- Japan

- /

- Transportation

- /

- TSE:9001

Tobu Railway (TSE:9001): Valuation Insights Following Forecast Upgrade and Treasury Share Cancellation

Reviewed by Simply Wall St

Tobu Railway (TSE:9001) has taken a two-pronged approach to shareholder value with its recent upward revision to this year’s financial forecast and a Board-approved cancellation of 3.9 million treasury shares. Investors are now watching both the company’s growth outlook and capital strategy.

See our latest analysis for Tobu Railway.

The recent forecast upgrade and treasury share cancellation have put fresh focus on Tobu Railway, but the stock’s share price return tells a more cautious story, with year-to-date and one-year declines. Longer term, its three- and five-year total shareholder returns remain in negative territory. This suggests that while short-term optimism is emerging, the stock’s underlying momentum is still rebuilding.

If you’re weighing new opportunities after this capital move, now may be the perfect moment to explore fast growing stocks with high insider ownership.

Given the uplift in financial forecasts and a notable discount to analyst price targets, investors are left wondering if Tobu Railway’s shares remain undervalued or if the market has already priced in this recovery, leaving little room for upside.

Price-to-Earnings of 9.8x: Is it justified?

Tobu Railway trades on a price-to-earnings (P/E) ratio of 9.8x, which is noticeably below both its industry and peer averages. This indicates the market values its earnings more conservatively. With a last close price of ¥2,512, the current valuation stands out as much lower than the typical sector benchmark.

The P/E ratio measures what investors are willing to pay today for a company’s earnings. In transportation, where stable profits are expected, a lower ratio may mean market skepticism or hidden opportunity if profits are sustainable.

For Tobu Railway, its earnings performance has lagged the industry but the low P/E points to potential underappreciation of its profitability. Against the industry average of 12.5x and a peer average of 14x, Tobu’s ratio suggests the market could shift higher if confidence improves. Even when compared to a fair P/E estimate of 13.1x, current levels appear muted and could set the stage for re-rating if fundamentals align.

Explore the SWS fair ratio for Tobu Railway

Result: Price-to-Earnings of 9.8x (UNDERVALUED)

However, weak net income growth and persistent long-term underperformance could weigh on sentiment. This may potentially limit the stock’s ability to re-rate in the near term.

Find out about the key risks to this Tobu Railway narrative.

Another View: What Does the SWS DCF Model Say?

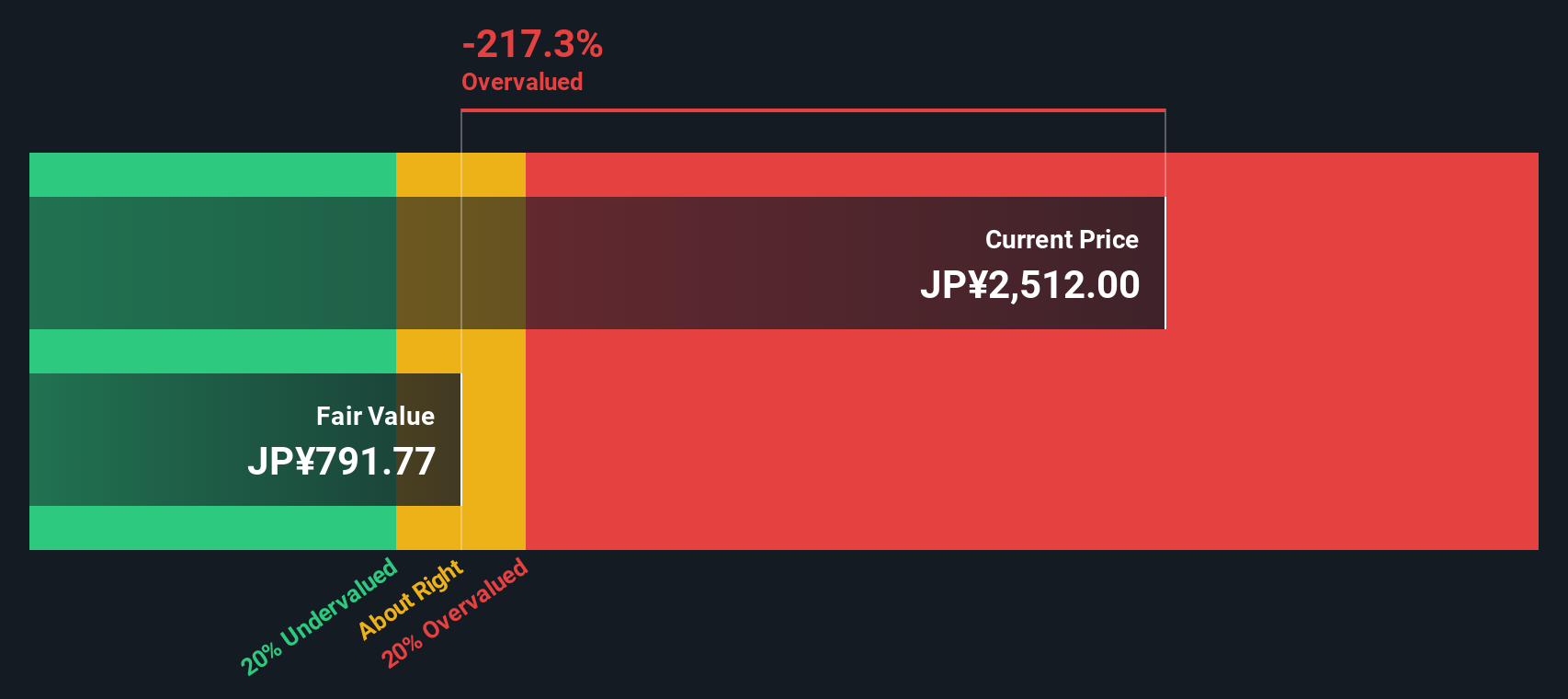

While the company’s low price-to-earnings ratio points to undervaluation, our DCF model comes to a very different conclusion. By estimating future cash flows, the DCF calculation suggests Tobu Railway’s current share price is trading well above its fair value. With these opposing signals, which should investors trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tobu Railway for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tobu Railway Narrative

If you see things differently or want to dig into the numbers yourself, you can easily put together your own perspective in just a few minutes, and Do it your way.

A great starting point for your Tobu Railway research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t settle for the obvious. Handpick your next opportunity from expertly curated ideas on Simply Wall Street. Miss these lists and you might miss tomorrow’s big winner.

- Capture consistent income streams by checking out these 16 dividend stocks with yields > 3% with yields many investors are searching for in today's market.

- Jump ahead of the curve by uncovering AI pioneers through these 24 AI penny stocks that are transforming industries with intelligent automation and machine learning.

- Target remarkable value prospects by reviewing these 870 undervalued stocks based on cash flows based on strong cash flow fundamentals that others often overlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tobu Railway might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9001

Good value with acceptable track record.

Market Insights

Community Narratives