- Japan

- /

- Electronic Equipment and Components

- /

- TSE:8154

3 Reliable Dividend Stocks Offering Yields Up To 5.4%

Reviewed by Simply Wall St

As global markets continue to experience record highs, with indices like the Dow Jones Industrial Average and S&P 500 reaching new peaks, investors are navigating a landscape influenced by geopolitical factors and domestic policy changes. In such an environment, dividend stocks stand out for their potential to offer steady income streams; they are particularly appealing when market volatility is a concern and interest rates fluctuate.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.28% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.20% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.69% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.91% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.25% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.31% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.98% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.86% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.87% | ★★★★★★ |

Click here to see the full list of 1947 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Topy Industries (TSE:7231)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Topy Industries, Limited operates in the steel, automotive, and industrial machinery components sectors in Japan with a market capitalization of ¥43.40 billion.

Operations: Topy Industries, Limited generates revenue from its Steel Business with ¥127.57 billion and Automobile & Industrial Machinery Parts with ¥193.90 billion.

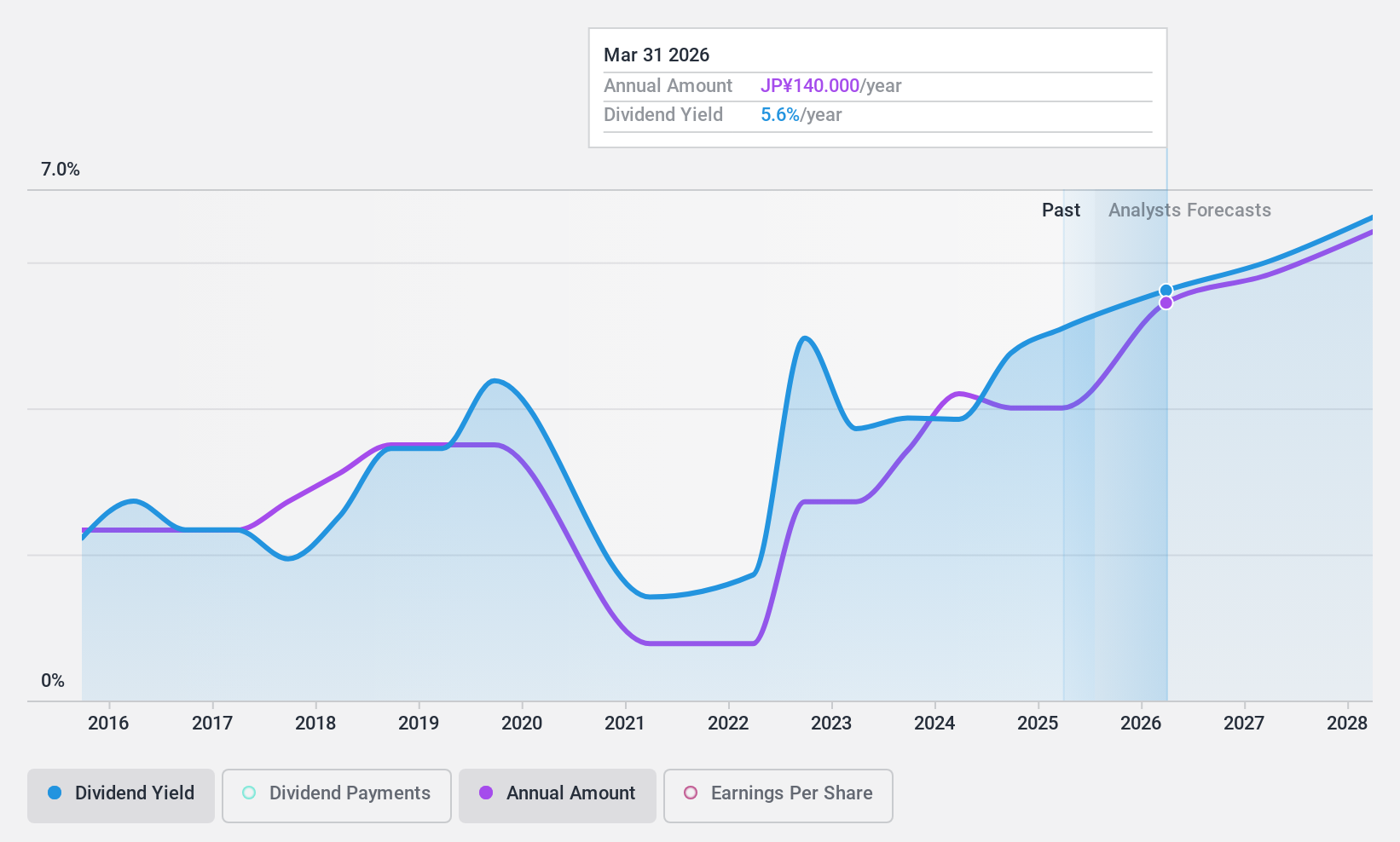

Dividend Yield: 5.4%

Topy Industries' dividend yield of 5.41% ranks in the top 25% of JP market payers, with an earnings payout ratio of 81.6% and a cash payout ratio of 18.9%, indicating dividends are well-covered by cash flows but less so by earnings. Despite a history of volatile and unreliable dividends, payments have grown over the past decade. Recent guidance cuts due to lower sales volumes may impact future payouts, though current dividends remain affirmed at ¥30 per share.

- Click here to discover the nuances of Topy Industries with our detailed analytical dividend report.

- The analysis detailed in our Topy Industries valuation report hints at an inflated share price compared to its estimated value.

Kamei (TSE:8037)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kamei Corporation is a general trading company operating both in Japan and internationally, with a market cap of approximately ¥60.81 billion.

Operations: Kamei Corporation's revenue is primarily derived from its Energy Business at ¥279.10 billion, followed by the Overseas/Trade Business at ¥86.78 billion, Automotive Related Business at ¥75.29 billion, Construction-Related Business at ¥52.50 billion, Food Business at ¥36.26 billion, Pharmacy Business at ¥19.71 billion, and Pet-Related Business at ¥13.97 billion.

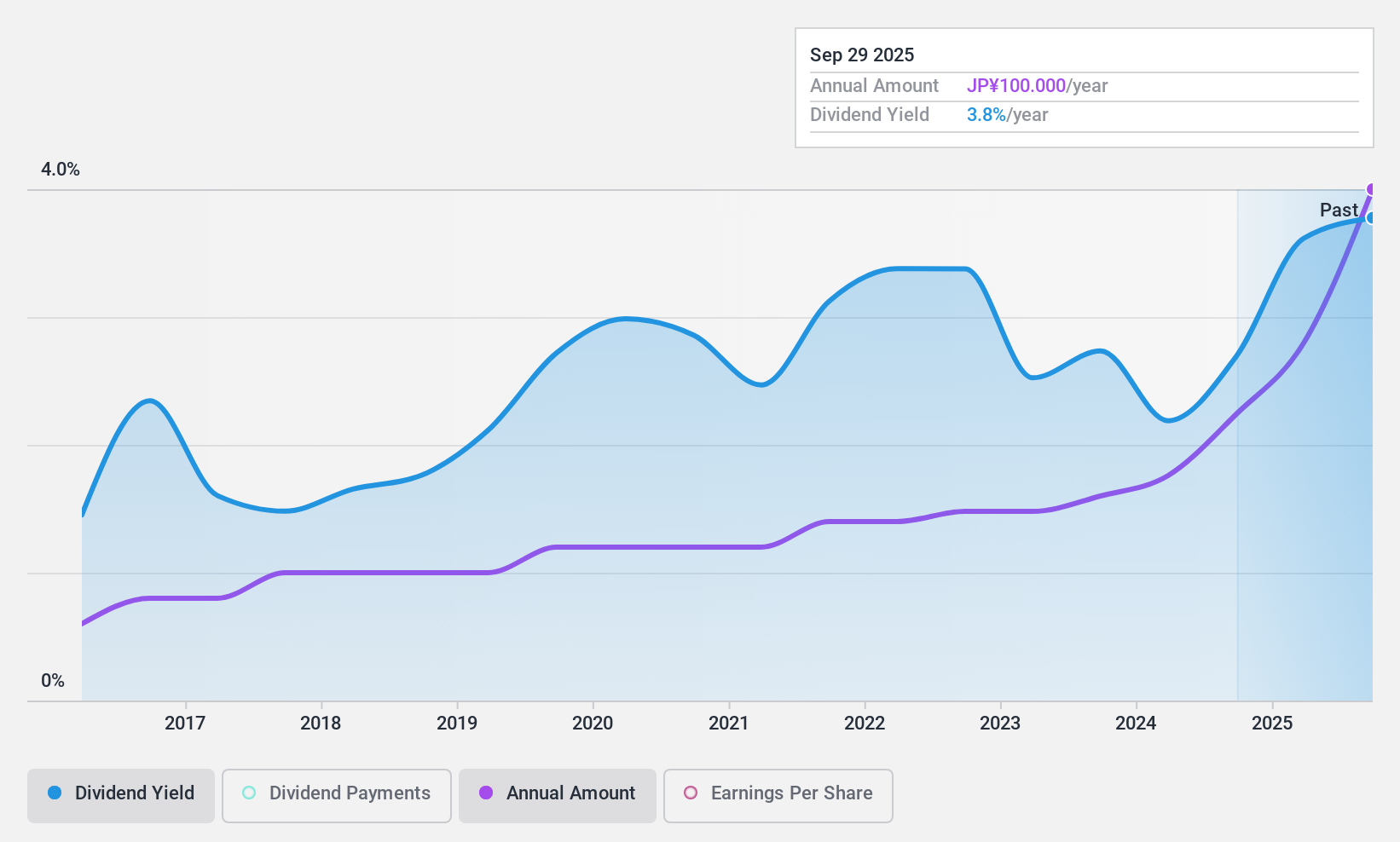

Dividend Yield: 3%

Kamei offers a dividend yield of 2.99%, below the top 25% in Japan, but maintains stability with consistent growth over the past decade. The company's dividends are well-covered by earnings and cash flows, with payout ratios of 18.6% and 7.6%, respectively, ensuring sustainability. Despite trading significantly below its estimated fair value, Kamei's reliable dividend history makes it a steady choice for income-focused investors seeking long-term stability rather than high yields.

- Delve into the full analysis dividend report here for a deeper understanding of Kamei.

- Our valuation report here indicates Kamei may be undervalued.

Kaga ElectronicsLtd (TSE:8154)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kaga Electronics Co., Ltd. is engaged in the sale of electronic parts, semiconductors, PCs, and peripherals across Japan, North America, Europe, and Asia with a market cap of ¥142.32 billion.

Operations: Kaga Electronics Co., Ltd. generates revenue through the distribution of electronic components, semiconductors, computers, and related accessories across various regions including Japan, North America, Europe, and Asia.

