- Japan

- /

- Telecom Services and Carriers

- /

- TSE:4347

There's Reason For Concern Over Broadmedia Corporation's (TSE:4347) Massive 27% Price Jump

Despite an already strong run, Broadmedia Corporation (TSE:4347) shares have been powering on, with a gain of 27% in the last thirty days. Looking further back, the 20% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

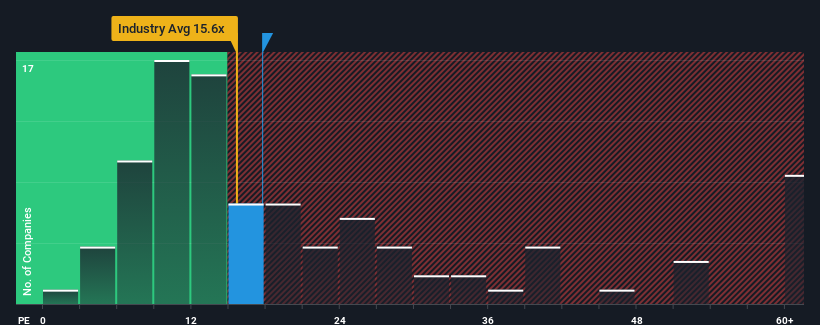

Since its price has surged higher, given around half the companies in Japan have price-to-earnings ratios (or "P/E's") below 14x, you may consider Broadmedia as a stock to potentially avoid with its 17.7x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Broadmedia could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Broadmedia

Does Growth Match The High P/E?

Broadmedia's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 38%. Still, the latest three year period has seen an excellent 379% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings growth is heading into negative territory, declining 4.5% over the next year. With the market predicted to deliver 11% growth , that's a disappointing outcome.

With this information, we find it concerning that Broadmedia is trading at a P/E higher than the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

The Bottom Line On Broadmedia's P/E

Broadmedia shares have received a push in the right direction, but its P/E is elevated too. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Broadmedia's analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a poor outlook with earnings heading backwards, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You need to take note of risks, for example - Broadmedia has 4 warning signs (and 1 which is a bit unpleasant) we think you should know about.

Of course, you might also be able to find a better stock than Broadmedia. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Broadmedia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4347

Broadmedia

Engages in information technology and content distribution business in Japan.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives