- Japan

- /

- Electric Utilities

- /

- TSE:7692

If EPS Growth Is Important To You, Earth InfinityLtd (TSE:7692) Presents An Opportunity

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Earth InfinityLtd (TSE:7692). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

How Fast Is Earth InfinityLtd Growing Its Earnings Per Share?

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. So for many budding investors, improving EPS is considered a good sign. It is awe-striking that Earth InfinityLtd's EPS went from JP¥0.30 to JP¥3.05 in just one year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. Could this be a sign that the business has reached an inflection point?

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The music to the ears of Earth InfinityLtd shareholders is that EBIT margins have grown from 3.9% to 9.5% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

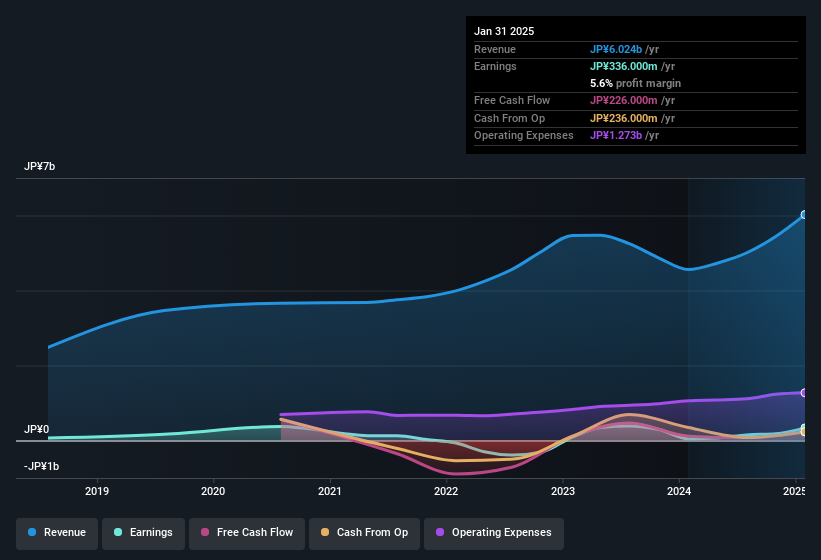

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

See our latest analysis for Earth InfinityLtd

Earth InfinityLtd isn't a huge company, given its market capitalisation of JP¥12b. That makes it extra important to check on its balance sheet strength.

Are Earth InfinityLtd Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So as you can imagine, the fact that Earth InfinityLtd insiders own a significant number of shares certainly is appealing. To be exact, company insiders hold 53% of the company, so their decisions have a significant impact on their investments. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. To give you an idea, the value of insiders' holdings in the business are valued at JP¥6.5b at the current share price. That should be more than enough to keep them focussed on creating shareholder value!

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. Well, based on the CEO pay, you'd argue that they are indeed. The median total compensation for CEOs of companies similar in size to Earth InfinityLtd, with market caps under JP¥29b is around JP¥137m.

The Earth InfinityLtd CEO received JP¥107m in compensation for the year ending July 2024. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Earth InfinityLtd Deserve A Spot On Your Watchlist?

Earth InfinityLtd's earnings have taken off in quite an impressive fashion. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The sharp increase in earnings could signal good business momentum. Earth InfinityLtd certainly ticks a few boxes, so we think it's probably well worth further consideration. It's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Earth InfinityLtd (at least 1 which makes us a bit uncomfortable) , and understanding them should be part of your investment process.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in JP with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Earth InfinityLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7692

Earth InfinityLtd

Engages in the electricity and gas retail businesses in Japan.

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives