- Japan

- /

- Marine and Shipping

- /

- TSE:9110

3 Asian Dividend Stocks With Up To 4.2% Yield

Reviewed by Simply Wall St

As global markets navigate a landscape marked by interest rate adjustments and trade negotiations, Asia's stock indices reflect a complex mix of optimism and caution, particularly in light of recent economic policy discussions in China and Japan. Amid these dynamics, dividend stocks stand out as attractive options for investors seeking steady income streams; they offer potential stability through regular payouts while capitalizing on the region's evolving economic conditions.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.41% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.85% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.01% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.96% | ★★★★★★ |

| NCD (TSE:4783) | 4.36% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.98% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.02% | ★★★★★★ |

| Daicel (TSE:4202) | 4.52% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.59% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.68% | ★★★★★★ |

Click here to see the full list of 1047 stocks from our Top Asian Dividend Stocks screener.

We'll examine a selection from our screener results.

STI Education Systems Holdings (PSE:STI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: STI Education Systems Holdings, Inc., with a market cap of ₱13.45 billion, operates through its subsidiaries to offer various educational services in the Philippines.

Operations: STI Education Systems Holdings, Inc. generates revenue primarily from its educational services through schools, colleges, and universities in the Philippines, amounting to ₱5.56 billion.

Dividend Yield: 3.2%

STI Education Systems Holdings demonstrates a robust dividend profile with a stable and reliable payout history over the past decade. The company's low payout ratio of 20.3% ensures dividends are well-covered by earnings, while the cash payout ratio of 22.2% indicates strong cash flow support. Despite its dividend yield of 3.17% being lower than top-tier payers in the Philippine market, recent earnings growth reflects potential for future increases in payouts, supported by rising revenues and net income.

- Click here to discover the nuances of STI Education Systems Holdings with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, STI Education Systems Holdings' share price might be too pessimistic.

NS United Kaiun Kaisha (TSE:9110)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: NS United Kaiun Kaisha, Ltd., with a market cap of ¥135.74 billion, operates in marine transportation services and related businesses both in Japan and internationally through its subsidiaries.

Operations: NS United Kaiun Kaisha, Ltd. generates revenue from its Coastal Shipping Business, which accounts for ¥31.86 billion, and its International Shipping Business, contributing ¥198.35 billion.

