- Japan

- /

- Electric Utilities

- /

- TSE:9504

Chugoku Electric Power (TSE:9504): Exploring If Recent Share Momentum Signals a True Value Opportunity

Reviewed by Simply Wall St

Chugoku Electric Power (TSE:9504) may have caught your eye recently, and you are not alone. Without a single headline-grabbing event to point to, the stock's movement over the past few months has quietly piqued investor curiosity. Sometimes, these subtle shifts tell us just as much about how investors are feeling as big announcements do, so it is worth a closer look at what might be driving sentiment.

Looking at the bigger picture, the stock has seen mixed fortunes. Chugoku Electric Power’s share price is up nearly 28% in the past three months, suggesting a meaningful shift in momentum after a year of lackluster performance that saw it slip 6%. While recent months have delivered some optimism, longer-term trends are still working against the company. Returns are flat to negative over one and five-year periods, and both annual revenue and net income have edged lower in the most recent data.

With the pendulum swinging between recent gains and longer-term headwinds, are investors looking at a genuine value opportunity with Chugoku Electric Power, or is the market already factoring in all plausible recovery and growth?

Price-to-Earnings of 3.1x: Is it justified?

Chugoku Electric Power’s current valuation is based on a price-to-earnings (P/E) ratio of 3.1, which is significantly lower than both its peer group at 3.8x and the broader Asian Electric Utilities industry average at 16.9x. This suggests the stock is trading at a discount to industry standards, making it look undervalued compared to similar companies.

The price-to-earnings ratio is a widely used metric that compares a company’s market price to its earnings per share. It is especially important for utility companies, where stable earnings tend to keep multiples consistent across the sector. A lower P/E ratio may indicate that investors are cautious about future profit potential or that the market has not fully priced in recent improvements in earnings quality or growth.

This means that, while investors are paying less for each unit of earnings relative to industry peers, this might be warranted if future earnings are expected to decline or face headwinds. It is essential to consider whether the low multiple truly reflects undervaluation or if it simply signals a lack of confidence in the company’s future fundamentals.

Result: Fair Value of ¥886.9 (ABOUT RIGHT)

See our latest analysis for Chugoku Electric Power.However, weak annual revenue and net income growth may signal ongoing challenges. Negative multi-year returns could also dampen near-term investor confidence.

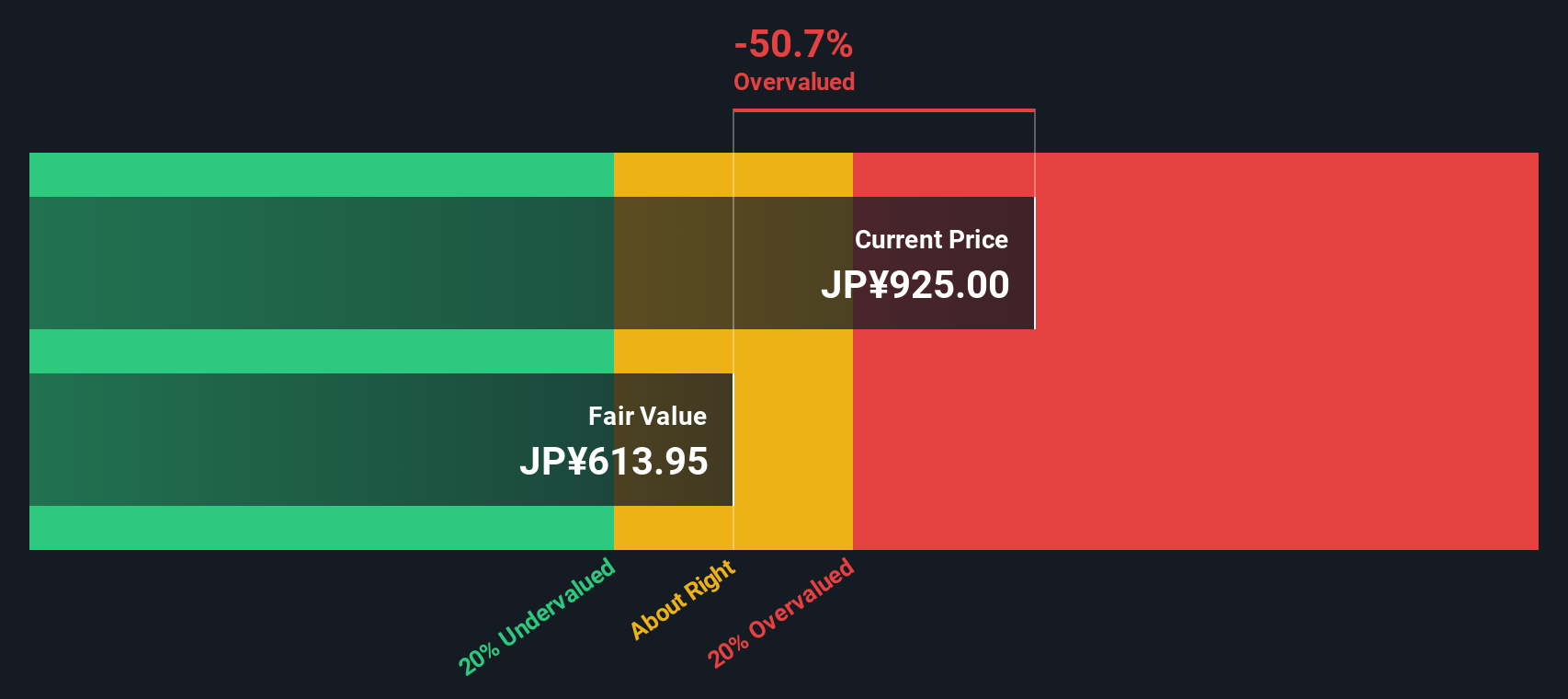

Find out about the key risks to this Chugoku Electric Power narrative.Another View: SWS DCF Model Tells a Different Story

While the share price looks attractive compared to industry averages, our DCF model paints a less optimistic picture. This approach suggests the market may be paying more than what the company’s cash flows justify. Which view should investors trust?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Chugoku Electric Power Narrative

If you want to draw your own conclusions or prefer a hands-on approach, you can easily build a personal view in under three minutes using the available data, and Do it your way.

A great starting point for your Chugoku Electric Power research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that opportunities go beyond a single stock. Expand your horizons and see what else could be working for your portfolio using the Simply Wall Street Screener.

- Capture outsized yield potential by tapping into a selection of dividend stocks with yields > 3%, ideal for those who want income that outpaces the market.

- Ride the momentum of artificial intelligence breakthroughs with our handpicked collection of AI penny stocks, poised to shape the future of tech and business.

- Find your next stealth winner by uncovering penny stocks with strong financials, which combine a low share price with strong fundamentals to hint at big upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9504

Chugoku Electric Power

Engages in generation, transmission, and distribution of electric power in Japan.

Solid track record and fair value.

Market Insights

Community Narratives