- Japan

- /

- Marine and Shipping

- /

- TSE:9104

Dividend Hike Amid Lower Outlook Could Be a Game Changer for Mitsui O.S.K. Lines (TSE:9104)

Reviewed by Sasha Jovanovic

- On November 4, 2025, Mitsui O.S.K. Lines held a board meeting to consider dividend payments and announced an upward revision to its 2025 fiscal year dividend guidance, raising its annual dividend forecast to ¥200.00 per share, despite simultaneously lowering its full-year profit outlook to ¥180.0 billion and operating profit to ¥104.0 billion.

- This move reflects the company’s ongoing commitment to shareholder returns, even as it expects softer profitability, highlighting a strategy to balance direct shareholder rewards with sustainable investment priorities under its “BLUE ACTION 2035” management plan.

- With Mitsui O.S.K. Lines increasing its dividend forecast despite revised profits, we’ll explore what this signals for its broader investment narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Mitsui O.S.K. Lines Investment Narrative Recap

For investors looking at Mitsui O.S.K. Lines, the essential thesis centers on the belief that the company can effectively manage through sector downturns while capitalizing on long-term logistics and energy transition opportunities. The recent upward revision in dividend guidance, even as profit forecasts were trimmed, does not materially shift the biggest near-term catalyst, which remains demand recovery in key routes, nor does it alter the largest risk: persistently weak shipping rates from soft global trade and overcapacity.

The most closely tied recent announcement is the company's move on November 4 to increase its annual dividend payout to ¥200.00 per share, an action positioned alongside lowered earnings guidance. This signals an intent to maintain shareholder returns in line with the ongoing “BLUE ACTION 2035” plan, but the backdrop remains challenging given the current pressure on shipping rates and industry-wide profitability.

In contrast, investors should not overlook the potential downside if freight rates remain depressed for longer than expected…

Read the full narrative on Mitsui O.S.K. Lines (it's free!)

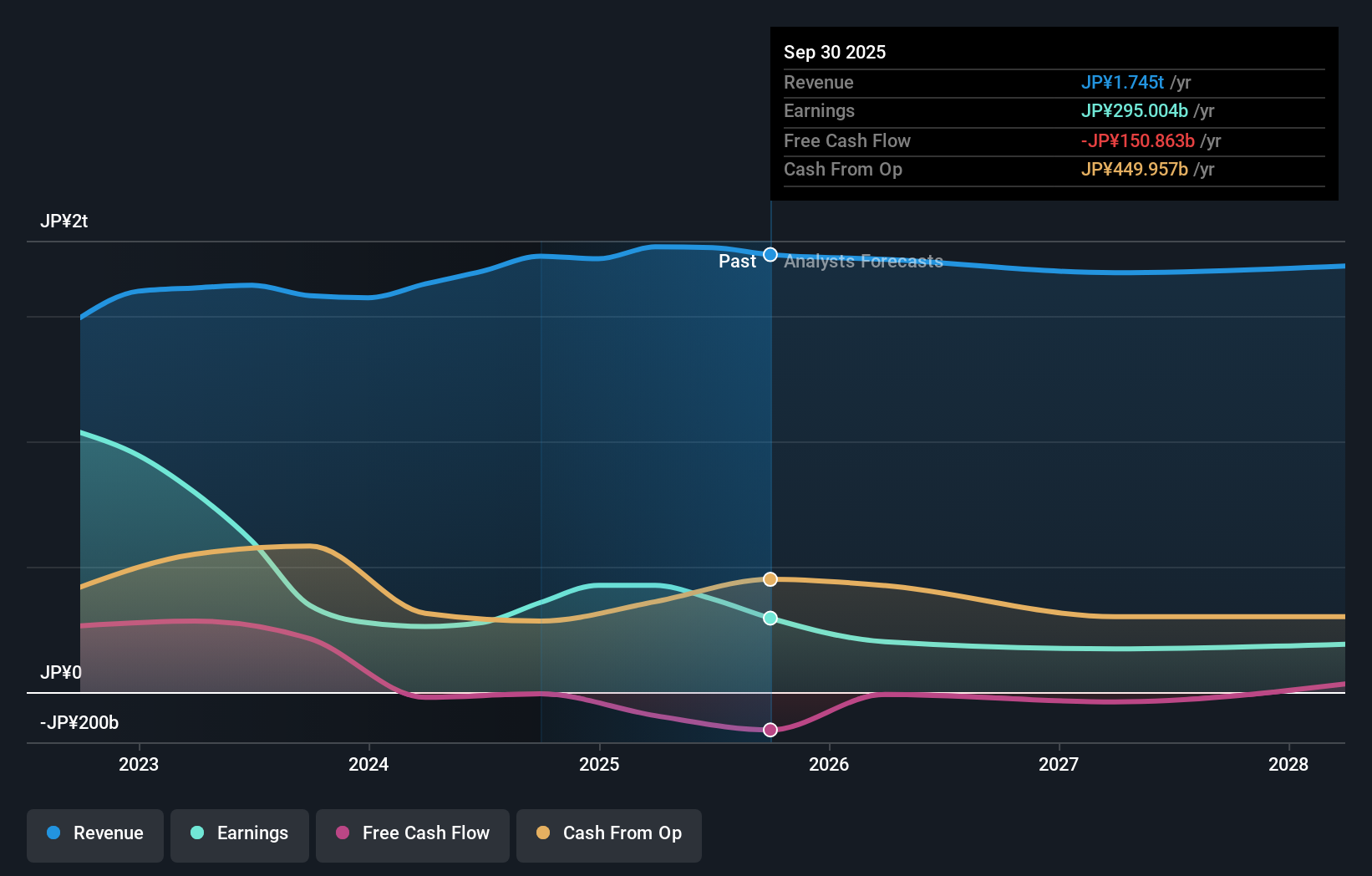

Mitsui O.S.K. Lines is projected to have ¥1,730.7 billion in revenue and ¥200.1 billion in earnings by 2028. This outlook reflects an annual revenue decline of 0.8% and a ¥171.2 billion decrease in earnings from the current ¥371.3 billion.

Uncover how Mitsui O.S.K. Lines' forecasts yield a ¥5364 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members produced two fair value estimates for Mitsui O.S.K. Lines, ranging from ¥341 to ¥5,363. While opinions vary, the trend of ongoing vessel oversupply could weigh on profitability, making it essential to review how different outlooks shape expectations for long-term performance.

Explore 2 other fair value estimates on Mitsui O.S.K. Lines - why the stock might be worth as much as 20% more than the current price!

Build Your Own Mitsui O.S.K. Lines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mitsui O.S.K. Lines research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Mitsui O.S.K. Lines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mitsui O.S.K. Lines' overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9104

Mitsui O.S.K. Lines

Provides marine transportation and vessel chartering services in Japan, North America, Europe, Singapore, rest of Asia, and internationally.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives