December 2024's Noteworthy Stocks That May Be Priced Below Fair Value Estimates

Reviewed by Simply Wall St

As global markets continue to reach record highs, buoyed by robust trading activity and positive economic indicators, investors are navigating a landscape shaped by geopolitical developments and domestic policy shifts. Amidst this environment, identifying stocks that may be undervalued can offer opportunities for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| HangzhouS MedTech (SHSE:688581) | CN¥62.38 | CN¥124.04 | 49.7% |

| Pan African Resources (AIM:PAF) | £0.3735 | £0.75 | 49.9% |

| Iguatemi (BOVESPA:IGTI3) | R$2.25 | R$4.49 | 49.8% |

| West Bancorporation (NasdaqGS:WTBA) | US$23.33 | US$46.41 | 49.7% |

| Elekta (OM:EKTA B) | SEK61.50 | SEK122.95 | 50% |

| Adtraction Group (OM:ADTR) | SEK38.40 | SEK76.45 | 49.8% |

| Pluk Phak Praw Rak Mae (SET:OKJ) | THB15.50 | THB30.86 | 49.8% |

| Privia Health Group (NasdaqGS:PRVA) | US$21.66 | US$43.17 | 49.8% |

| Genesis Minerals (ASX:GMD) | A$2.41 | A$4.82 | 50% |

| Akeso (SEHK:9926) | HK$66.50 | HK$132.56 | 49.8% |

Here we highlight a subset of our preferred stocks from the screener.

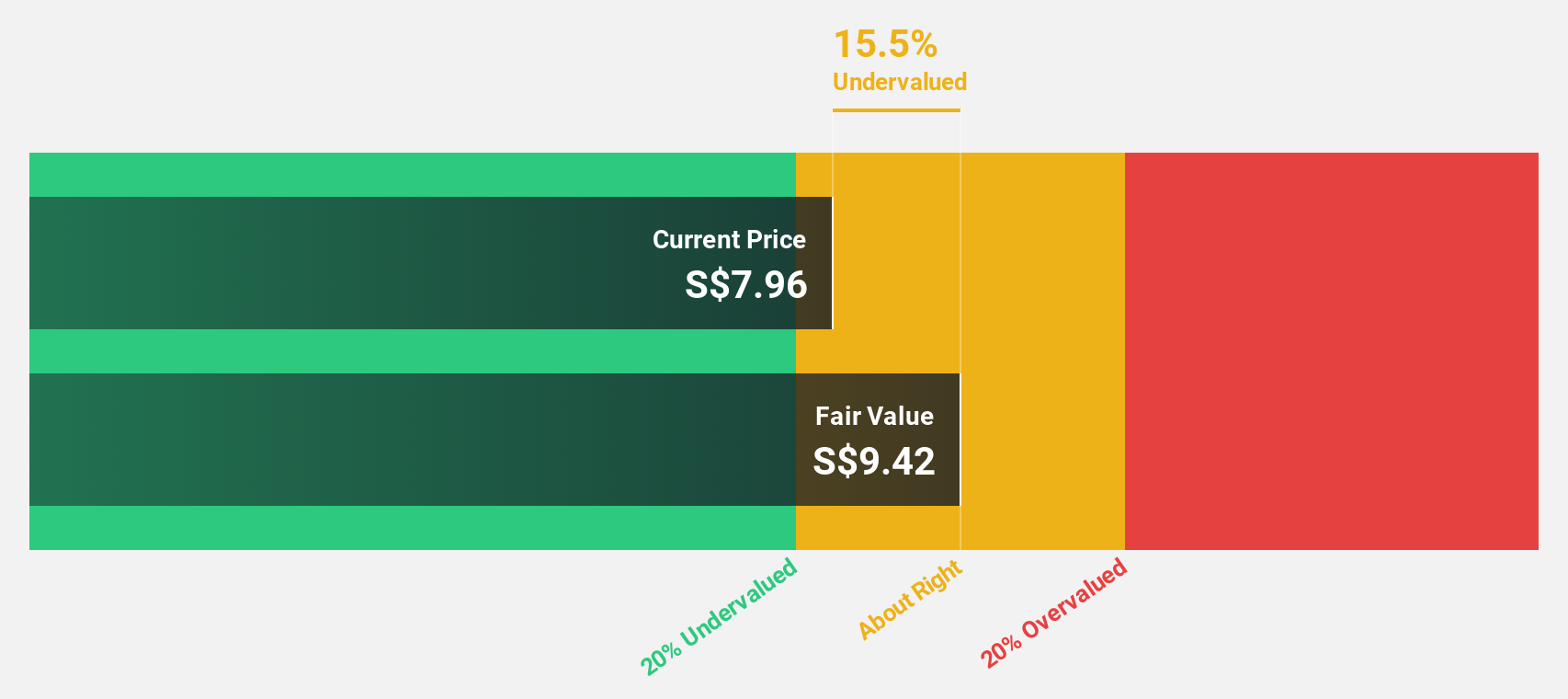

Singapore Technologies Engineering (SGX:S63)

Overview: Singapore Technologies Engineering Ltd is a global technology, defence, and engineering company with a market cap of SGD14.17 billion.

