- Japan

- /

- Electronic Equipment and Components

- /

- TSE:8157

Tsuzuki Denki (TSE:8157) Net Profit Margin Jumps, Reinforcing Bullish Community Narratives

Reviewed by Simply Wall St

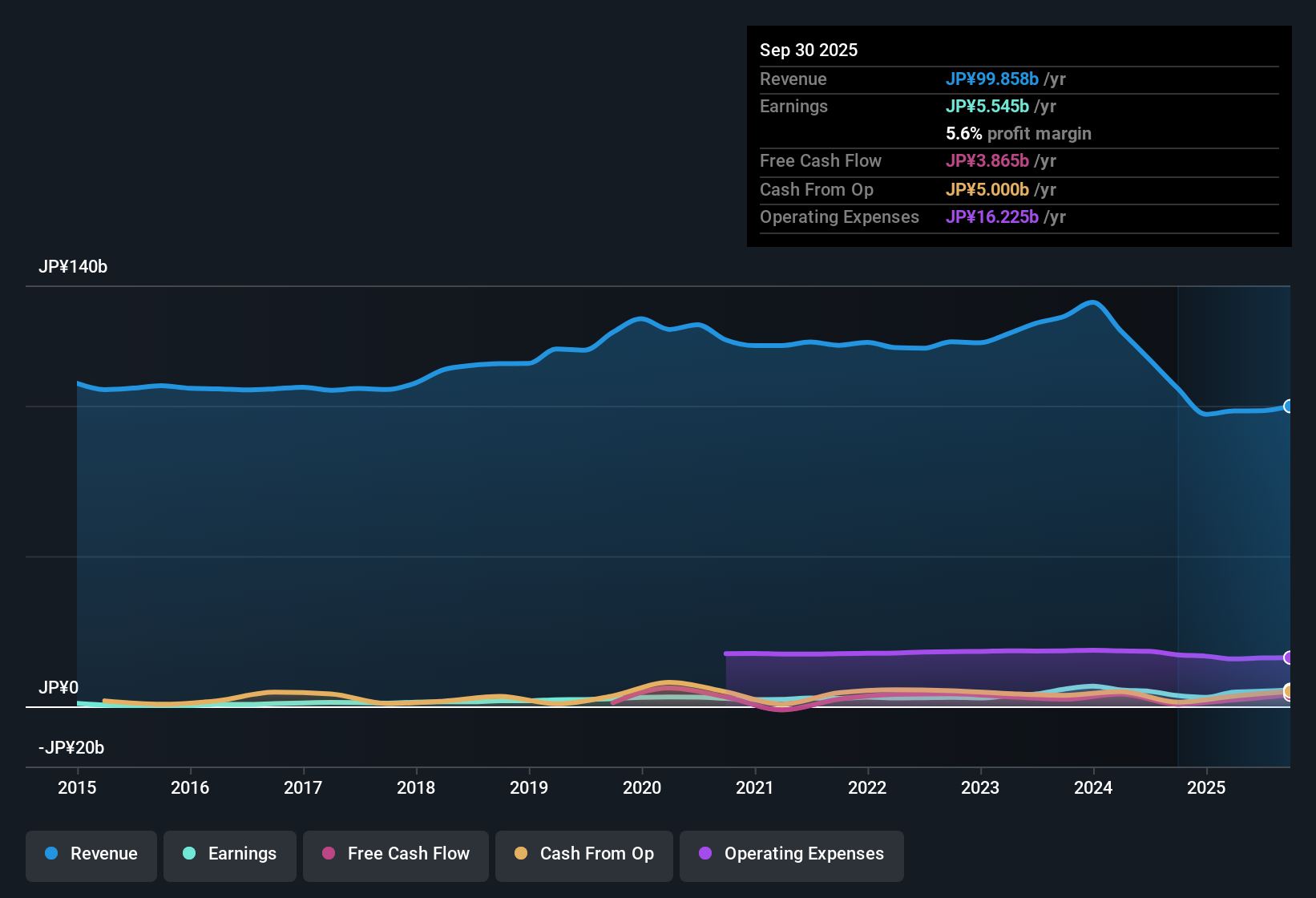

Tsuzuki Denki (TSE:8157) delivered a net profit margin of 5.6%, rising from 3.4% a year ago, and posted impressive EPS growth of 53.7% over the past twelve months. Over the last five years, earnings have grown at an average annual rate of 16.3%, reflecting a consistent upward performance trend. With a Price-To-Earnings Ratio of 10.3x, well below both the JP Electronic industry average of 15.6x and the peer average of 12.5x, the results suggest that the company is delivering high-quality earnings while still trading at a relative valuation discount.

See our full analysis for Tsuzuki Denki.The next section takes these headline figures and compares them to the broader narratives that investors are following. This provides a clearer sense of whether sentiment and story are truly anchored in the numbers.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Firm Up, Dividend Stability in Focus

- Net profit margin climbed to 5.6% from 3.4% the previous year, a notable improvement that has not yet been matched by commentary on dividend reliability.

- Recent margin strength strongly supports the optimistic view that Tsuzuki Denki’s core business is executing well. However,

- the company’s ability to sustain above-average profits could be tested if dividend payouts face challenges,

- as margin gains have outpaced any updates on dividend sustainability, raising a key point for ongoing performance evaluation.

Pace of Long-Term Growth Stands Out

- Earnings have maintained a robust average annual growth rate of 16.3% over five years, indicating durable operational momentum beyond the latest reporting period.

- This growth record gives weight to prevailing arguments for Tsuzuki Denki’s “defensive” reputation in the IT solutions sector.

- Steady compounding attracts investors seeking stability when broader tech markets fluctuate,

- yet the lack of major new catalysts may keep growth perceptions measured even as historical performance outpaces many peers.

Valuation Gap Relative to Sector Appealing

- The company’s 10.3x Price-To-Earnings ratio is well below the JP Electronic industry average of 15.6x and the peer average of 12.5x, making shares appear discounted against comparable businesses at a current price of ¥3,160.

- Compared to broader digital transformation trends lifting sector averages, this pricing presents

- an opportunity for those who see margin and growth durability as underappreciated by the market,

- while risk-conscious investors may remain attentive to whether the valuation discount persists if profit and dividend trends hold over time.

See what the community is saying about Tsuzuki Denki See what the community is saying about Tsuzuki Denki

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Tsuzuki Denki's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite solid profit margin gains, Tsuzuki Denki’s lack of commentary on dividend reliability raises ongoing questions about the stability of shareholder payouts.

If stable and growing income streams are critical for you, consider focusing on companies with a proven record of payout reliability and strength using these these 1999 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tsuzuki Denki might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8157

Tsuzuki Denki

Engages in the design, development, construction, and maintenance of network and information systems.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives