- Japan

- /

- Electric Utilities

- /

- TSE:9501

What Tokyo Electric Power Company Holdings (TSE:9501)'s Latest Government Grant Means for Shareholders

Reviewed by Sasha Jovanovic

- Tokyo Electric Power Company Holdings recently received a ¥21.1 billion grant from the Nuclear Damage Compensation and Decommissioning Facilitation Corporation under the approved Special Business Plan to help fund nuclear accident compensation and decommissioning costs.

- This funding highlights the continued regulatory and government commitment to supporting the company's efforts in managing ongoing nuclear liability and restoration activities.

- To better understand the implications of this government support, we'll explore how ongoing grant approvals shape TEPCO's investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Tokyo Electric Power Company Holdings' Investment Narrative?

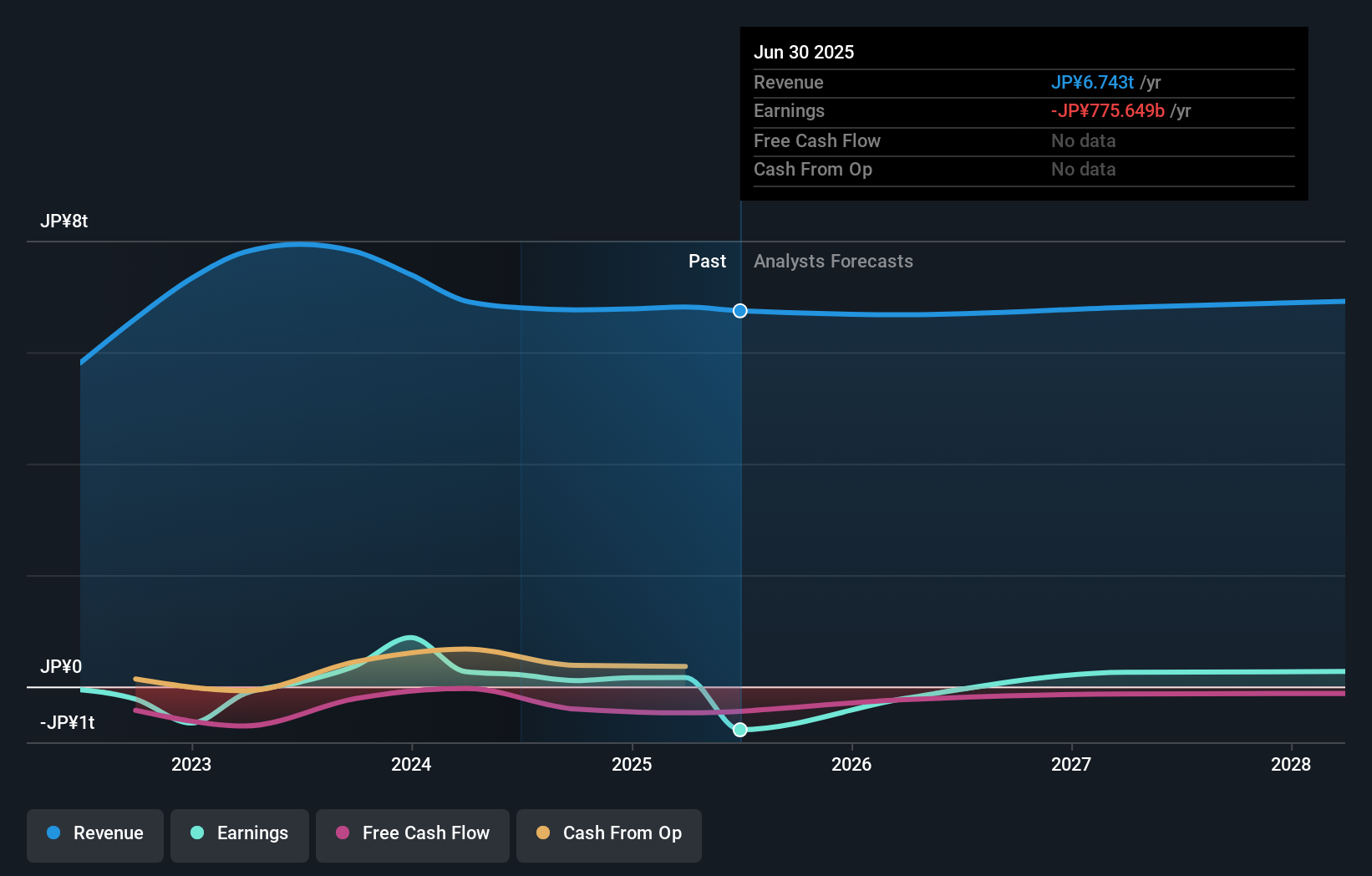

To be a shareholder in Tokyo Electric Power Company Holdings, you have to believe in its ability to navigate complex regulatory, financial, and operational challenges tied to nuclear liability, decommissioning, and ongoing business transformation. The recent ¥21.1 billion grant extension from the Nuclear Damage Compensation and Decommissioning Facilitation Corporation signals that government support for TEPCO’s obligations remains strong, temporarily reducing immediate liquidity risk and taking some pressure off the balance sheet. While this funding shores up short-term confidence and addresses imminent payout needs, it does not remove persistent overhangs around future nuclear liabilities, consistent unprofitability, and dependence on government backing. Near-term catalysts like scheduled earnings releases or corporate deals could be overshadowed by regulatory headlines or shifting investor sentiment on risk, making the direct impact of this grant material for liquidity, but not necessarily a game-changer for the overall risk profile or long-term investment story.

On the other hand, the risk of ongoing losses and dependency on future government intervention remains a factor for investors. According our valuation report, there's an indication that Tokyo Electric Power Company Holdings' share price might be on the cheaper side.Exploring Other Perspectives

Explore another fair value estimate on Tokyo Electric Power Company Holdings - why the stock might be worth as much as ¥648!

Build Your Own Tokyo Electric Power Company Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tokyo Electric Power Company Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Tokyo Electric Power Company Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tokyo Electric Power Company Holdings' overall financial health at a glance.

No Opportunity In Tokyo Electric Power Company Holdings?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 32 companies in the world exploring or producing it. Find the list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tokyo Electric Power Company Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9501

Tokyo Electric Power Company Holdings

Engages in the generation, transmission, distribution, and retail of electric power in Japan and internationally.

Fair value with moderate growth potential.

Market Insights

Community Narratives