- Japan

- /

- Transportation

- /

- TSE:9024

A Look at Seibu Holdings (TSE:9024) Valuation Following Dividend Increase Announcement

Reviewed by Simply Wall St

Seibu Holdings (TSE:9024) just announced it will boost its interim cash dividend for the second quarter of 2025 to JPY 20 per share. This is an increase from JPY 15 a year ago. For investors, this increased payout signals confidence from the company and could support renewed interest ahead of the scheduled December 2 payment date.

See our latest analysis for Seibu Holdings.

Seibu Holdings’ dividend boost comes as the stock has enjoyed a strong run, with its 1-year total shareholder return reaching 48.4% and a remarkable 3-year total return of 283.9%. The company’s share price has surged nearly 50% year-to-date, which suggests that investor optimism may be building as the latest payout reflects management’s confidence and a potential re-rating of the business.

If you’re interested in where momentum and ownership trends intersect, now is a perfect moment to explore fast growing stocks with high insider ownership.

With Seibu’s share price already up almost 50 percent this year, the question now is whether the stock remains undervalued or if the market has already priced in all of the company’s future growth prospects. Is there still an opportunity for investors to buy in, or is the current rally reflecting full optimism?

Price-to-Earnings of 6.2x: Is it justified?

At a price-to-earnings (P/E) ratio of 6.2x, Seibu Holdings stands out as notably inexpensive when compared to both the broader Japanese market and its direct industry competitors. This low multiple, even with the recent share price surge, invites a closer look at what is driving market expectations for the company’s earnings.

The P/E ratio measures how much investors are willing to pay for each yen of Seibu’s current earnings. In industries like transportation where returns are often scrutinized against cyclical performance and capital intensity, a lower P/E may indicate the market anticipates future headwinds or is discounting recent profit growth as unsustainable. However, Seibu’s profitability rebound and recent dividend increase may be prompting reconsideration of those assumptions.

Compared to its peers and industry, Seibu’s 6.2x ratio looks especially compelling, as the JP Transportation sector trades at an average of 12x and its direct peers at 13.1x. In addition, regression analysis suggests a fair multiple would be around 6.6x. This points to a market that remains cautious, yet leaves room for further revaluation should fundamentals hold.

Explore the SWS fair ratio for Seibu Holdings

Result: Price-to-Earnings of 6.2x (UNDERVALUED)

However, revenue and net income have declined annually. This could pressure future growth if these negative trends continue to outweigh current investor optimism.

Find out about the key risks to this Seibu Holdings narrative.

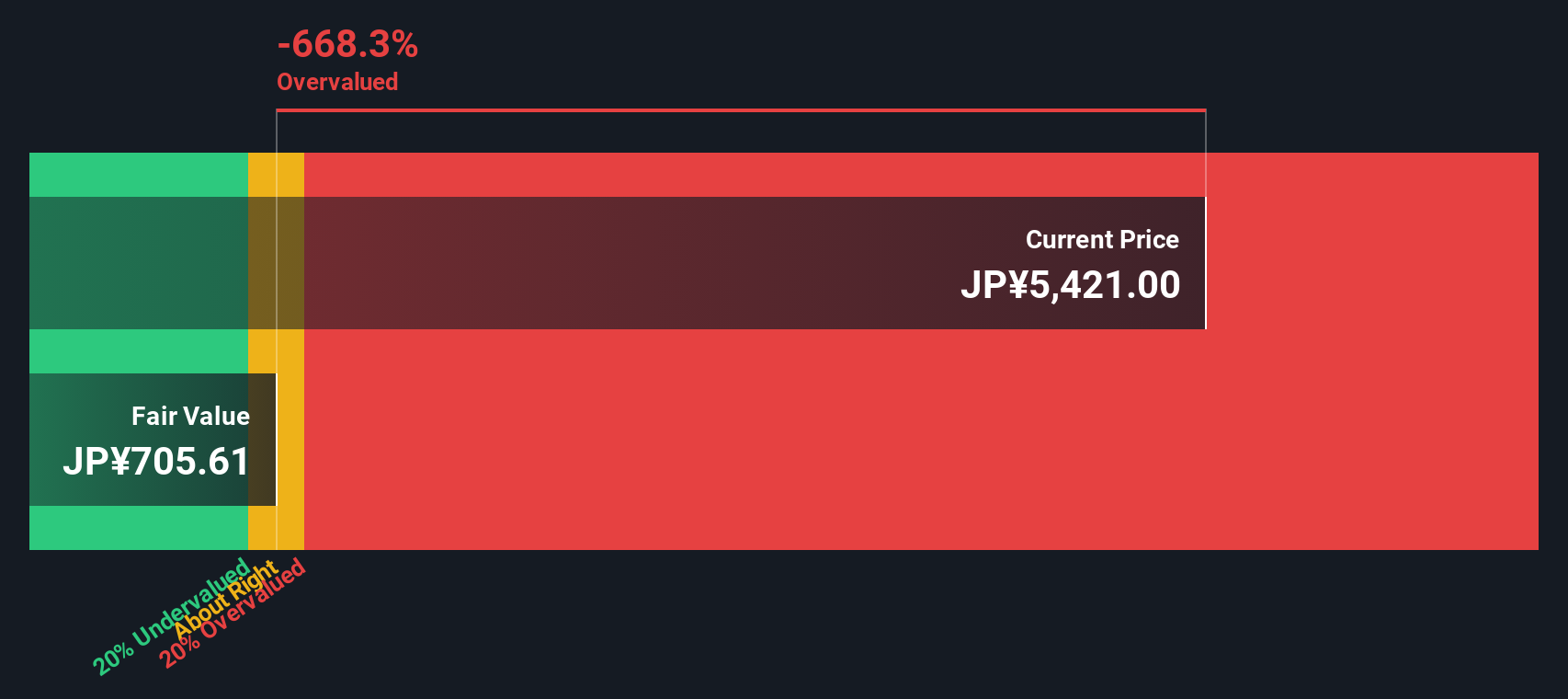

Another View: Discounted Cash Flow Tells a Different Story

While Seibu Holdings looks undervalued on an earnings basis, the SWS DCF model arrives at a far lower fair value of ¥749.24 per share, which is well beneath the current market price of ¥4,888. This suggests the optimism in the share price may be outpacing longer-term cash flow fundamentals. Is the market pricing in too much growth already?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Seibu Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 926 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Seibu Holdings Narrative

If you see things differently or want to dive deeper into Seibu Holdings’ story yourself, you can explore the data and shape your personal view in just a few minutes with Do it your way.

A great starting point for your Seibu Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready to Expand Your Investing Playbook?

Unlock even more opportunities by checking out these hand-picked stock ideas. Make sure you act now so you don't miss standout moves in sectors transforming the market.

- Uncover high-yield potential and shield your portfolio from volatility with these 15 dividend stocks with yields > 3%, which offers robust returns and reliable income streams.

- Ride the wave of innovation by targeting these 26 AI penny stocks, which are reshaping industries with groundbreaking advancements in artificial intelligence.

- Tap into explosive future growth through these 26 quantum computing stocks, featuring disruptive firms at the cutting edge of computing and encryption technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9024

Seibu Holdings

Engages in the urban transportation, hotel and leisure, real estate, construction, and baseball team management businesses in Japan and internationally.

Solid track record and fair value.

Market Insights

Community Narratives