- Japan

- /

- Marine and Shipping

- /

- TSE:9104

Mitsui O.S.K. Lines (TSE:9104) Earnings Surge 33.8%, Challenging Tepid Growth Narratives

Reviewed by Simply Wall St

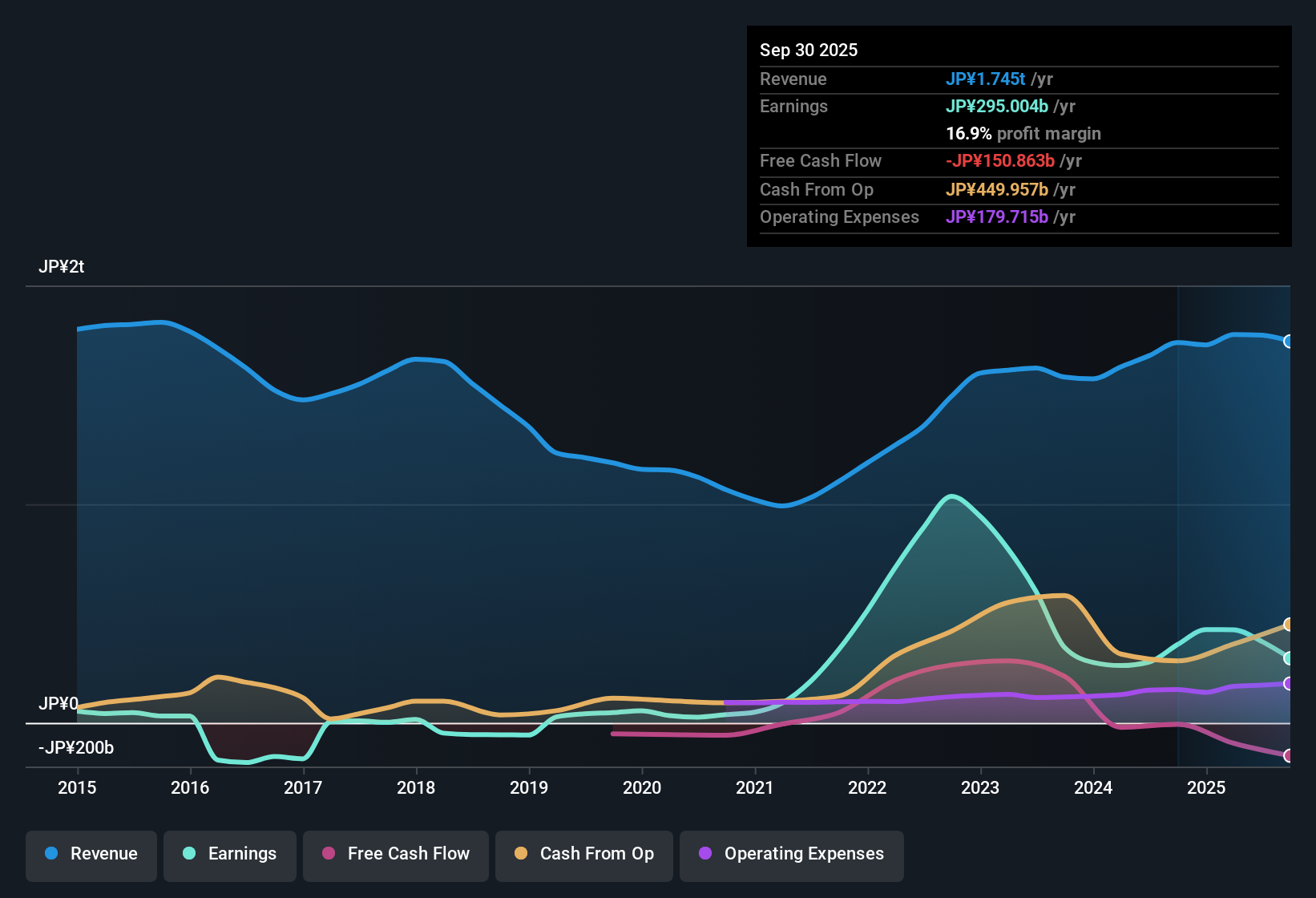

Mitsui O.S.K. Lines (TSE:9104) delivered a 33.8% jump in earnings over the last year, far surpassing its five-year average annual growth of 6.7%. Net profit margins climbed to 21% from last year’s 16.5%, while the company continues to deliver high-quality earnings despite revenue forecasts of only 0.07% growth per year. After another period of steady profit expansion, investors will now weigh these strong historical results and attractive valuation multiples against a more cautious outlook for future growth and flagged risks.

See our full analysis for Mitsui O.S.K. Lines.Next, we will see how these results stack up against the prevailing narratives that drive investor sentiment. Some expectations may hold up, while others could be put to the test.

See what the community is saying about Mitsui O.S.K. Lines

Margin Resilience as Profit Pressures Build

- Profit margins currently stand at 21%, an increase from last year’s 16.5%, even as analysts expect these margins to decline to 11.6% over the next three years.

- According to the analysts' consensus view, stable long-term contracts and robust vehicle transport demand help underpin margin stability. Consensus also notes that margin resilience could be challenged as vessel oversupply, fleet renewal costs, and weak shipping rates force margins lower toward future guidance.

- Consensus highlights that, while high-margin LNG and offshore contracts currently support earnings, persistent weak market conditions for bulkers and tankers may erode these gains.

- This creates a tension where ongoing investments in greener vessels could bolster long-run margins, but sector-wide pressures still put the optimistic scenario to the test.

Valuation Edges Out Peers, But Gap to Fair Value Remains

- The stock trades at a Price-to-Earnings ratio of 4.1x, well below both the Asian shipping industry average of 10.7x and peer average of 6.2x. The share price of ¥4,403 is also under the analyst target of 5,363.64, but continues to sit far above the DCF fair value estimate of 343.14.

- The consensus narrative acknowledges Mitsui O.S.K. Lines' good relative value versus peers and the market, yet also notes that trading above DCF estimates introduces a valuation risk, especially if revenue and earnings continue shrinking as projected.