Operations: The company generates revenue from three main segments: Commercial Aerospace (SGD4.34 billion), Urban Solutions & Satcom (SGD2.01 billion), and Defence & Public Security (SGD4.54 billion).

Estimated Discount To Fair Value: 34.4%

Singapore Technologies Engineering is trading at S$4.59, significantly below its estimated fair value of S$7, suggesting potential undervaluation. Despite a forecasted earnings growth rate of 11.9% annually, outpacing the Singapore market's 11.3%, revenue growth remains moderate at 6.4%. However, debt coverage by operating cash flow is inadequate, and its dividend history is unstable. Recent board changes include Ms. Lien Siaou-Sze joining the Audit Committee to enhance governance oversight.

- The analysis detailed in our Singapore Technologies Engineering growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Singapore Technologies Engineering.

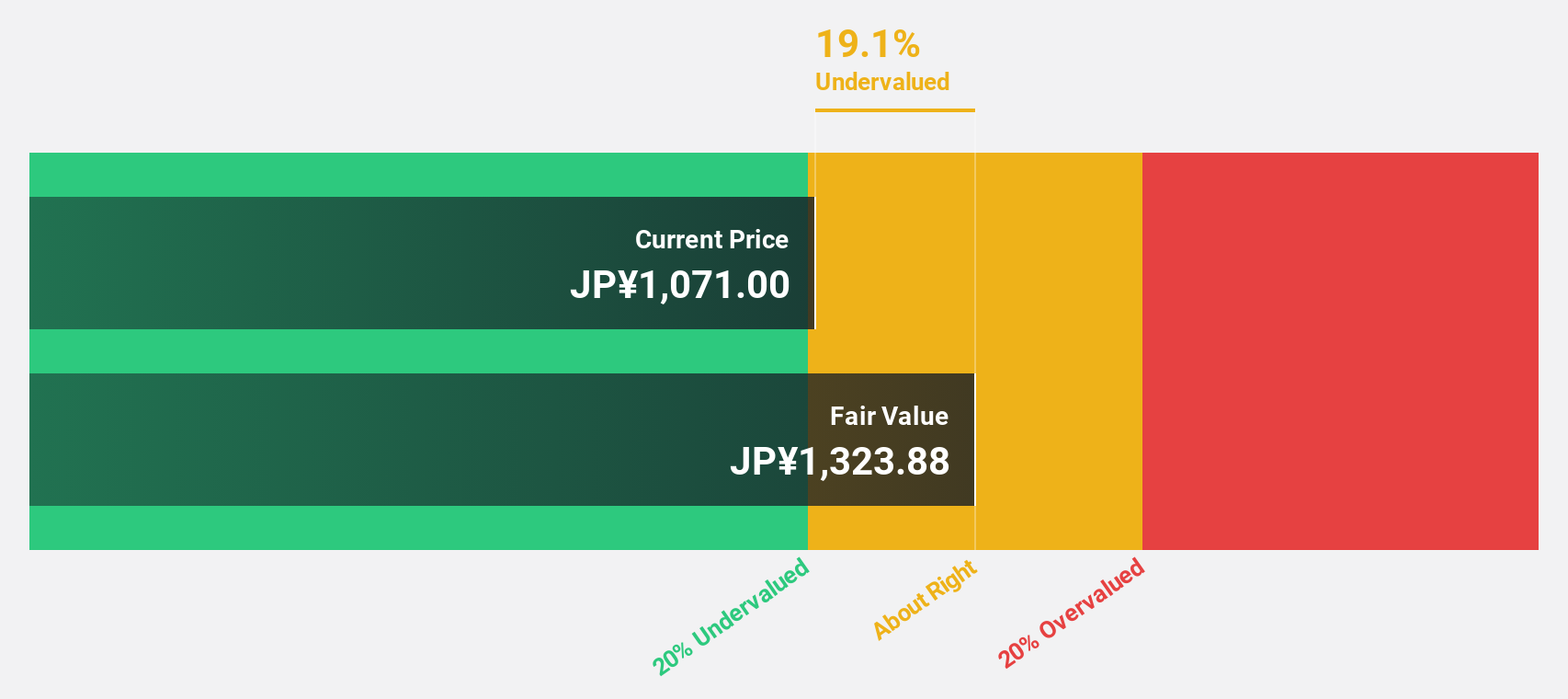

JAC Recruitment (TSE:2124)

Overview: JAC Recruitment Co., Ltd. operates as a recruitment consultancy business in Japan with a market cap of ¥113.22 billion.

Operations: The company's revenue segments include the Domestic Recruitment Business generating ¥33.46 billion, Overseas Business contributing ¥3.74 billion, and the Domestic Job Offer Advertising Business with ¥390 million.

Estimated Discount To Fair Value: 32%

JAC Recruitment, trading at ¥721, is significantly undervalued compared to its estimated fair value of ¥1060.58, indicating potential for appreciation. The company offers a reliable dividend yield of 3.61% and has completed a share buyback worth ¥1,486 million. Earnings are expected to grow 19.2% annually, outpacing the Japanese market's growth rate of 7.8%, although revenue growth is slower than ideal at 16.2% per year.

- Our earnings growth report unveils the potential for significant increases in JAC Recruitment's future results.

- Navigate through the intricacies of JAC Recruitment with our comprehensive financial health report here.

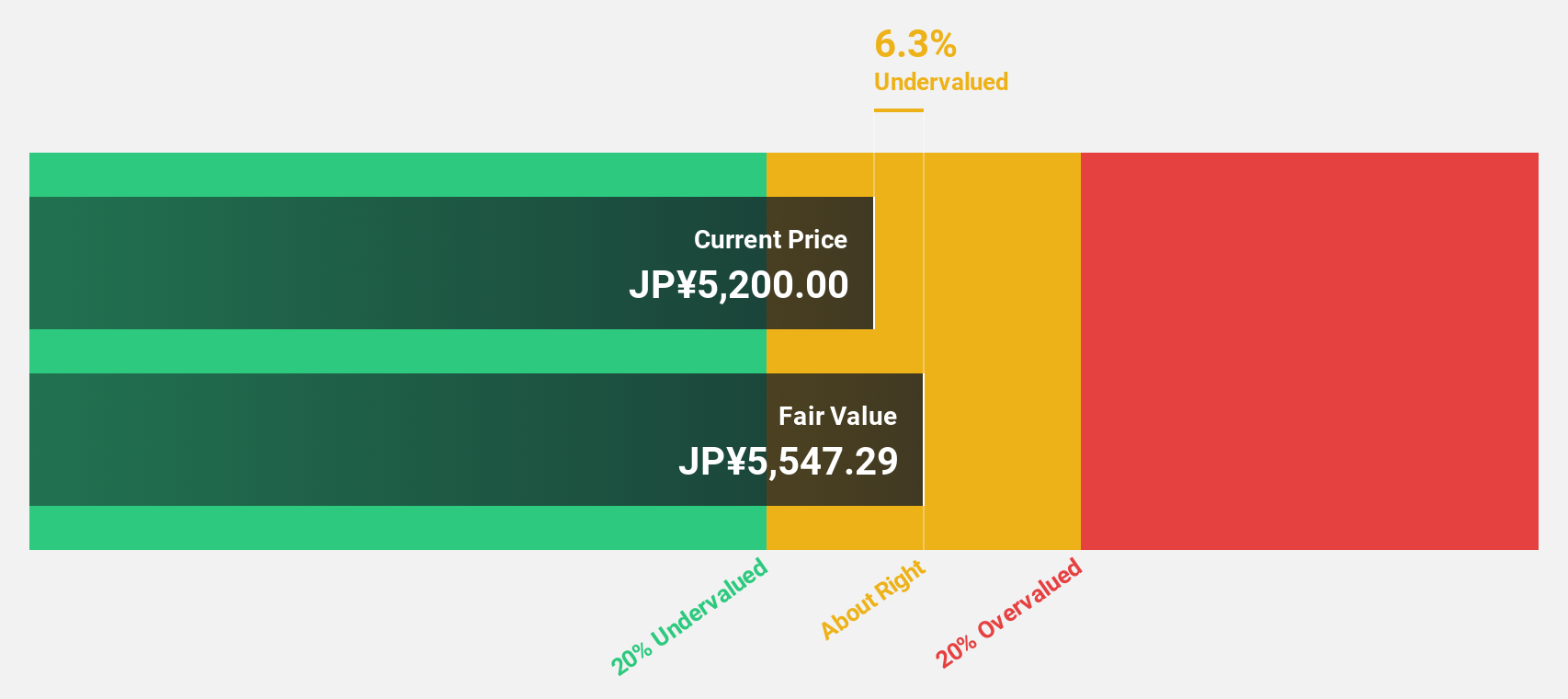

DTS (TSE:9682)

Overview: DTS Corporation offers systems integration services in Japan and has a market capitalization of approximately ¥179.19 billion.

Operations: The company's revenue is derived from three main segments: Platform & Services with ¥29.38 billion, Business & Solutions contributing ¥49.81 billion, and Technology & Solutions generating ¥42.66 billion.

Estimated Discount To Fair Value: 11.2%

DTS Corporation, trading at ¥4,285, is undervalued relative to its fair value estimate of ¥4,761.24. Despite slower revenue growth forecasted at 6.8% annually and earnings growth of 12.3%, the company outpaces the Japanese market averages. A recent share buyback program worth ¥5 billion aims to enhance shareholder returns and improve capital efficiency by repurchasing and cancelling 1,600,000 shares by March 2025.

- In light of our recent growth report, it seems possible that DTS' financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of DTS stock in this financial health report.

Where To Now?

- Unlock more gems! Our Undervalued Stocks Based On Cash Flows screener has unearthed 885 more companies for you to explore.Click here to unveil our expertly curated list of 888 Undervalued Stocks Based On Cash Flows.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9682

Flawless balance sheet with reasonable growth potential and pays a dividend.