- Japan

- /

- Transportation

- /

- TSE:9003

Sotetsu Holdings (TSE:9003) Margin Miss Challenges Defensive Narrative Despite Above-Market Earnings Growth

Reviewed by Simply Wall St

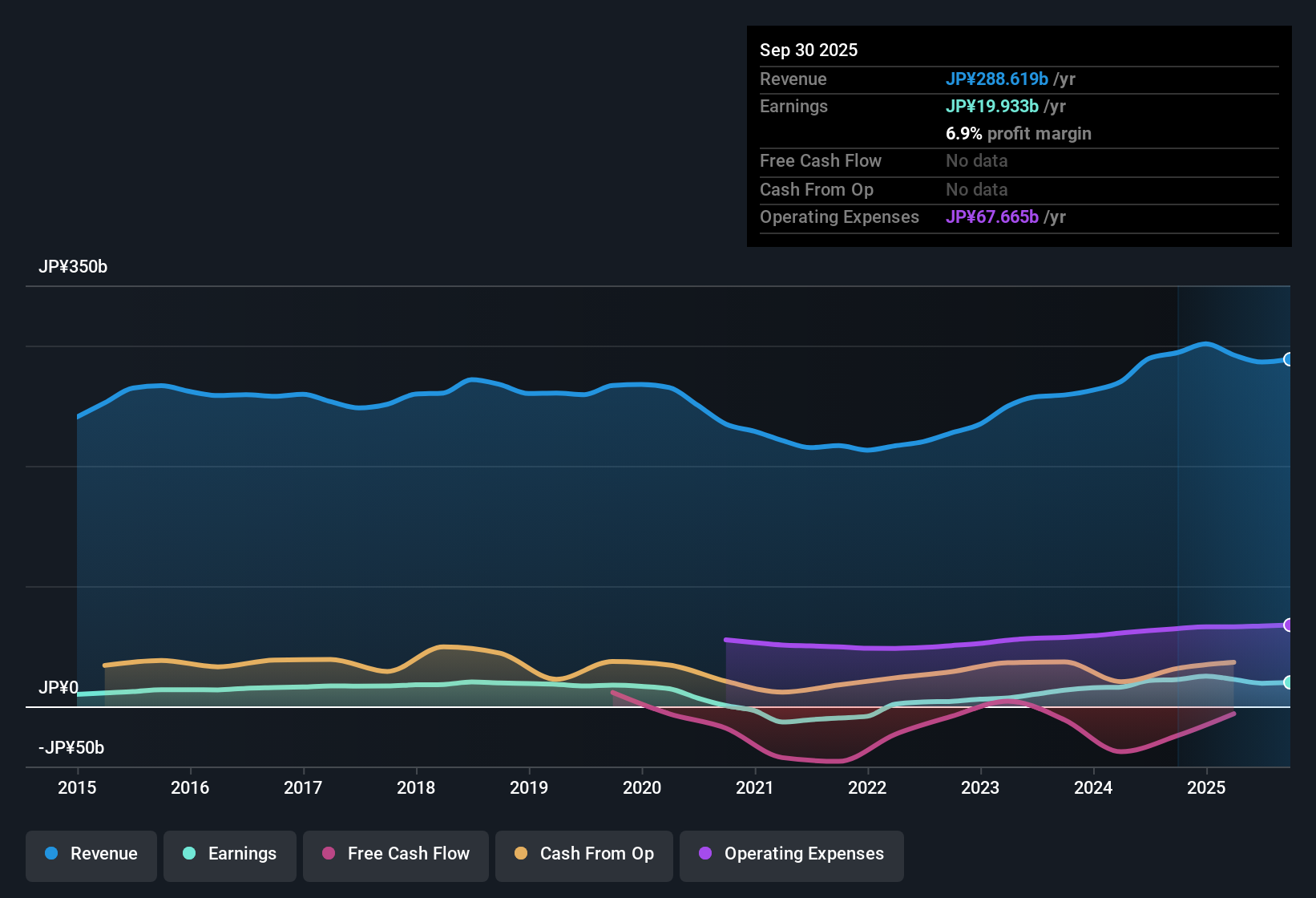

Sotetsu Holdings (TSE:9003) is projected to deliver robust earnings growth of 14.4% per year, handily beating the broader Japanese market’s 7.9% forecast. Despite the high quality of earnings, the company’s net profit margin has edged down to 6.9% from last year’s 7.6%, and revenue growth is expected to come in at 3.3% per year, trailing the market average of 4.5%. With a Price-To-Earnings Ratio of 12.4x that is lower than both the industry and peer group averages, investors may see value, but risks around financial strength and dividend sustainability are worth keeping in mind.

See our full analysis for Sotetsu Holdings.The real test is how these figures stack up against the main market and community narratives. Sometimes the numbers confirm conventional wisdom, and other times they tell a very different story.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Slides to 6.9%, Pressuring Quality Story

- The latest net profit margin is 6.9%, dropping from 7.6% last year, even as the company maintains high earnings quality by sector standards.

- While recent margin movement pressures the bullish view that Sotetsu’s operations are insulated from sector volatility,

- The prevailing market perspective notes how defensive features, such as steady ridership and infrastructure assets, support the investment case despite compressed margins,

- and also recognizes that success in capital efficiency or cost control will be needed to keep sentiment positive if margin softness persists.

Growth Forecast Trails Japanese Market Pace

- Sotetsu’s revenue growth is projected at 3.3% per year, lagging the Japanese market average of 4.5% and signaling slower top-line momentum going forward.

- On the one hand, growth below the national pace tests claims that stable urban mobility demand will drive durable upside,

- but the prevailing narrative highlights that relative safety and stable demand in urban infrastructure markets can still attract investors during uncertain times,

- particularly if the company sustains above-average earnings growth compared to many other sectors.

Valuation Discount vs Peers, But Stock Trades Above DCF Fair Value

- The 12.4x Price-To-Earnings Ratio is modestly below both transportation industry (12.5x) and peer (12.6x) averages, but the current share price of 2,584.00 sits well above the calculated DCF fair value of 1,378.97 yen.

- This apparent discount to sector multiples boosts the case for those seeking relative value opportunities,

- yet the prevailing view warns that trading above DCF fair value adds a note of caution, especially for value-focused investors monitoring the fundamentals beyond headline ratios,

- while steady profit growth could still underpin longer-term optimism if operational trends stabilize or improve.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Sotetsu Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Sotetsu’s slowing revenue growth, narrowing margins, and a share price above fair value highlight concerns around both operational momentum and current valuation.

If you’re searching for stocks with more attractive pricing, discover these 834 undervalued stocks based on cash flows that could offer compelling value and stronger upside potential right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9003

Fair value with mediocre balance sheet.

Market Insights

Community Narratives