- Consensus warns that, for the current share price to be justified, the company would need to command a future PE ratio of 10.2x on sharply lower earnings by 2028, much higher than the current industry average.

- This underlines the market’s expectation for stabilization or improvement, despite headline forecasts implying contraction—a risky bet if industry trends weaken further.

Revenue Headwinds as Sector Faces Structural Shifts

- Revenue is forecast to decline by 0.8% annually over the next three years, running well behind the Japanese market’s average yearly growth of 4.5% and reflecting muted demand caused by sector headwinds.

- The analysts’ consensus narrative cites structural changes like trade tensions, global shipping overcapacity, and sluggish Chinese demand as threats to top-line resilience. These factors could drag on revenue and net profit, even as new growth areas such as renewables and logistics investments show promise.

- Consensus points to the company’s diversification into LNG, renewable projects, and vehicle logistics as critical for mitigating pressure on core segments, but cautions that these won’t fully offset shrinking bulk and container shipping volumes in the near-term.

- This creates a complex setup where legacy weaknesses weigh on forecasts even as longer-term strategic bets offer a potential partial buffer.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Mitsui O.S.K. Lines on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you interpret the data with a unique angle? Share your perspective and shape the story in just a few minutes. Do it your way.

A great starting point for your Mitsui O.S.K. Lines research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Mitsui O.S.K. Lines faces industry headwinds with forecast revenue declines, and margins are expected to narrow amid shifting sector trends and valuation uncertainties.

To sidestep these volatility risks, use stable growth stocks screener (2083 results) to identify companies that consistently deliver steady growth and resilient earnings even when the broader market faces pressure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9104

Mitsui O.S.K. Lines

Provides marine transportation and vessel chartering services in Japan, North America, Europe, Singapore, rest of Asia, and internationally.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives