ANA Holdings (TSE:9202) Margin Decline Challenges Sustainability Narrative Despite Strong Valuation

Reviewed by Simply Wall St

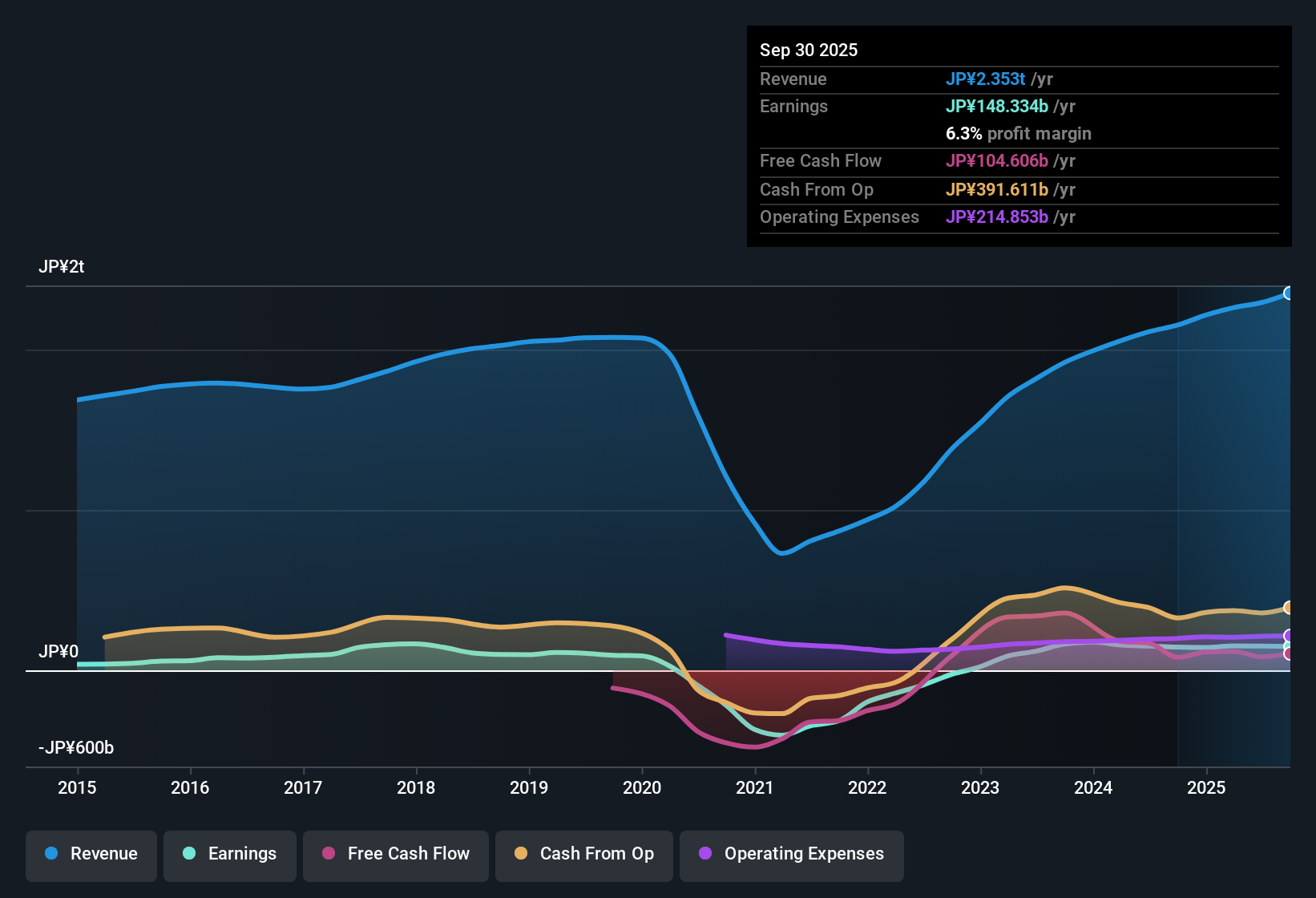

ANA Holdings (TSE:9202) posted revenue growth of 2.5% per year, trailing the broader Japanese market’s average of 4.5%. Net profit margins stood at 6.3%, slightly lower than last year’s 6.7%. While the company has transitioned to consistent profitability over the past five years with annual earnings growth averaging 67.9%, the latest year’s earnings rise was just 2.5%, which is well below historical trends. Looking ahead, consensus forecasts call for a modest decline in earnings of 1.2% per year over the next three years. This makes valuation and past improvements in profitability a focal point for investors.

See our full analysis for ANA Holdings.The next section takes these reported results and compares them to the stories investors are following right now. Some narratives may be confirmed, while others could face a reality check.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Erode Despite Multi-Year Gains

- Net profit margins slipped to 6.3%, down from 6.7% last year, meaning that even as profitability stabilized over the last five years, the latest margin figure is moving in the wrong direction.

- Prevailing narrative highlights that margin headwinds, such as higher fuel and labor costs, are offsetting much of the travel demand recovery.

- While ANA’s shift to sustained profitability in recent years is a win, the erosion in margins undercuts confidence that these improvements are durable.

- Despite revenue growth, rising costs and narrowing margins suggest the company needs more than just travel volume to deliver stronger results going forward.

Valuation Undercuts Broader Market Skepticism

- Trading at a price-to-earnings ratio of 9.1x, ANA Holdings is priced noticeably below both Asian airline peers (14.3x) and the industry average (10.1x). The current share price of 2,889.00 is below the analyst price target of 3,502.50 and well below the DCF fair value of 6,551.74.

- The prevailing narrative recognizes that this relative valuation discount draws attention from value-focused investors, even as near-term growth is forecast to contract.

- Despite weaker forward earnings, trading well below fair value adds a compelling counterpoint for those wary of slowing headline growth.

- It is notable how both strong long-term profit growth and a valuation gap can coexist amid fading short-term optimism, inviting debate over where the "real" bottom is for the stock.

Consensus Sees Near-Term Earnings Dip After Rapid Growth

- Consensus forecasts now expect ANA’s earnings to decline by 1.2% per year over the next three years, marking a significant pivot from the extraordinary 67.9% annualized growth achieved over the last five years.

- With travel recovering yet profitability growth stalling, the company’s prospects reflect the prevailing market view: a transition away from outsized post-pandemic rebounds toward stabilizing, but not expanding, fundamentals.

- This expectation of falling earnings, despite renewed travel activity, challenges the idea that a demand surge alone can sustain rapid profit growth.

- Instead, the story shifts to how ANA can protect margins and cut costs rather than betting on higher volumes to improve the bottom line in the coming years.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on ANA Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

ANA Holdings faces shrinking profit margins and an outlook for declining earnings, casting doubt on the durability of its recent profitability gains.

If you want to bypass these volatility risks, filter for steadier performers with stable growth stocks screener (2094 results) and discover which companies consistently grow earnings and revenue regardless of the cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9202

ANA Holdings

Provides air transportation services in Japan and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives