- Japan

- /

- Telecom Services and Carriers

- /

- TSE:4415

Broad Enterprise Co.,Ltd. (TSE:4415) Stock Rockets 27% As Investors Are Less Pessimistic Than Expected

The Broad Enterprise Co.,Ltd. (TSE:4415) share price has done very well over the last month, posting an excellent gain of 27%. Taking a wider view, although not as strong as the last month, the full year gain of 17% is also fairly reasonable.

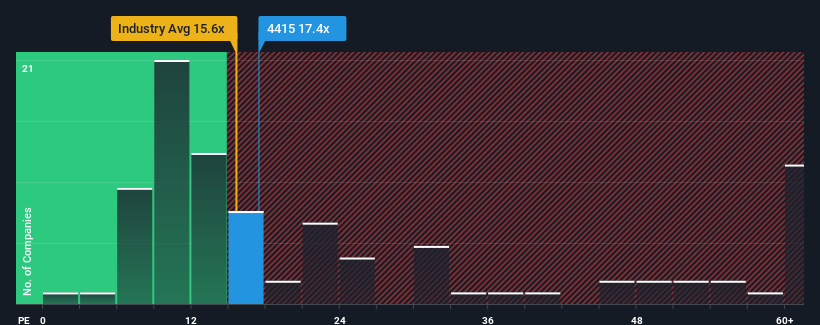

Since its price has surged higher, given around half the companies in Japan have price-to-earnings ratios (or "P/E's") below 13x, you may consider Broad EnterpriseLtd as a stock to potentially avoid with its 17.4x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

For instance, Broad EnterpriseLtd's receding earnings in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Broad EnterpriseLtd

Does Growth Match The High P/E?

Broad EnterpriseLtd's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 71%. This means it has also seen a slide in earnings over the longer-term as EPS is down 62% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 12% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we find it concerning that Broad EnterpriseLtd is trading at a P/E higher than the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Final Word

The large bounce in Broad EnterpriseLtd's shares has lifted the company's P/E to a fairly high level. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Broad EnterpriseLtd currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Broad EnterpriseLtd (1 is a bit concerning) you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Broad EnterpriseLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4415

Broad EnterpriseLtd

Provides Internet infrastructure for condominium management in Japan.

Proven track record with mediocre balance sheet.

Market Insights

Community Narratives