- Japan

- /

- Electronic Equipment and Components

- /

- TSE:5208

3 Dividend Stocks Yielding Between 3% And 5.5%

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by busy earnings reports and mixed economic signals, investors are seeking stability amid volatility. With major indices experiencing fluctuations and growth stocks lagging behind value shares, dividend stocks offering yields between 3% and 5.5% present an attractive option for those looking to balance income with potential capital appreciation. In such uncertain times, a good dividend stock typically combines a solid payout history with the financial strength to maintain dividends despite economic headwinds.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.92% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.69% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.50% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.77% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.46% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.33% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.23% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.56% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.53% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.94% | ★★★★★★ |

Click here to see the full list of 1950 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

Shanghai Daimay Automotive Interior (SHSE:603730)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shanghai Daimay Automotive Interior Co., Ltd specializes in the research, development, production, and sale of passenger car components for OEMs and automakers both in China and internationally, with a market cap of CN¥17.01 billion.

Operations: Shanghai Daimay Automotive Interior Co., Ltd generates revenue through the research, development, production, and sale of passenger car components to OEMs and automakers in both domestic and international markets.

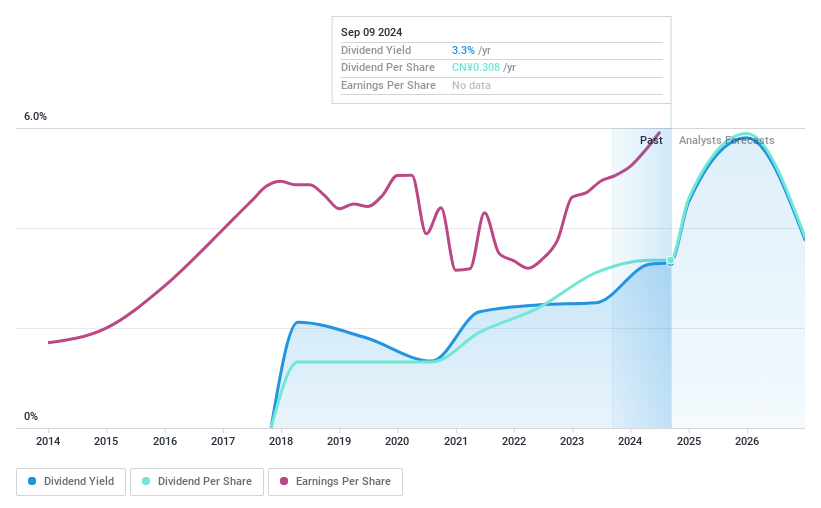

Dividend Yield: 3%

Shanghai Daimay Automotive Interior's dividend yield of 3.02% ranks in the top 25% of CN market payers. Despite a relatively short history of under ten years, dividends have been stable and growing with minimal volatility. The company covers its dividends through earnings and cash flows, with payout ratios at 67.3% and 65.3%, respectively. Recent earnings growth supports sustainability, as net income rose to CNY 623.03 million for the first nine months of 2024 from CNY 539.16 million last year.

- Click here to discover the nuances of Shanghai Daimay Automotive Interior with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Shanghai Daimay Automotive Interior's current price could be quite moderate.

Arisawa Mfg (TSE:5208)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Arisawa Mfg. Co., Ltd. manufactures and sells electronic, optoelectronic, electrical insulating, display, and industrial structural materials in Japan and internationally, with a market cap of ¥47.52 billion.

Operations: Arisawa Mfg. Co., Ltd.'s revenue segments include Electronic Materials at ¥26.87 billion, Industrial Application Structural Materials at ¥10.84 billion, Display Materials at ¥4.12 billion, and Electrical Insulation Material at ¥2.52 billion.

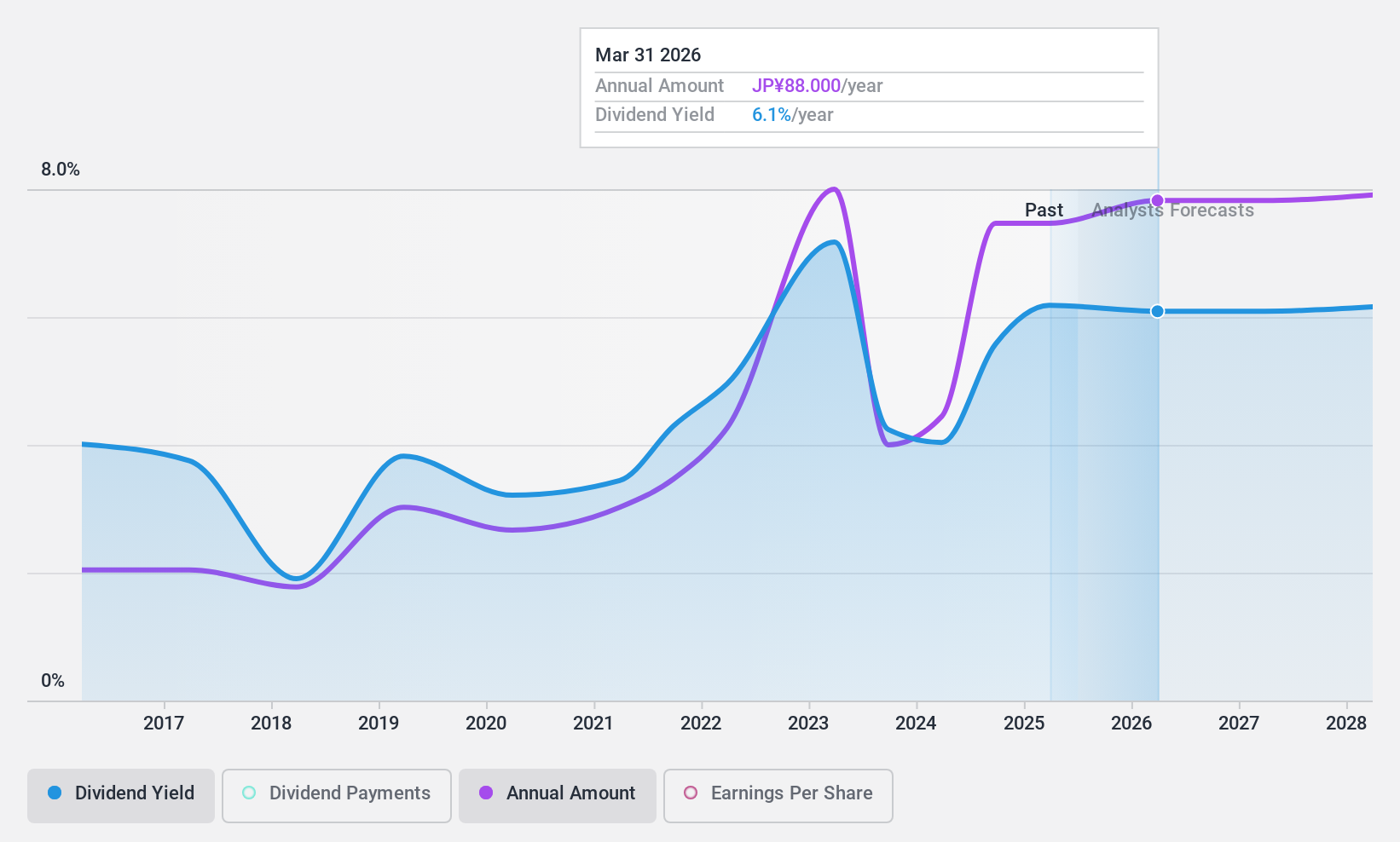

Dividend Yield: 5.6%

Arisawa Mfg's dividend yield of 5.6% places it among the top 25% in Japan, yet its dividends have been volatile and unreliable over the past decade. Despite a reasonable payout ratio of 70.7%, dividends are not covered by free cash flows, raising sustainability concerns. Earnings growth is promising, with an 89% increase last year and forecasted annual growth of 6.34%, but dividend coverage remains a challenge due to insufficient cash flow support.

- Dive into the specifics of Arisawa Mfg here with our thorough dividend report.

- According our valuation report, there's an indication that Arisawa Mfg's share price might be on the expensive side.

Japan Transcity (TSE:9310)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Japan Transcity Corporation operates in the logistics sector both domestically and internationally, with a market cap of ¥61.75 billion.

Operations: Japan Transcity Corporation's revenue segments include logistics operations in Japan and overseas.

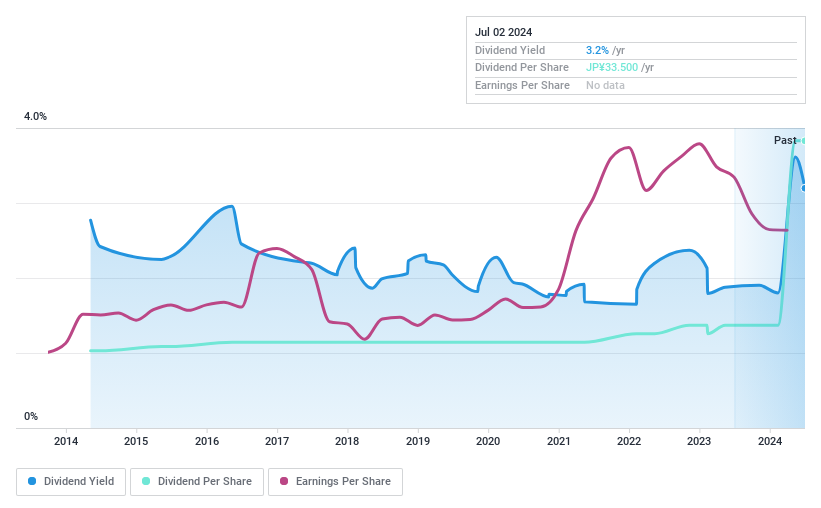

Dividend Yield: 3.4%

Japan Transcity offers a stable dividend history with reliable payments over the past decade, supported by a low payout ratio of 17.2% and cash payout ratio of 37.6%. Its dividend yield of 3.41% is below the top tier in Japan but remains well-covered by earnings and cash flows. The company recently completed a share buyback worth ¥314.77 million, enhancing shareholder value, while maintaining competitive valuation with a price-to-earnings ratio of 12.9x against the market's 13.5x.

- Get an in-depth perspective on Japan Transcity's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Japan Transcity's current price could be inflated.

Key Takeaways

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1947 more companies for you to explore.Click here to unveil our expertly curated list of 1950 Top Dividend Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5208

Arisawa Mfg

Manufactures and sells electronic, optoelectronic, electrical insulating, display, and industrial structural materials in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.