- Japan

- /

- Tech Hardware

- /

- TSE:7752

Assessing Ricoh (TSE:7752) Valuation After 2024 Share Price Slide

Reviewed by Simply Wall St

Ricoh Company (TSE:7752) has recently caught the eye of investors, prompting a closer look at its stock's performance and valuation. Over the past month, shares have dipped nearly 5 percent, leading some to reassess growth prospects.

See our latest analysis for Ricoh Company.

Zooming out from this month's drop, Ricoh's share price has struggled to regain momentum during 2024 and is now down more than 23 percent year-to-date. Still, looking at the bigger picture, the 5-year total shareholder return stands at an impressive 128 percent. This shows that long-term holders have seen significant gains even as recent sentiment has cooled and risk perceptions shift.

If you’re weighing your next move, now might be the perfect chance to discover fast growing stocks with high insider ownership.

But with a 23 percent loss so far this year and five-year gains still intact, is Ricoh’s current valuation signaling an attractive entry point? Or is the market already reflecting all its future growth potential?

Price-to-Earnings of 12.4x: Is it justified?

Ricoh Company trades at a price-to-earnings (P/E) ratio of 12.4x, which is below both its peers and industry averages. At the last close of ¥1,327.5, the stock looks undervalued according to this key metric.

The P/E ratio measures how much investors are willing to pay for each yen of the company’s earnings. In the technology sector, it is a widely used gauge of whether a stock is priced too high or represents a value opportunity based on current profitability.

Ricoh's P/E of 12.4x is notably lower than the peer group average of 14.2x and the broader JP Tech industry average of 14.4x. The figure is also well below the estimated fair P/E ratio of 18.5x. This suggests the market may not be fully valuing Ricoh’s earnings potential, and that the company could re-rate if sentiment or results improve.

Explore the SWS fair ratio for Ricoh Company

Result: Price-to-Earnings of 12.4x (UNDERVALUED)

However, persistently slow revenue growth and a nearly 20 percent one-year total return loss could weigh on sentiment and stall any near-term recovery.

Find out about the key risks to this Ricoh Company narrative.

Another View: Discounted Cash Flow Perspective

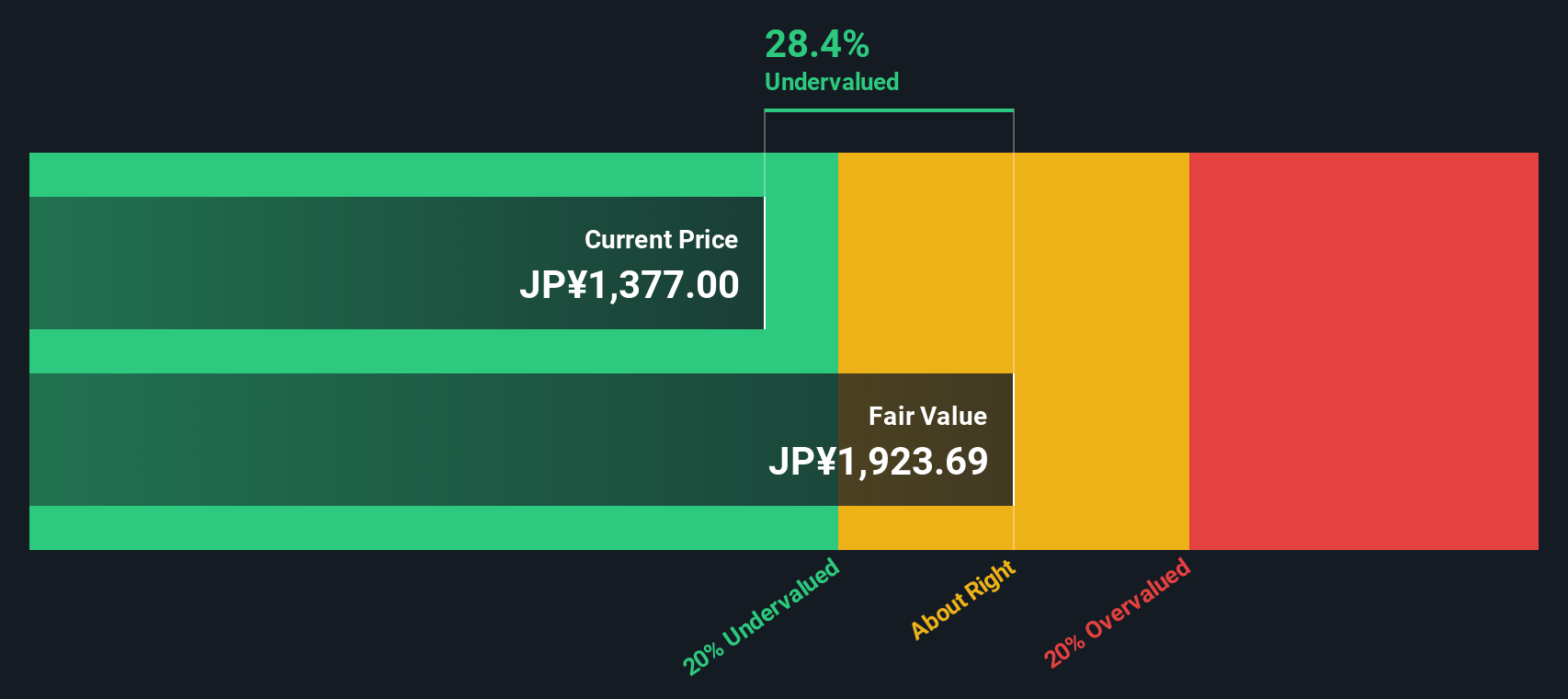

Looking at Ricoh Company through the lens of our DCF model provides another angle. The SWS DCF model estimates Ricoh's fair value at ¥1,909.78 per share, which is about 31 percent above the current market price. This suggests a significant degree of undervaluation compared to the stock's recent performance. Might the market be overlooking Ricoh’s true long-term potential, or is there a reason for the cautious sentiment?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ricoh Company for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ricoh Company Narrative

If you’d like to dig deeper or form your own conclusions, you can easily craft a personal Ricoh Company story in just a few minutes. Do it your way

A great starting point for your Ricoh Company research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take your investing strategy further and seize new opportunities using Simply Wall Street’s powerful Screener. Don’t let the next big winner pass you by.

- Capture higher yields by checking out these 16 dividend stocks with yields > 3% delivering consistent income with attractive payout ratios and strong balance sheets.

- Position yourself at the forefront of healthcare innovation with these 32 healthcare AI stocks focusing on breakthroughs in AI-driven diagnostics, patient care, and biotech advances.

- Boost your portfolio’s tech exposure and profit from disruption by tapping into these 25 AI penny stocks with potential to transform industries and drive exponential growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7752

Ricoh Company

Develops, manufactures, and sells digital products and services in Japan, the Americas, Europe, the Middle East, Africa, China, South East Asia, and Oceania.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives