- Japan

- /

- Electric Utilities

- /

- TSE:9503

Kansai Electric (TSE:9503) Valuation in Focus After Upgraded Earnings Outlook and Dividend Forecast

Reviewed by Simply Wall St

Kansai Electric Power Company (TSE:9503) just raised its earnings guidance for the fiscal year ending March 2026, citing higher profits from increased electricity demand and reduced costs across its core businesses.

See our latest analysis for Kansai Electric Power Company.

After a solid 30.3% share price return so far this year, Kansai Electric Power Company’s momentum is attracting attention, especially following revised guidance and a projected dividend increase. While the company’s one-year total shareholder return remains in the red at -4.9%, the three-year and five-year total returns of 119% and 178% respectively present a much more impressive long-term picture. This suggests renewed growth potential as confidence in its operations builds.

Curious about other movers with strong momentum and high insider ownership? Now is a perfect time to explore fast growing stocks with high insider ownership.

With Kansai Electric Power Company’s revised guidance and dividend boost, is the stock still trading below its true value? Or has the recent rally already factored in all of the anticipated growth?

Price-to-Earnings of 6.3x: Is it justified?

Kansai Electric Power Company is trading with a price-to-earnings (P/E) ratio of 6.3x, based on its last close price of ¥2,267. This is well below both the Japanese market average and the regional electric utilities industry.

The P/E ratio measures how much investors are willing to pay for each yen of the company's earnings. For utilities, a lower multiple may suggest the market sees slower growth or increased risk, but it can also signal attractive value if earnings are steady.

Kansai Electric Power’s P/E is significantly below the Asian Electric Utilities sector average of 17.2x, positioning the stock as inexpensive relative to the broader industry despite recent momentum. Compared to the estimated fair P/E of 8.8x, the current multiple leaves headroom for potential upside if the company’s operational turnaround proves sustainable.

Explore the SWS fair ratio for Kansai Electric Power Company

Result: Price-to-Earnings of 6.3x (UNDERVALUED)

However, persistent declines in annual revenue and net income growth raise questions about the durability of the recent turnaround.

Find out about the key risks to this Kansai Electric Power Company narrative.

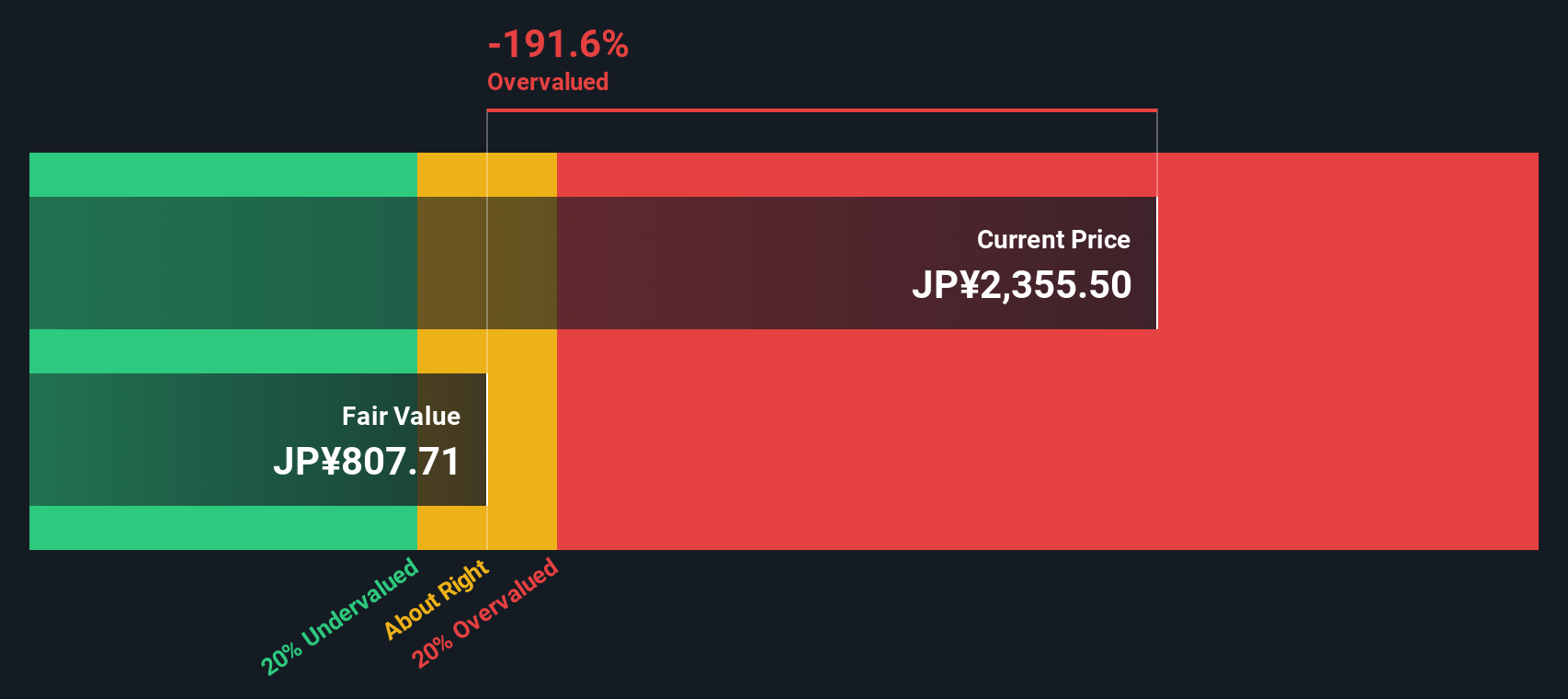

Another View: Discounted Cash Flow Model

While the price-to-earnings ratio suggests Kansai Electric Power Company may be undervalued, our DCF model indicates a different perspective. The SWS DCF model estimates the fair value at ¥846.11, which is well below the current share price of ¥2,267. This may suggest the stock is overvalued. Does this disconnect highlight caution or reveal a hidden opportunity?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kansai Electric Power Company for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 850 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kansai Electric Power Company Narrative

If you’d like to take a different view or prefer digging into the numbers yourself, you can craft your own narrative in just a few minutes, right from the data. Do it your way

A great starting point for your Kansai Electric Power Company research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t wait for the market to move without you. Access unique opportunities with our handpicked screeners and spot tomorrow’s leaders ahead of the crowd.

- Capture outsized returns by zeroing in on these 3584 penny stocks with strong financials with impressive fundamentals and real growth potential.

- Tap into tomorrow’s breakthrough trends with these 26 AI penny stocks driving innovation at the intersection of technology and artificial intelligence.

- Boost your income stream with these 24 dividend stocks with yields > 3% offering resilient yields above 3% and helping you build lasting wealth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kansai Electric Power Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9503

Kansai Electric Power Company

Engages in electricity, gas and heat supply, and telecommunication and gas supply in Japan.

Solid track record with slight risk.

Market Insights

Community Narratives