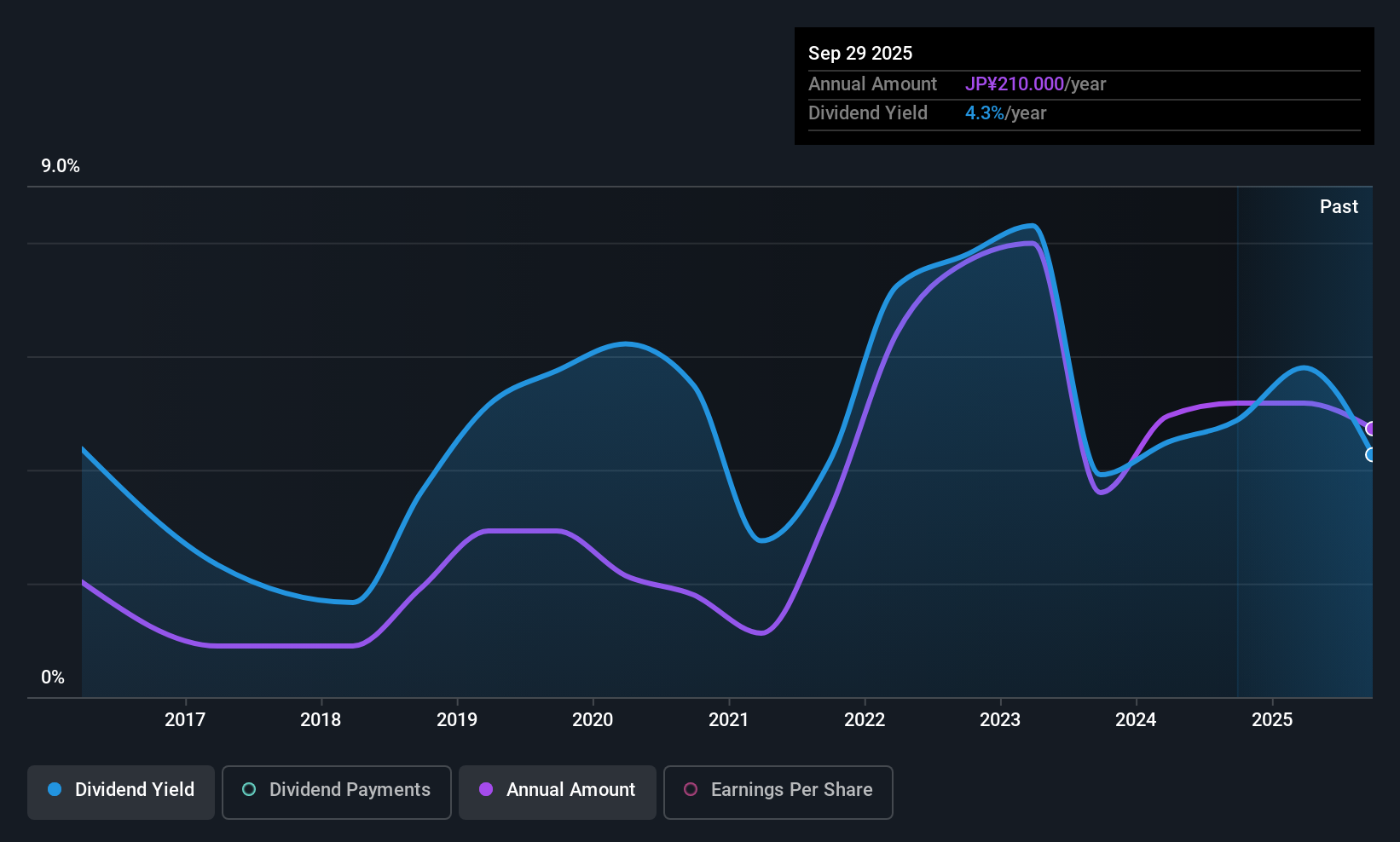

Dividend Yield: 4.3%

NS United Kaiun Kaisha's dividend payments are well-covered by earnings and cash flows, with payout ratios of 26.4% and 20.8%, respectively. Despite a top-tier yield of 4.25% in the Japanese market, its dividend history is marked by volatility and unreliability over the past decade. The company's recent growth in earnings suggests potential for future stability, although large one-off items have impacted financial results, requiring careful consideration for sustained dividends.

- Click here and access our complete dividend analysis report to understand the dynamics of NS United Kaiun Kaisha.

- According our valuation report, there's an indication that NS United Kaiun Kaisha's share price might be on the cheaper side.

Miroku Jyoho Service (TSE:9928)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Miroku Jyoho Service Co., Ltd. offers systems and solutions to tax accounting and CPA firms, their client companies, and small to mid-sized companies in Japan, with a market cap of ¥56.89 billion.

Operations: Miroku Jyoho Service Co., Ltd. generates revenue by providing systems and solutions to tax accounting and CPA firms, their client companies, and small to mid-sized businesses in Japan.

