Nippon Express (TSE:9147): Assessing Valuation After Major Buyback and Upcoming Treasury Stock Decision

Reviewed by Simply Wall St

Nippon Express Holdings (TSE:9147) has just wrapped up a major share buyback and is now weighing the retirement of some of its treasury stock in an upcoming board meeting. These steps can draw attention from value-focused investors.

See our latest analysis for Nippon Express Holdings.

The upbeat tone from Nippon Express Holdings’ sizable buyback is apparent when you look at its performance, with a running year-to-date share price return of 32.5% and a strong 12-month total shareholder return of 36.7%. Momentum has been building, and these new capital management moves could bolster confidence further as attention turns to the next board decision.

If corporate actions like these have you thinking beyond transportation stocks, now is a perfect time to broaden your investing lens and check out fast growing stocks with high insider ownership

But with shares rallying more than 32 percent this year and trading just 13 percent below analyst targets, investors might ask if Nippon Express Holdings still offers value or if its future growth is already priced in.

Price-to-Earnings of 31.2x: Is it justified?

Nippon Express Holdings is currently trading at a price-to-earnings (P/E) ratio of 31.2x, which positions its shares at a premium relative to sector averages and what the market considers fair value.

The price-to-earnings multiple measures how much investors are willing to pay today for each unit of current earnings. For logistics companies, this ratio helps signal what the market expects from future growth and profitability.

At 31.2x, Nippon Express Holdings’ shares are markedly more expensive than their logistics peers in Japan, which average a P/E of just 13.5x. The stock is also well above its estimated fair P/E of 25.1x. This level is one the market could eventually shift towards if earnings do not accelerate. This implies heightened market optimism, perhaps in anticipation of sharply improved profit growth or stronger future margins.

Explore the SWS fair ratio for Nippon Express Holdings

Result: Price-to-Earnings of 31.2x (OVERVALUED)

However, slowing revenue growth and a significant premium over peers could quickly dampen optimism if profit expansion stalls or if market sentiment shifts.

Find out about the key risks to this Nippon Express Holdings narrative.

Another View: Discounted Cash Flow Paints a Different Picture

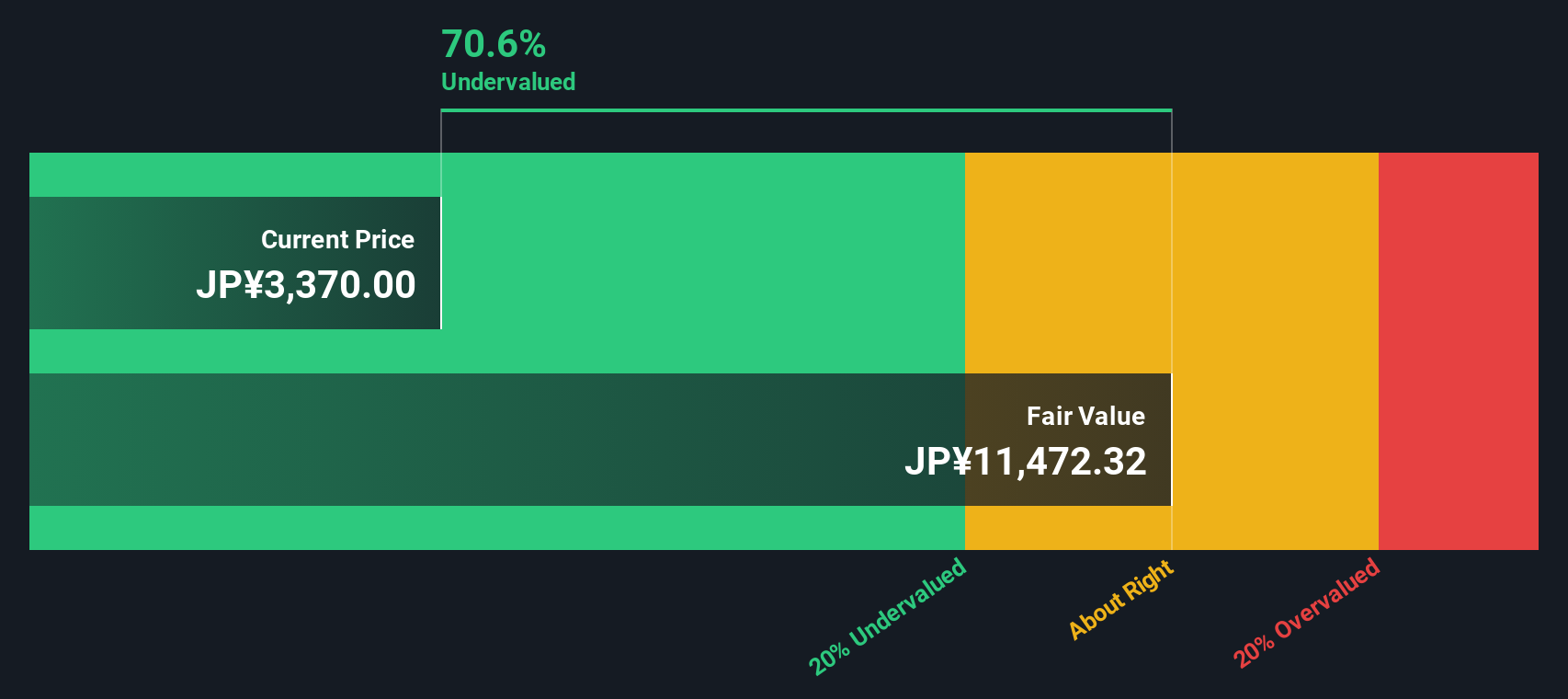

While the price-to-earnings perspective suggests Nippon Express Holdings is overvalued relative to peers, our DCF model tells a different story. It estimates the stock is trading nearly 70% below its intrinsic value, which may indicate substantial potential upside if market expectations shift.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nippon Express Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 901 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nippon Express Holdings Narrative

If you want to dig into the numbers yourself or believe another perspective could tell a different story, you can build your own view in just minutes using Do it your way.

A great starting point for your Nippon Express Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investing means staying a step ahead with stocks that fit your strategy. Don’t miss out on these standout opportunities across emerging trends and proven favorites:

- Tap into tomorrow’s technology with these 27 AI penny stocks, which are leading advances in artificial intelligence and reshaping entire industries.

- Capture long-term income potential through these 18 dividend stocks with yields > 3%, offering consistent yields above 3% for a solid foundation in your portfolio.

- Position yourself early by seizing these 3579 penny stocks with strong financials, set to surge with strong balance sheets and impressive financial fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Express Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9147

Nippon Express Holdings

Provides logistics services in Japan, the Americas, Europe, East Asia, South Asia, and Oceania.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives