- Japan

- /

- Marine and Shipping

- /

- TSE:9115

Meiji Shipping Group (TSE:9115) Earnings Quality Questioned as ¥9.7B One-Off Gain Drives Profit Beat

Reviewed by Simply Wall St

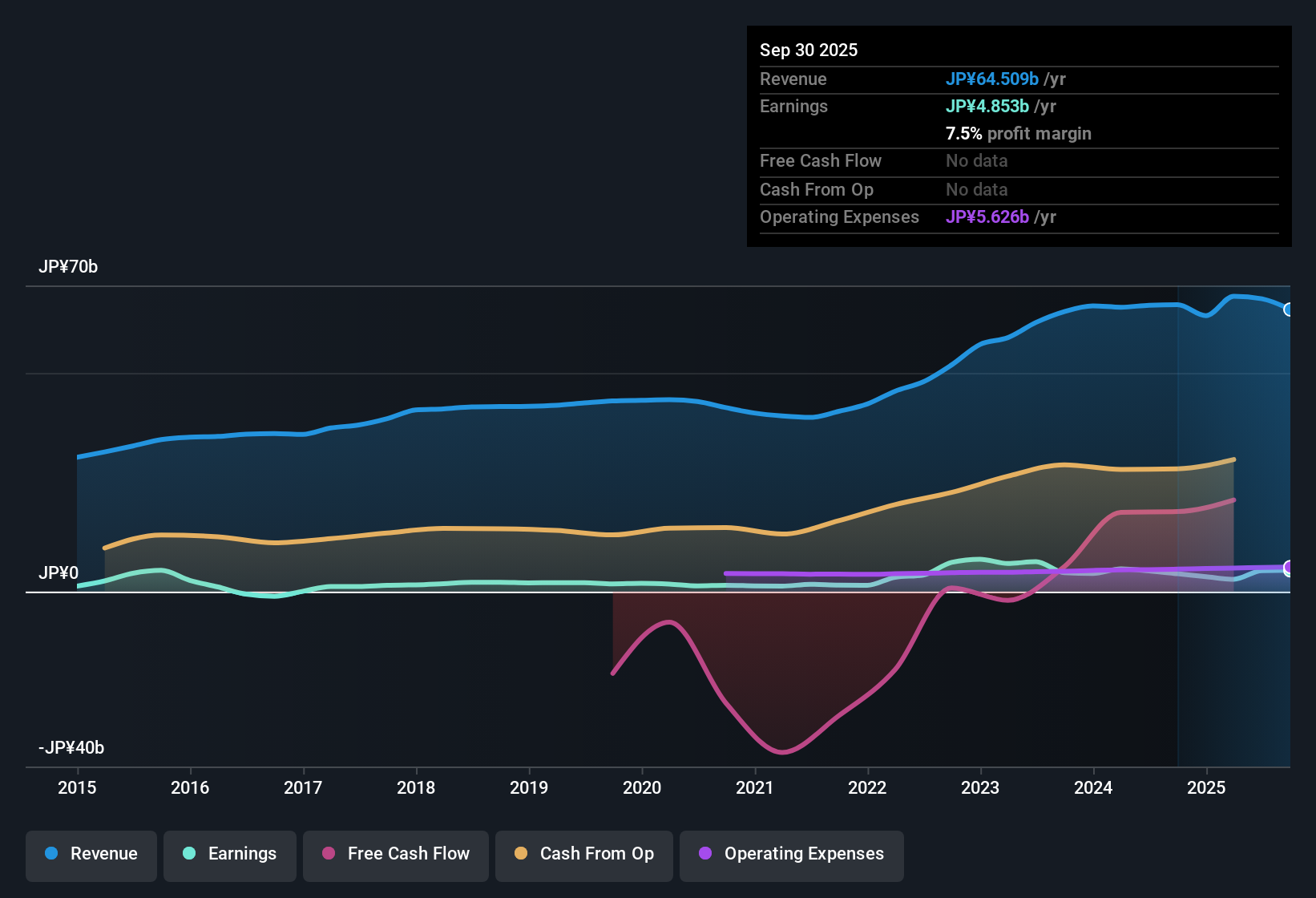

Meiji Shipping Group (TSE:9115) reported net profit margins of 7.5%, up from 6.2% the previous year. EPS reflected strong 19.1% growth over the last twelve months and an average annual increase of 16.9% over five years. The company's price-to-earnings ratio sits at just 4.9x, which is notably cheaper than both the Asian Shipping industry average of 10.9x and the peer average of 16.1x. Shares currently trade at ¥701, well below an estimated fair value of ¥3,883.06. Results for the latest period were influenced by a sizable one-off gain of ¥9.7 billion, raising investor questions about the sustainability of these earnings, but also highlighting Meiji Shipping Group as a value name in the sector with improving profitability.

See our full analysis for Meiji Shipping Group.Next up, we will see how these headline results compare to the narratives circulating among market watchers and the Simply Wall St community. Some assumptions may get a boost, while others could be put to the test.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off ¥9.7 Billion Gain Clouds Underlying Profit Quality

- Reported net profit includes a significant one-off gain of ¥9.7 billion, which complicates the picture of true underlying earnings for the period.

- While bulls highlight Meiji Shipping Group’s multi-year average earnings growth rate of 16.9% per year, the presence of this extraordinary gain introduces tension around the durability of such momentum.

- The recurring core profit, excluding the gain, may be lower than it first appears.

- Bulls’ hopes for continued strong bottom-line expansion rely on future periods delivering organic profit drivers, not just temporary windfalls.

Share Price Movement Flags Short-Term Instability

- Despite posting improved margins and growth, company disclosures point to less stable share price action over the past three months, which serves as a caution signal for near-term investors.

- Prevailing market view sees Meiji Shipping as a stable, conservative holding, but the recent share price swings challenge the notion that shipping stocks necessarily provide shelter from sector cycles.

- Even with operational consistency and muted newsflow, the stock’s volatility shows that broader market or sector developments still set the tone.

- Investors attracted by defensive characteristics should remain mindful that shipping sector sentiment can override company fundamentals in the short run.

Trading at Less Than One-Fifth of DCF Fair Value

- The current share price of ¥701 trades at under one-fifth the DCF fair value estimate of ¥3,883.06, creating a sizable valuation gap relative to both sector averages and Meiji’s own historical metrics.

- With the prevailing market view emphasizing the company’s solid operational reputation and sector normalization, this deep discount may offer upside if macro trends or shipping rates strengthen.

- Relative valuation multiples already show Meiji at a lower 4.9x P/E compared to the Asian Shipping industry average of 10.9x and peer average of 16.1x.

- This disconnect between price and value will likely be tested as market sentiment evolves and core profit trends become clearer in subsequent periods.

Catch the full debate on whether Meiji’s deep discount is a buried opportunity or a warning sign for value traps. 📊 Read the full Meiji Shipping Group Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Meiji Shipping Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Meiji Shipping Group’s recent profits are heavily influenced by a large one-off gain, which makes it difficult to assess the sustainability of its underlying growth.

If you want to focus on companies delivering consistent results without relying on extraordinary windfalls, check out stable growth stocks screener (2090 results) to find businesses built for steady expansion through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9115

Meiji Shipping Group

Through its subsidiaries, engages in the maritime business in Japan and internationally.

Good value with adequate balance sheet.

Market Insights

Community Narratives