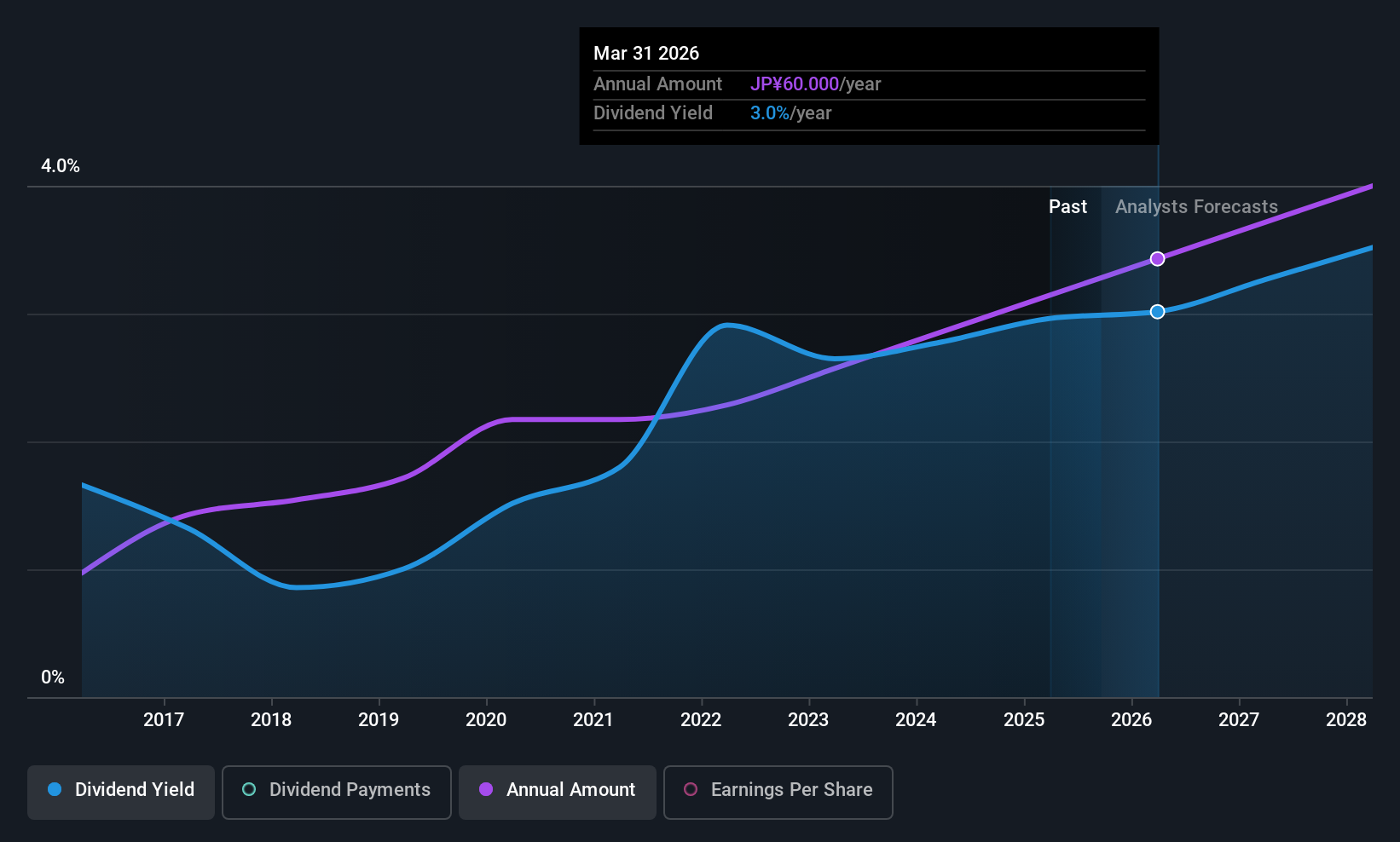

Dividend Yield: 3.2%

Miroku Jyoho Service offers a stable dividend history with consistent growth over the past decade, supported by a low payout ratio of 33.1%, indicating coverage by earnings. However, its dividend yield of 3.16% lags behind top-tier Japanese stocks and is not well covered by cash flows due to a high cash payout ratio of 109.6%. The recent launch of LucaTech GX Lite, a SaaS cloud ERP product, may enhance long-term financial performance but has limited immediate impact on sales.

- Get an in-depth perspective on Miroku Jyoho Service's performance by reading our dividend report here.

- The analysis detailed in our Miroku Jyoho Service valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Click here to access our complete index of 1047 Top Asian Dividend Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NS United Kaiun Kaisha might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9110

NS United Kaiun Kaisha

Engages in the marine transportation services and related business in Japan and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives