- Japan

- /

- Transportation

- /

- TSE:9021

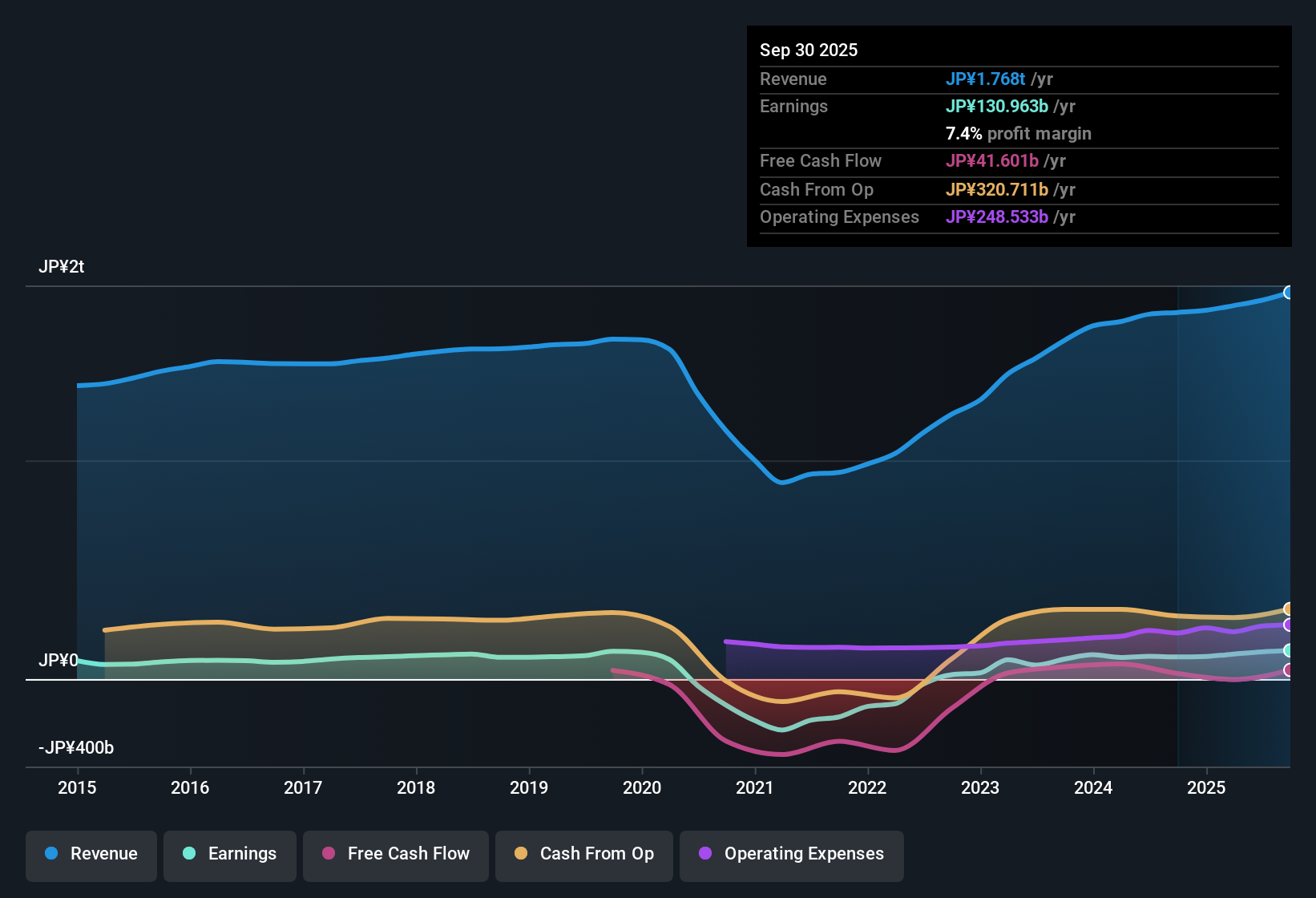

JR West (TSE:9021) Profit Margin Rises to 7.4%, Challenging Bearish Earnings Outlook

Reviewed by Simply Wall St

West Japan Railway (TSE:9021) posted a net profit margin of 7.4%, up from 6% in the prior period, as annual earnings grew 29.2% year-over-year. Over the last five years, average annual earnings growth reached 66.9%, marking a robust stretch of profit expansion for the company. While revenue is forecast to grow at 2.4% per year, which trails the Japanese market rate of 4.5%, forward estimates project a 2.3% annual decline in earnings over the next three years. This puts the spotlight on both past momentum and future challenges.

See our full analysis for West Japan Railway.The next step is to see how these latest numbers compare to market narratives and community viewpoints. Some stories may gain more credibility, while others will be tested by the recent results.

Curious how numbers become stories that shape markets? Explore Community Narratives

P/E Discount Paints a Mixed Picture

- West Japan Railway’s Price-to-Earnings ratio stands at 10.8x, notably below both the peer group average of 12.1x and the Transportation industry’s 12.4x. This signals a market discount relative to similar companies.

- Despite this apparent value, the company’s current share price of ¥3,114 sits well above its DCF fair value of ¥970.69.

- Market participants may see the low P/E as a sign of undervaluation, but the wide gap between trading price and intrinsic value introduces caution.

- This tension underscores that even a “cheap” P/E does not always mean the stock is a bargain if forward profit decline and fair value estimates are factored in.

Margins Rebound, but Growth Slows

- The net profit margin improved to 7.4% from 6% in the previous period, yet guidance points to a 2.3% annual earnings decline over the next three years.

- Bulls have highlighted the company’s significant earnings growth over five years.

- The average annual earnings growth of 66.9% stands out among industry peers and supports confidence in the company’s historic ability to deliver strong results.

- However, the projected future downturn in earnings growth directly challenges bullish optimism and raises questions about whether the past can be repeated or if structural hurdles will limit further upside.

Revenue Growth Trails the Market

- West Japan Railway is forecast to grow revenue at 2.4% annually, falling short of the broader Japanese market’s 4.5% rate and indicating limited top-line momentum.

- The prevailing market outlook underscores that, even with recovering passenger demand and normalization post-pandemic,

- The slower revenue trajectory suggests headwinds from competition, population trends, or cost pressures could persist.

- Solid historic profit expansion may be offset by these more modest growth expectations and a need for ongoing cost management.

Want the full balanced take? Analysts weigh past momentum and future risks in depth for West Japan Railway. 📊 Read the full West Japan Railway Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on West Japan Railway's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite impressive past earnings growth, West Japan Railway faces a stalled outlook. Projected earnings declines, combined with a trading price far above intrinsic value estimates, present concerns for investors.

To find attractively priced companies with potential upside, use our these 842 undervalued stocks based on cash flows and uncover investment opportunities offering a better balance of value and future prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if West Japan Railway might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9021

Proven track record and fair value.

Market Insights

Community Narratives