Yamato Holdings (TSE:9064) Margin Rebound Raises Earnings Quality Questions Following Large One-Off Gain

Reviewed by Simply Wall St

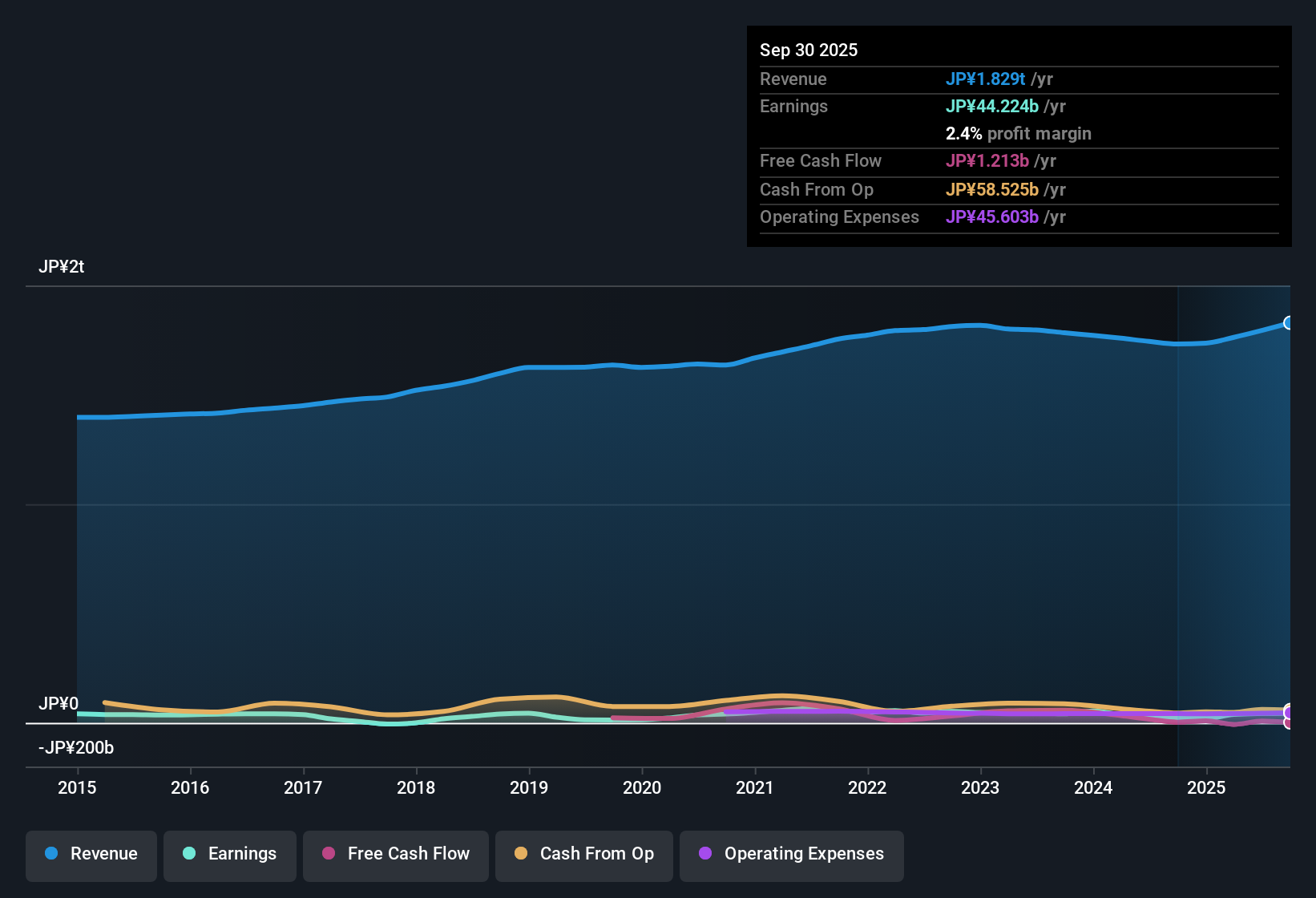

Yamato Holdings (TSE:9064) posted a striking earnings turnaround, with last year’s growth of 109.9% sharply reversing a prior five-year annual earnings decline of 10.1%. Net profit margins doubled from 1.2% to 2.4% year-on-year, and earnings are now forecast to grow 12.58% per year, well ahead of the Japanese market’s expected 7.9% growth rate. While revenue growth is expected to be slightly below the national average, investors will be weighing the stronger profitability and forward growth outlook against the impact of a recent ¥36.0 billion one-off gain on earnings quality.

See our full analysis for Yamato Holdings.Next, we will see how these numbers compare to the current narratives tracking Yamato Holdings. This will help determine which stories hold up and which might face new questions.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Recover Despite Prior Decline

- Net profit margin lifted significantly, reaching 2.4% this period after being just 1.2% last year. This marks a substantial turnaround from the prior multi-year downtrend.

- The prevailing view emphasizes that this margin recovery is central to Yamato's investment appeal, as it strongly supports the case that operational improvements are finally finding traction.

- This expansion in margins follows five years where average annual profits declined by 10.1%. Investors are watching closely to see if improved execution can be sustained.

- Market watchers note the 109.9% profit growth further underscores this momentum, especially as logistics peers continue to grapple with cost and competitive challenges.

One-Off Gain Clouds Earnings Clarity

- The latest ¥36.0 billion one-off gain accounted for a major share of reported profits, introducing real questions around the underlying quality of this year’s earnings.

- What is surprising is that even with this boost, some observers remain cautious about whether ongoing profit levels can be maintained without extraordinary items.

- Risks to sustainability loom, as the improvement in net margin could partially unwind once the impact of this gain is removed from results.

- Bears highlight that much of the improvement may not reflect true operating performance, so future results could reset at a lower base if similar events do not recur.

Valuation Signals: Attractive Versus Peers, Costly Versus Sector

- Shares are trading above their DCF fair value (¥2,252.00 price vs ¥2,222.87 DCF fair value). However, Yamato’s P/E ratio of 16.1x looks appealing compared to direct peers (21.2x), even as it trades at a premium to the broader logistics sector’s average (14.9x).

- Investors are analyzing whether the share’s premium to industry norms is justified by the company’s earnings recovery or whether competitive and structural headwinds will ultimately pressure valuation multiples.

- The 3% forecasted annual revenue growth, lagging the market average of 4.5%, adds to the debate over whether Yamato deserves to command a higher multiple in the long term.

- Despite the ongoing profit rally, the one-off gain and mixed sector context leave some questioning the stock’s upside from current levels.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Yamato Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Although Yamato Holdings’ net margin recovery and earnings growth are promising, the sharp reliance on a one-off gain and below-average revenue forecasts raise doubts about consistent long-term performance.

If sustained growth is your priority, use stable growth stocks screener (2094 results) to discover companies that are delivering reliable expansion in earnings and revenue year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9064

Yamato Holdings

Provides logistics shipping services in Japan and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives