- Japan

- /

- Transportation

- /

- TSE:9031

A Look at Nishi-Nippon Railroad (TSE:9031) Valuation Following Profit Surge and Upgraded Dividend Outlook

Reviewed by Simply Wall St

Nishi-Nippon Railroad (TSE:9031) just reported a 79% jump in interim profit compared to last year. This prompted the company to raise its dividend forecast and update its financial outlook for 2026.

See our latest analysis for Nishi-Nippon Railroad.

After a string of upbeat announcements, including a raised dividend and improved earnings outlook, Nishi-Nippon Railroad’s recent momentum is showing up in its share price, which has climbed 16.9% over the last 90 days. For investors looking beyond the interim excitement, the company’s one-year total shareholder return sits at 13.1%, while longer-term returns remain subdued. This suggests the recent performance may mark a shift in sentiment and valuation.

If this turnaround has piqued your interest, now’s a perfect time to broaden your search and discover fast growing stocks with high insider ownership.

With analysts projecting future growth and the stock price already up nearly 17% in the past three months, investors now face a crucial question: Is Nishi-Nippon Railroad still undervalued, or has the market already priced in the rebound?

Price-to-Earnings of 7x: Is it justified?

At a price-to-earnings (P/E) ratio of 7x, Nishi-Nippon Railroad’s shares look cheap compared to peers and the broader sector. The last close at ¥2615 suggests the market may be overlooking something.

The P/E ratio measures how much investors are willing to pay for each yen of company earnings. This makes it a key barometer for valuing established, profitable businesses such as Nishi-Nippon Railroad. In the transport sector, where steady cash generation is important, a low P/E can signal a bargain or underlying market skepticism.

The 7x P/E is well below the Japanese market average of 13.7x. It is also below the transportation industry average of 11.6x and the typical peer at 13.4x. It remains beneath our SWS fair value regression of 9.1x, which sets the benchmark for where value could eventually normalize.

Explore the SWS fair ratio for Nishi-Nippon Railroad

Result: Price-to-Earnings of 7x (UNDERVALUED)

However, softer annual net income growth and a recent drop below analyst price targets highlight uncertainty, which could temper this upbeat momentum.

Find out about the key risks to this Nishi-Nippon Railroad narrative.

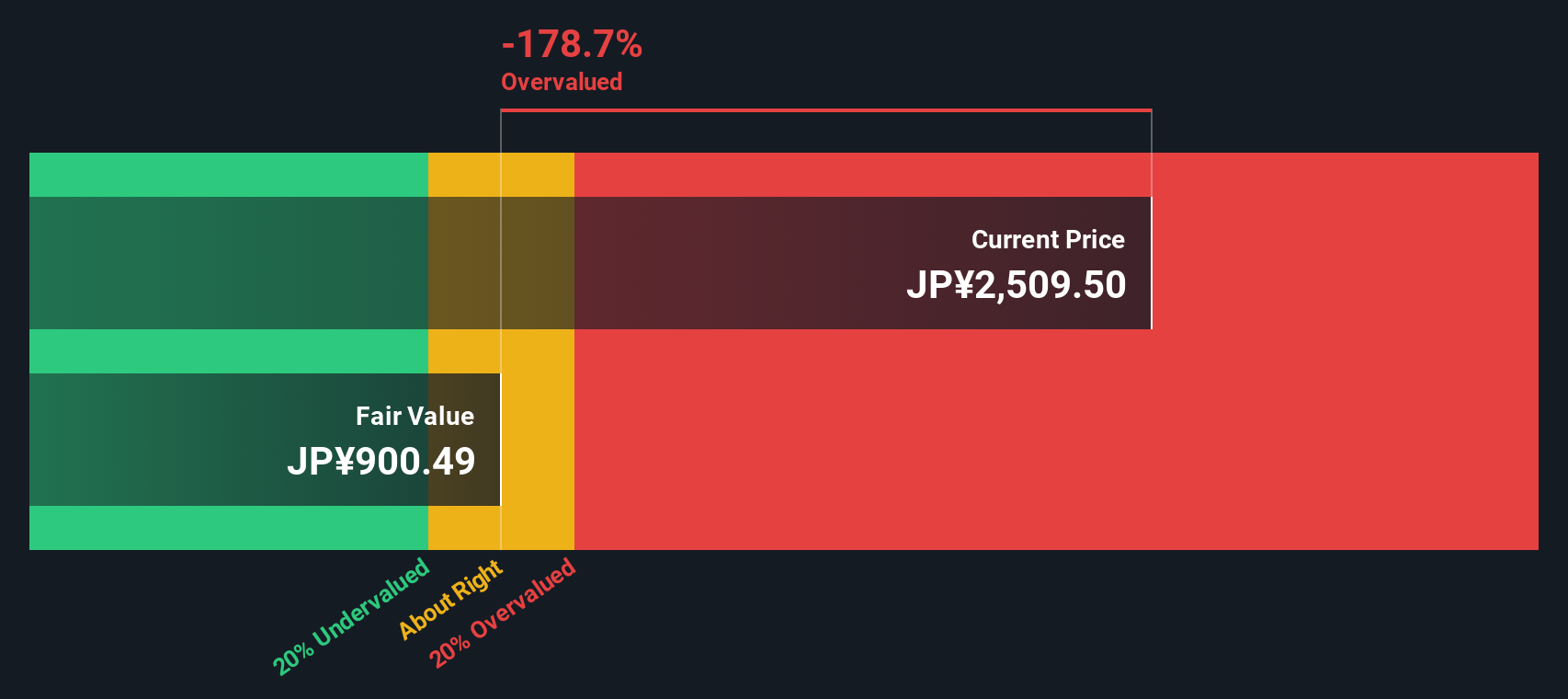

Another View: Our DCF Model Paints a Different Picture

While Nishi-Nippon Railroad’s low price-to-earnings ratio hints at value, our SWS DCF model suggests caution. With the stock trading well above our estimated fair value, this approach signals the shares may not be the bargain they appear to be. Are investors missing risks, or is the market right to pay a premium?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nishi-Nippon Railroad for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 917 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nishi-Nippon Railroad Narrative

If you have a different perspective, or want to test your own assumptions, you can easily build your own analysis and narrative in just a few minutes. Do it your way.

A great starting point for your Nishi-Nippon Railroad research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let unique opportunities pass you by. The Simply Wall Street Screener puts smart investing at your fingertips, making it easy to spot the next big winner.

- Tap into potential with these 917 undervalued stocks based on cash flows, which are flying below the radar while delivering strong fundamentals and attractive cash flow prospects.

- Target reliable income by browsing these 17 dividend stocks with yields > 3% with yields above 3 percent, making consistent returns more accessible.

- Catalyze your portfolio growth as health and technology intersect in these 30 healthcare AI stocks, driving innovation forward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nishi-Nippon Railroad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9031

Nishi-Nippon Railroad

Engages in the transportation business in Japan and internationally.

Fair value with acceptable track record.

Market Insights

Community Narratives