- Japan

- /

- Transportation

- /

- TSE:9044

Nankai Electric Railway (TSE:9044) Margin Decline Challenges Premium Valuation Narrative

Reviewed by Simply Wall St

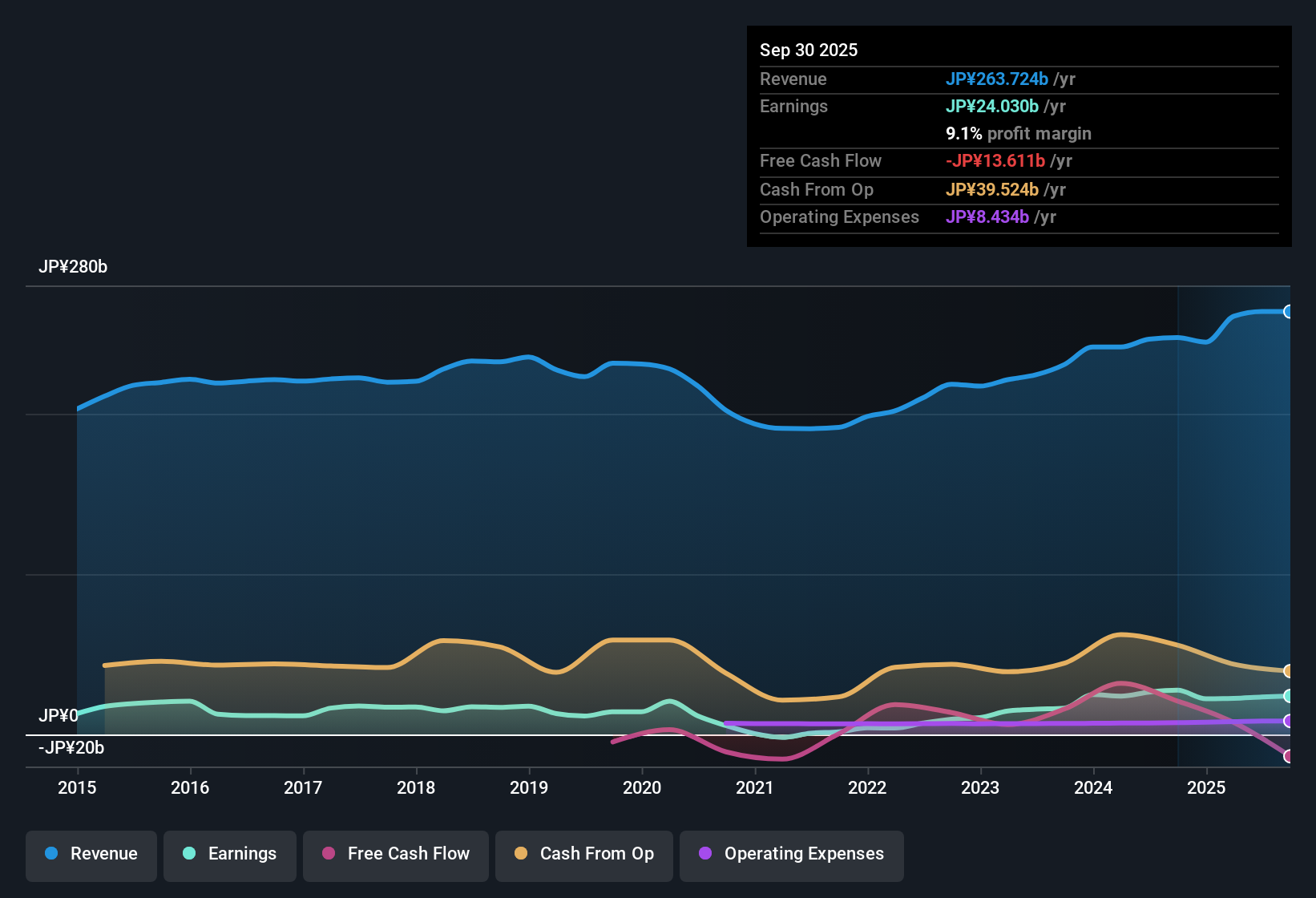

Nankai Electric Railway (TSE:9044) reported its latest net profit margin at 9.1%, down from 11.2% a year earlier. Earnings are expected to grow just 0.7% per year, with revenue forecast to increase by 3.4% annually. Although the company averaged a robust 43.9% annual earnings growth over the past five years, the most recent results reveal a year-on-year earnings decline. This sets a cautious tone for investors monitoring the company’s outlook.

See our full analysis for Nankai Electric Railway.Now let’s see how these numbers compare to the broader market narratives, which expectations get validated, and which might get a second look.

Curious how numbers become stories that shape markets? Explore Community Narratives

P/E Ratio Stands Above Sector Peers

- Nankai Electric Railway's P/E ratio is 12.7x, surpassing both its peer average and the broader Japanese transportation sector, which are each at 12.4x.

- The recent premium in valuation, paired with a net profit margin drop from 11.2% to 9.1%, brings a layer of caution that fits current analysis trends:

- The current multiple is not fully matched by forward earnings growth, which is forecast at just 0.7% per year. This makes the premium harder to justify.

- At ¥2,784.5, the share price is more than triple the DCF fair value estimate of ¥828.53. This directly challenges narratives that claim sector tailwinds alone will sustain the valuation gap.

DCF Fair Value Points to Cautious Approach

- The current share price of ¥2,784.5 sits far above the company's DCF fair value estimate of ¥828.53, indicating a substantial valuation risk by traditional cash flow metrics.

- Examining the situation further, market perspective focuses on this valuation disparity as a reason for restraint:

- Despite the company's historically high-quality earnings, its present valuation leaves little margin for error should expected growth of 0.7% per year not materialize as hoped.

- Bulls may see sector and tourism momentum as a buffer, but the stark gap to fair value and underwhelming profit forecasts highlight why some investors will stand back for now.

Profit Growth Lags Market Expectations

- The company's anticipated revenue growth rate of 3.4% annually trails the broader Japanese market's figure of 4.5%, positioning Nankai Electric Railway behind the curve for sector expansion.

- Viewed through the current lens, investor discussions highlight several factors at odds with broader optimism:

- Nankai's earnings averaged an impressive 43.9% growth per year over five years, but the latest negative year-on-year performance signals that momentum has waned.

- This combination of lower future growth and recent margin contraction makes it difficult to support a premium valuation relative to peers based purely on forward prospects.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Nankai Electric Railway's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Nankai Electric Railway faces an overvalued price tag, lagging revenue growth, and diminishing profit margins. These factors challenge its premium status compared to peers.

If you want alternatives with more attractive pricing and better upside, check out these 831 undervalued stocks based on cash flows for investment ideas offering stronger value for money right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nankai Electric Railway might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9044

Average dividend payer with questionable track record.

Market Insights

Community Narratives