- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7745

Investors Still Aren't Entirely Convinced By A&D HOLON Holdings Company, Limited's (TSE:7745) Earnings Despite 31% Price Jump

Despite an already strong run, A&D HOLON Holdings Company, Limited (TSE:7745) shares have been powering on, with a gain of 31% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 77% in the last year.

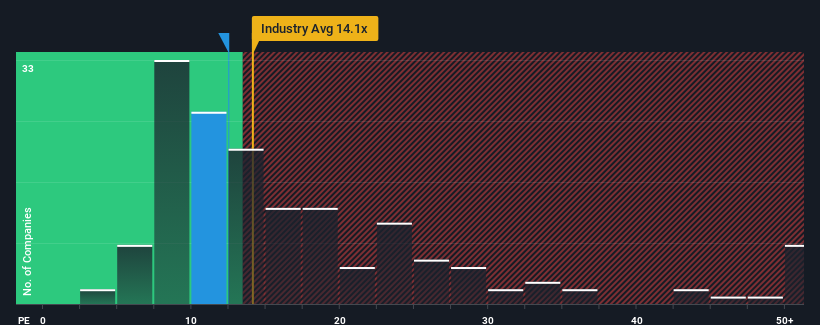

In spite of the firm bounce in price, given about half the companies in Japan have price-to-earnings ratios (or "P/E's") above 15x, you may still consider A&D HOLON Holdings Company as an attractive investment with its 12.5x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

There hasn't been much to differentiate A&D HOLON Holdings Company's and the market's earnings growth lately. One possibility is that the P/E is low because investors think this modest earnings performance may begin to slide. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

See our latest analysis for A&D HOLON Holdings Company

How Is A&D HOLON Holdings Company's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like A&D HOLON Holdings Company's to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 7.0% last year. The latest three year period has also seen a 26% overall rise in EPS, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 12% during the coming year according to the two analysts following the company. Meanwhile, the rest of the market is forecast to expand by 11%, which is not materially different.

In light of this, it's peculiar that A&D HOLON Holdings Company's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Bottom Line On A&D HOLON Holdings Company's P/E

A&D HOLON Holdings Company's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of A&D HOLON Holdings Company's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for A&D HOLON Holdings Company with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7745

A&D HOLON Holdings Company

Provides measurement technologies and products.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives