- Japan

- /

- Tech Hardware

- /

- TSE:7751

Canon (TSE:7751) Valuation in Focus After Earnings Outlook Cut and Tariff Concerns

Reviewed by Simply Wall St

Canon (TSE:7751) updated its earnings guidance for 2025, lowering profit expectations in response to ongoing global uncertainty and new tariffs. The company still anticipates stronger product sales as the year-end season approaches.

See our latest analysis for Canon.

Canon’s revised outlook comes after a turbulent spell for its stock. The 2025 guidance shift contributed to a muted tone in recent trading, with the 1-year total shareholder return down nearly 10%, and the share price sitting at ¥4,383. Despite this pullback, Canon’s five-year total return of nearly 184% still signals serious long-term growth, even as near-term momentum has faded a bit.

If Canon’s resilience through industry headwinds has you rethinking your watchlist, this could be the perfect moment to explore fast growing stocks with high insider ownership.

With shares pulling back and future earnings expectations tempered, the question is whether Canon’s current valuation offers a genuine bargain or if the market already anticipates a return to stronger growth ahead.

Price-to-Earnings of 23.9x: Is it justified?

Canon currently trades at a price-to-earnings ratio of 23.9x, putting it at a premium to direct peers and the broader JP Tech sector. The last close price of ¥4,383 reflects this higher-than-average valuation compared to industry norms.

The price-to-earnings ratio is a cornerstone metric that measures how much investors are willing to pay for each yen of Canon’s earnings. A higher ratio like 23.9x generally signals optimism around future growth or quality, but it can also point to an overheated stock if earnings fundamentals do not support it.

While Canon’s ratio is above that of its peer group (14x) and the wider JP Tech industry (14.4x), the market may be factoring in recent earnings volatility, future growth potential, and the company’s track record. However, compared to the estimated fair price-to-earnings ratio of 24.4x, Canon is actually aligned with where valuations could trend if positive forecasts are realized.

Explore the SWS fair ratio for Canon

Result: Price-to-Earnings of 23.9x (OVERVALUED)

However, persistent global uncertainty and lower earnings growth could limit Canon's upside, particularly if tariffs remain in place or if demand in the tech sector weakens.

Find out about the key risks to this Canon narrative.

Another View: Discounted Cash Flow Model

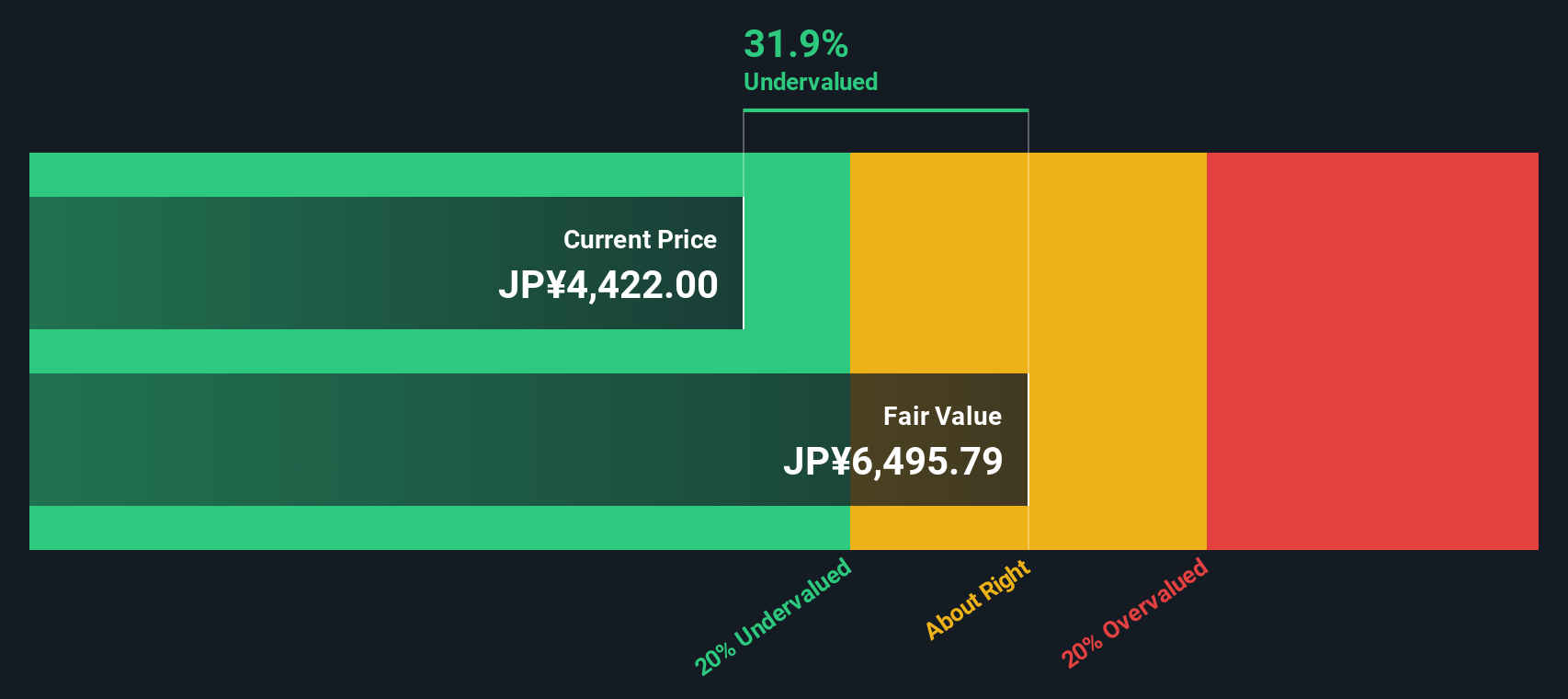

Looking at Canon from a different angle, our DCF model suggests something quite different from the earlier multiples approach. By estimating the present value of all future cash flows, the SWS DCF model values Canon at ¥6,358. This means the current share price trades 31% below this fair value. Is the market overlooking Canon’s long-term earning power, or is the discount a sign to be cautious?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Canon for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 859 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Canon Narrative

Keep in mind, if you have your own perspective or want to dig into the numbers on your own terms, you can craft a complete view in just a few minutes, Do it your way.

A great starting point for your Canon research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Give your portfolio a real advantage by actively seeking out companies beyond household names. The Simply Wall Street Screener uncovers hidden opportunities and fresh directions for your investment strategy.

- Tap into technology’s future by assessing the companies making breakthroughs in artificial intelligence with these 25 AI penny stocks.

- Boost potential returns with steady income streams by checking out these 17 dividend stocks with yields > 3% offering yields above 3%.

- Ride the next wave of financial evolution and harness potential from market disruptors using these 82 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7751

Canon

Manufactures and sells office multifunction devices (MFDs), laser and inkjet printers, cameras, medical equipment, and lithography equipment in Japan, the Americas, Europe, and Asia and Oceania.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives