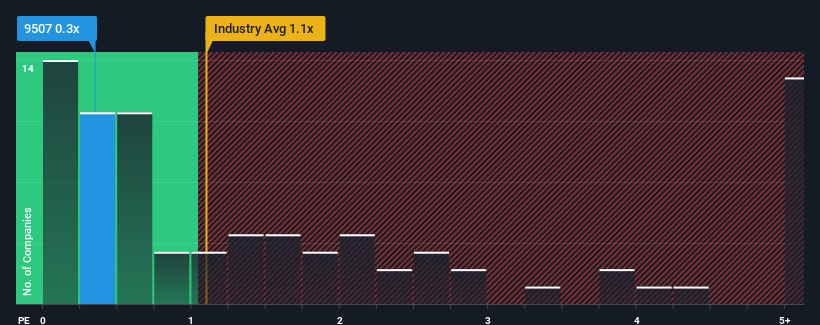

It's not a stretch to say that Shikoku Electric Power Company, Incorporated's (TSE:9507) price-to-sales (or "P/S") ratio of 0.3x seems quite "middle-of-the-road" for Electric Utilities companies in Japan, seeing as it matches the P/S ratio of the wider industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Shikoku Electric Power Company

How Has Shikoku Electric Power Company Performed Recently?

Shikoku Electric Power Company's negative revenue growth of late has neither been better nor worse than most other companies. It seems that few are expecting the company's revenue performance to deviate much from most other companies, which has held the P/S back. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. At the very least, you'd be hoping that revenue doesn't accelerate downwards if your plan is to pick up some stock while it's not in favour.

Keen to find out how analysts think Shikoku Electric Power Company's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Shikoku Electric Power Company?

The only time you'd be comfortable seeing a P/S like Shikoku Electric Power Company's is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 6.4%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 18% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 0.9% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 0.3% each year, which is not materially different.

With this information, we can see why Shikoku Electric Power Company is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On Shikoku Electric Power Company's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at Shikoku Electric Power Company's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Shikoku Electric Power Company (2 make us uncomfortable) you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9507

Shikoku Electric Power Company

Shikoku Electric Power Company engages in generating, transmitting, distributing, and selling electricity in Japan and internationally.

Proven track record average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.