- Japan

- /

- Transportation

- /

- TSE:9023

Tokyo Metro (TSE:9023) Margins Rise, Challenging Cautious Market Narrative on Profit Quality

Reviewed by Simply Wall St

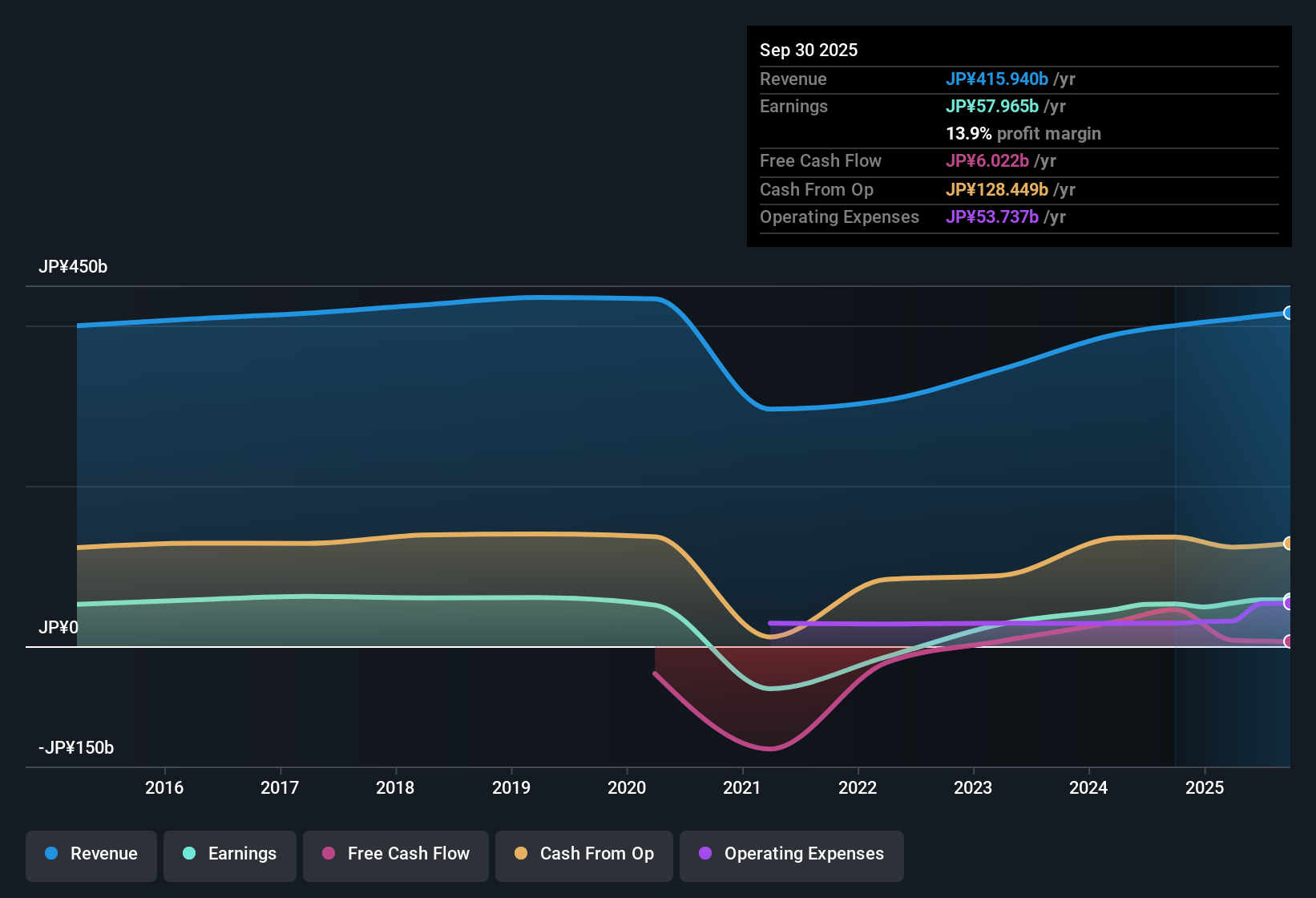

Tokyo Metro (TSE:9023) posted net profit margins of 13.9%, up from 13.2% last year, with earnings expected to grow at 2.29% per year. Over the past five years, the company delivered a remarkable 51.8% annual growth in earnings. However, in the most recent year, that pace slowed to 10%. Looking ahead, both revenue and earnings are forecast to rise at a slower pace than Japan's overall market. Margins are maintaining their upward trend, and earnings quality remains high.

See our full analysis for Tokyo Metro.Next, we’ll see how these figures stack up against prevailing narratives and market consensus to find out which story holds true and where expectations might need to shift.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Defy Slowing Growth Pace

- Net profit margins climbed to 13.9% from 13.2% the prior year, underlining a continued focus on operational efficiency even as earnings growth has moderated from its recent five-year average of 51.8% to 10% in the latest year.

- Recent margin strength heavily supports a prevailing view that Tokyo Metro, despite tapering growth speed, remains adept at delivering high-quality earnings.

- Profitability continues to move higher year on year even as revenue and profit growth forecasts trail the broader Japanese market.

- Market participants often highlight margin trends as evidence of stable operations, reinforcing the company’s reputation for earnings durability.

Premium Valuation Versus Peers and Sector

- Tokyo Metro trades at a 16.2x P/E multiple, significantly higher than the peer average of 10.2x and the industry average of 12.4x. This suggests investors are willing to pay more for perceived stability or future growth potential despite slower forecasted growth rates.

- The elevated valuation creates a tension with moderating growth:

- The current share price of 1619.50 stands well above the DCF fair value estimate of 555.25, reinforcing concerns about limited short-term upside for value-focused investors.

- Premium multiples may be justified in part by a consistent track record of margin improvement. However, those paying more today are more exposed to any disappointment around future revenue and profitability trends.

Market Growth Lag Narrows Future Upside

- Revenue is forecast to grow at just 2.6% per year, much slower than the wider Japanese market’s 4.5% expected pace, while earnings are similarly projected to trail market averages.

- The prevailing market view notes the company’s established track record for profit and revenue increases is a reward, but

- Analysts caution that slower projected growth tempers enthusiasm about outperformance, especially in the context of the company’s premium valuation.

- For investors seeking high-growth opportunities, a revenue forecast below market averages may point to less compelling upside compared to other Japanese stocks.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Tokyo Metro's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Tokyo Metro’s premium valuation and slowing growth rates mean the upside may be limited compared to faster-growing peers in the Japanese market.

If you're after stronger growth prospects and more compelling upside potential, check out high growth potential stocks screener (60 results) for leading companies forecast to deliver robust earnings expansion over the next few years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tokyo Metro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9023

Tokyo Metro

Engages in the operation and management of railways in Japan.

Proven track record with imperfect balance sheet.

Market Insights

Community Narratives