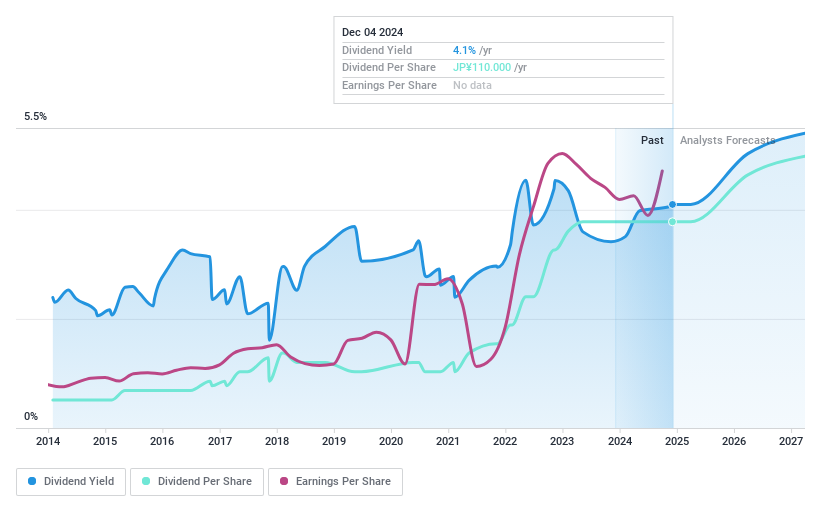

Dividend Yield: 4.1%

Kaga Electronics provides a dividend yield of 4.1%, placing it in the top 25% of Japanese dividend payers. Despite past volatility and an unstable track record, recent dividends have increased over the decade. With low payout (12.8%) and cash payout (20.3%) ratios, dividends are well-covered by earnings and cash flows, ensuring sustainability. Trading at 59.5% below estimated fair value suggests potential for capital appreciation alongside income generation from dividends.

- Get an in-depth perspective on Kaga ElectronicsLtd's performance by reading our dividend report here.

- The analysis detailed in our Kaga ElectronicsLtd valuation report hints at an deflated share price compared to its estimated value.

Make It Happen

- Investigate our full lineup of 1947 Top Dividend Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kaga ElectronicsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8154

Kaga ElectronicsLtd

Sells electronics parts, semiconductors, PCs, and peripherals in Japan, North America, Europe, and Asia.

Flawless balance sheet, undervalued and pays a dividend.