- Japan

- /

- Telecom Services and Carriers

- /

- TSE:9432

Nippon Telegraph and Telephone Corporation's (TSE:9432) Business Is Trailing The Market But Its Shares Aren't

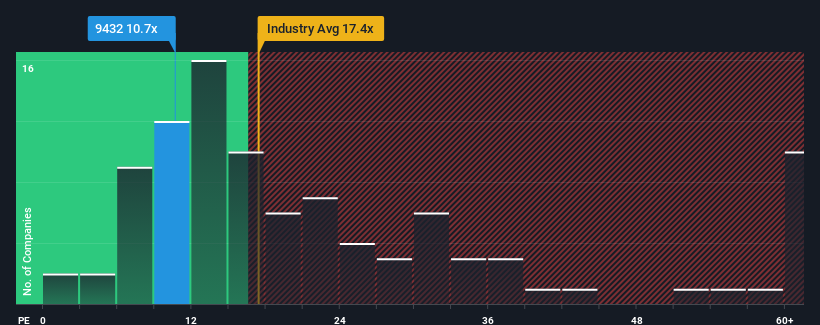

With a median price-to-earnings (or "P/E") ratio of close to 12x in Japan, you could be forgiven for feeling indifferent about Nippon Telegraph and Telephone Corporation's (TSE:9432) P/E ratio of 10.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Nippon Telegraph and Telephone could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Nippon Telegraph and Telephone

What Are Growth Metrics Telling Us About The P/E?

Nippon Telegraph and Telephone's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 4.7%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 9.5% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 5.7% per annum as estimated by the twelve analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 9.6% per year, which is noticeably more attractive.

In light of this, it's curious that Nippon Telegraph and Telephone's P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Nippon Telegraph and Telephone's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you settle on your opinion, we've discovered 2 warning signs for Nippon Telegraph and Telephone (1 makes us a bit uncomfortable!) that you should be aware of.

If these risks are making you reconsider your opinion on Nippon Telegraph and Telephone, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if NTT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9432

NTT

Operates as a telecommunications company in Japan and internationally.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.