- Japan

- /

- Marine and Shipping

- /

- TSE:9104

A Look at Mitsui O.S.K. Lines (TSE:9104) Valuation Following Ethane Transport Joint Venture Expansion

Reviewed by Simply Wall St

Mitsui O.S.K. Lines (TSE:9104) is taking a strategic step forward as it partners with Oil and Natural Gas Corporation Limited to form two joint venture companies, each with an equal shareholding. This alliance signals a deliberate expansion into the ethane transportation sector and paves the way for new business opportunities and enhanced value chain integration.

See our latest analysis for Mitsui O.S.K. Lines.

Despite some turbulence this year, with a 21.9% year-to-date share price decline, Mitsui O.S.K. Lines’ latest joint venture news arrives at a time when momentum shows signs of stabilization. Notably, its long-run resilience stands out, reflected in a 67.7% total shareholder return over three years, even as the past year’s total return sits at -14.5%.

If corporate partnerships and energy transport piqued your interest, this is a prime moment to broaden your search and discover fast growing stocks with high insider ownership

This strategic move raises a key question for investors: Is Mitsui O.S.K. Lines now trading at an attractive valuation, or has the market already priced in the growth from its latest joint ventures?

Most Popular Narrative: 17.8% Undervalued

With Mitsui O.S.K. Lines closing at ¥4,408 and the most widely cited narrative assigning a higher fair value, the valuation gap has market watchers taking notice. The modest discount rate used draws attention to company fundamentals and sets the stage for a pivotal growth story.

Ongoing expansion and investment in energy logistics, including LNG dual-fuel VLCCs, long-term LNG charter contracts, and entry into offshore wind projects, position Mitsui O.S.K. Lines to capture new high-margin revenue streams from the global transition to decarbonization and renewable energy, supporting long-term revenue growth and margin resilience.

Curious how analysts justify this premium? Their bold blueprint relies on strategic pivots, powerful industry catalysts, and shifting profit dynamics. The real surprise lies in just how much they expect revenues and margins to evolve. Unlock the full narrative to see which specific shifts might drive the next big price move.

Result: Fair Value of ¥5,364 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent global trade tensions or a prolonged economic slowdown in China could quickly dampen the growth outlook for Mitsui O.S.K. Lines.

Find out about the key risks to this Mitsui O.S.K. Lines narrative.

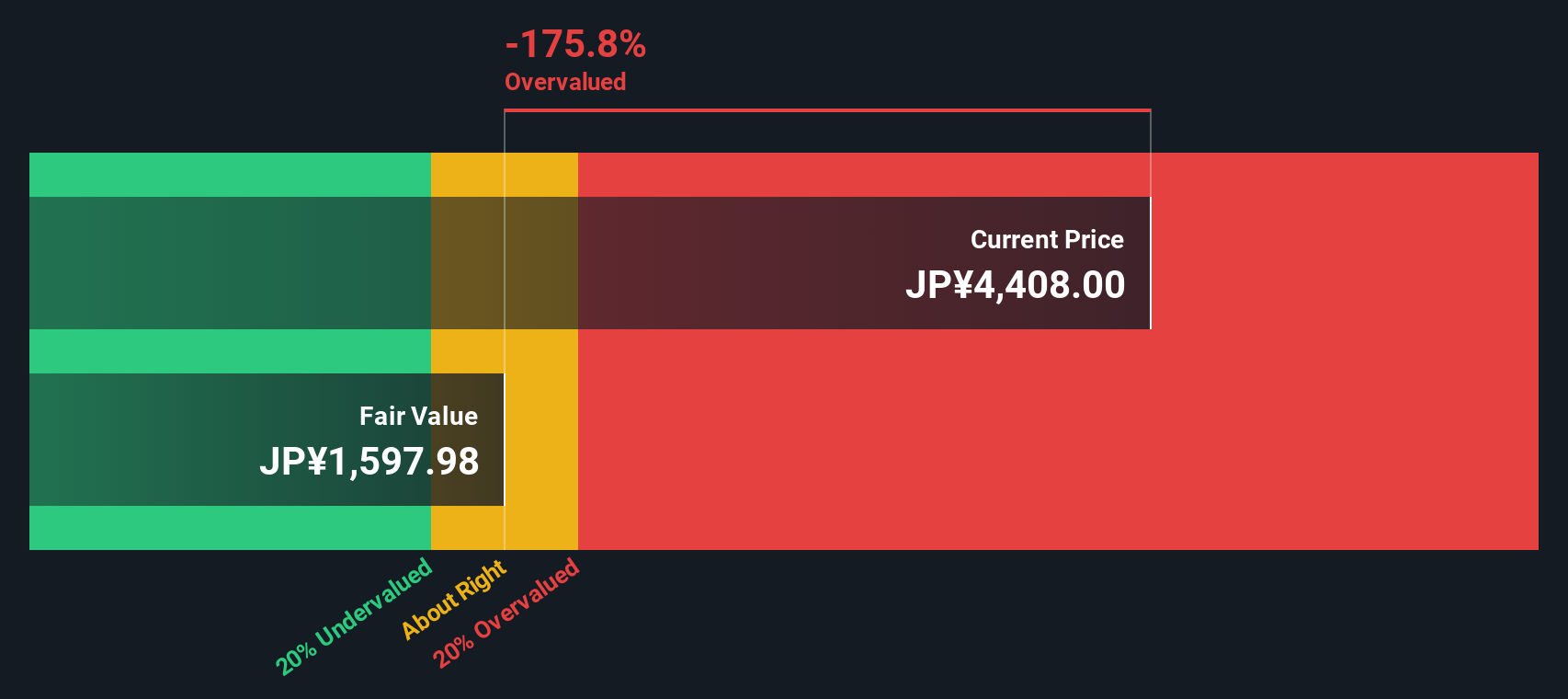

Another Perspective: DCF Model Tells a Different Story

While the prevailing view sees Mitsui O.S.K. Lines as undervalued, our DCF model presents a much more cautious picture. According to this method, the shares are actually trading significantly above their estimated fair value. This suggests the market might be overestimating near-term growth. Does the disconnect signal opportunity or added risk for investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mitsui O.S.K. Lines for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 921 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mitsui O.S.K. Lines Narrative

If you have a different perspective or want to test your own approach, you can craft a custom narrative in just a few minutes. Do it your way.

A great starting point for your Mitsui O.S.K. Lines research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Act now to broaden your portfolio beyond the obvious. These tailored lists reveal some of the market’s best-kept opportunities you might regret missing.

- Secure steady income with companies that yield over 3% when you select these 16 dividend stocks with yields > 3%. Lock in reliable returns for your future.

- Access the innovators shaping artificial intelligence by reviewing these 25 AI penny stocks. Get ahead of tomorrow’s growth trends today.

- Spot bargains with strong cash flow potential by checking out these 921 undervalued stocks based on cash flows. Give yourself a serious edge over the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9104

Mitsui O.S.K. Lines

Provides marine transportation and vessel chartering services in Japan, North America, Europe, Singapore, rest of Asia, and internationally.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives