- Japan

- /

- Electric Utilities

- /

- TSE:7692

Earth Infinity Co.Ltd. (TSE:7692) Looks Just Right With A 26% Price Jump

Those holding Earth Infinity Co.Ltd. (TSE:7692) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 35% in the last twelve months.

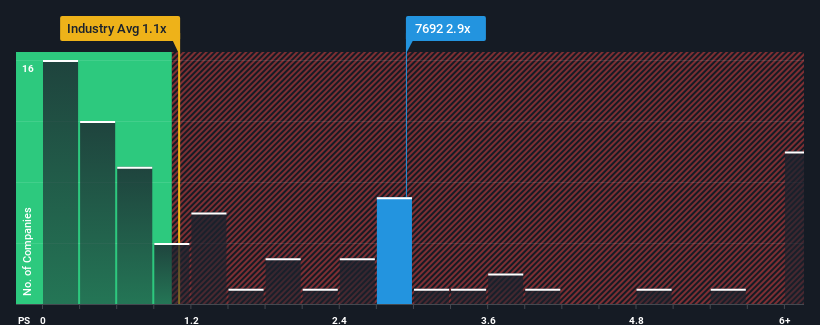

Following the firm bounce in price, given around half the companies in Japan's Electric Utilities industry have price-to-sales ratios (or "P/S") below 0.3x, you may consider Earth InfinityLtd as a stock to avoid entirely with its 2.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Earth InfinityLtd

How Has Earth InfinityLtd Performed Recently?

For example, consider that Earth InfinityLtd's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Earth InfinityLtd's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

Earth InfinityLtd's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 14%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 29% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 1.3% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Earth InfinityLtd's P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Final Word

Earth InfinityLtd's P/S has grown nicely over the last month thanks to a handy boost in the share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's no surprise that Earth InfinityLtd can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 5 warning signs for Earth InfinityLtd (2 can't be ignored!) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Earth InfinityLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7692

Earth InfinityLtd

Engages in the electricity and gas retail businesses in Japan.

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives