- Japan

- /

- Transportation

- /

- TSE:9008

Keio (TSE:9008): Assessing Valuation After Share Buyback, Dividend Hike, and Stock Split Announcement

Reviewed by Simply Wall St

Keio (TSE:9008) made headlines as its Board of Directors rolled out a share buyback program, higher dividends, and a stock split. These actions are tied to improved earnings guidance and a drive to enhance capital efficiency and liquidity.

See our latest analysis for Keio.

Keio’s recent announcements have helped spark renewed investor attention, with the 1-day share price return jumping 3.45% on the heels of their buyback and dividend hike. While the stock has built some momentum lately, posting a 6.88% return over the last 90 days, the 1-year total shareholder return remains modest at just 0.81%, and the long-term picture shows the total shareholder return is still well below previous peaks. That said, this mix of improved guidance, shareholder rewards, and a stock split suggests Keio is building a foundation for potential recovery, even if long-term investors are still waiting to see meaningful upside.

If Keio’s renewed strategy has you curious, this could be the perfect chance to broaden your investing horizons and discover fast growing stocks with high insider ownership

With Keio’s shares rising on positive news, investors may wonder whether the current price reflects all of the company’s improving fundamentals or if there is still an attractive buying opportunity as future growth unfolds.

Price-to-Earnings of 12x: Is it justified?

Based on its price-to-earnings (P/E) ratio of 12x at the last close of ¥3,993, Keio trades close to the Japanese market average, but appears slightly more expensive than its peers.

The P/E ratio measures how much investors are paying for each yen of earnings. It serves as a snapshot of the market's expectations for future growth and profitability. For a company like Keio in the transportation sector, this multiple is closely watched because it can reflect both stable earnings and the degree of investor confidence in sustained returns.

Keio's current price-to-earnings ratio (12x) is below the broader JP market average (13.9x). This suggests a potential value signal compared to the entire market. However, the company is trading at a premium to the peer average (11.4x) and is even with the industry average (12x), which points to balanced market expectations. Compared to the estimated fair P/E ratio (12.8x), the market could move higher if positive momentum continues.

Explore the SWS fair ratio for Keio

Result: Price-to-Earnings of 12x (ABOUT RIGHT)

However, softer net income growth and long-term underperformance remain concerns. These factors could weigh on sentiment if improvements do not materialize soon.

Find out about the key risks to this Keio narrative.

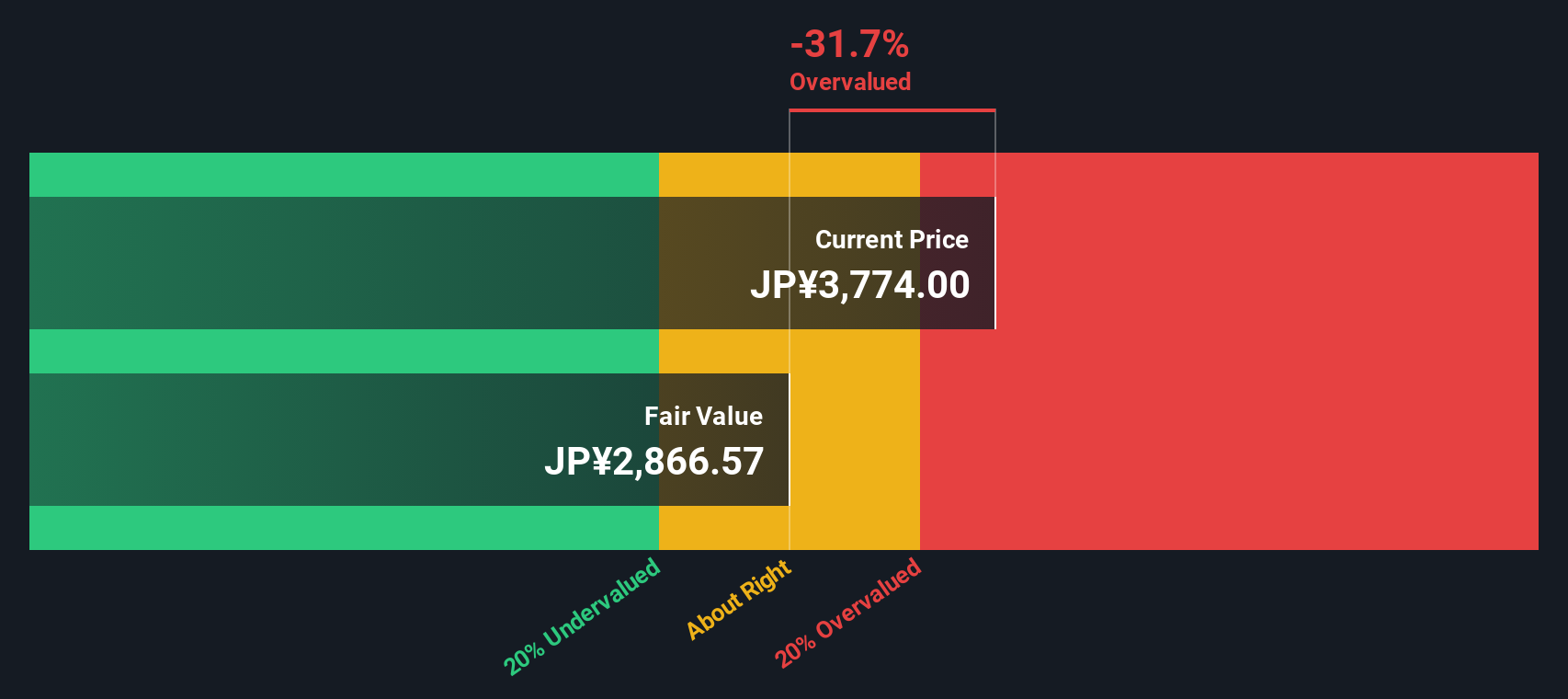

Another View: SWS DCF Model Offers a Different Perspective

Looking at Keio’s valuation from another angle, our SWS DCF model estimates a fair value that sits below the current share price. This suggests the company may be overvalued based on projected future cash flows. It presents a challenge to the story told by earnings multiples and raises the question of which signal is more reliable for long-term investors.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Keio for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 926 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Keio Narrative

If you see the story differently or want hands-on experience with the numbers, you can quickly build your own perspective in just a few minutes, Do it your way

A great starting point for your Keio research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for More Smart Stock Ideas?

Momentum is building across the markets, making this an ideal time to explore new investment opportunities you won’t want to miss.

- Boost your portfolio income and identify long-term payers by exploring these 16 dividend stocks with yields > 3%, which features yields above 3% and dependable fundamentals.

- Stay ahead by considering these 26 AI penny stocks, companies that are transforming industries with artificial intelligence and swift innovation.

- Discover early-stage growth prospects and potential significant movers in these 3597 penny stocks with strong financials, all supported by strong financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Keio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9008

Acceptable track record second-rate dividend payer.

Market Insights

Community Narratives