- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7723

Aichi Tokei Denki (TSE:7723): Earnings Growth Surges, Reinforcing Bullish Narratives on Operational Quality

Reviewed by Simply Wall St

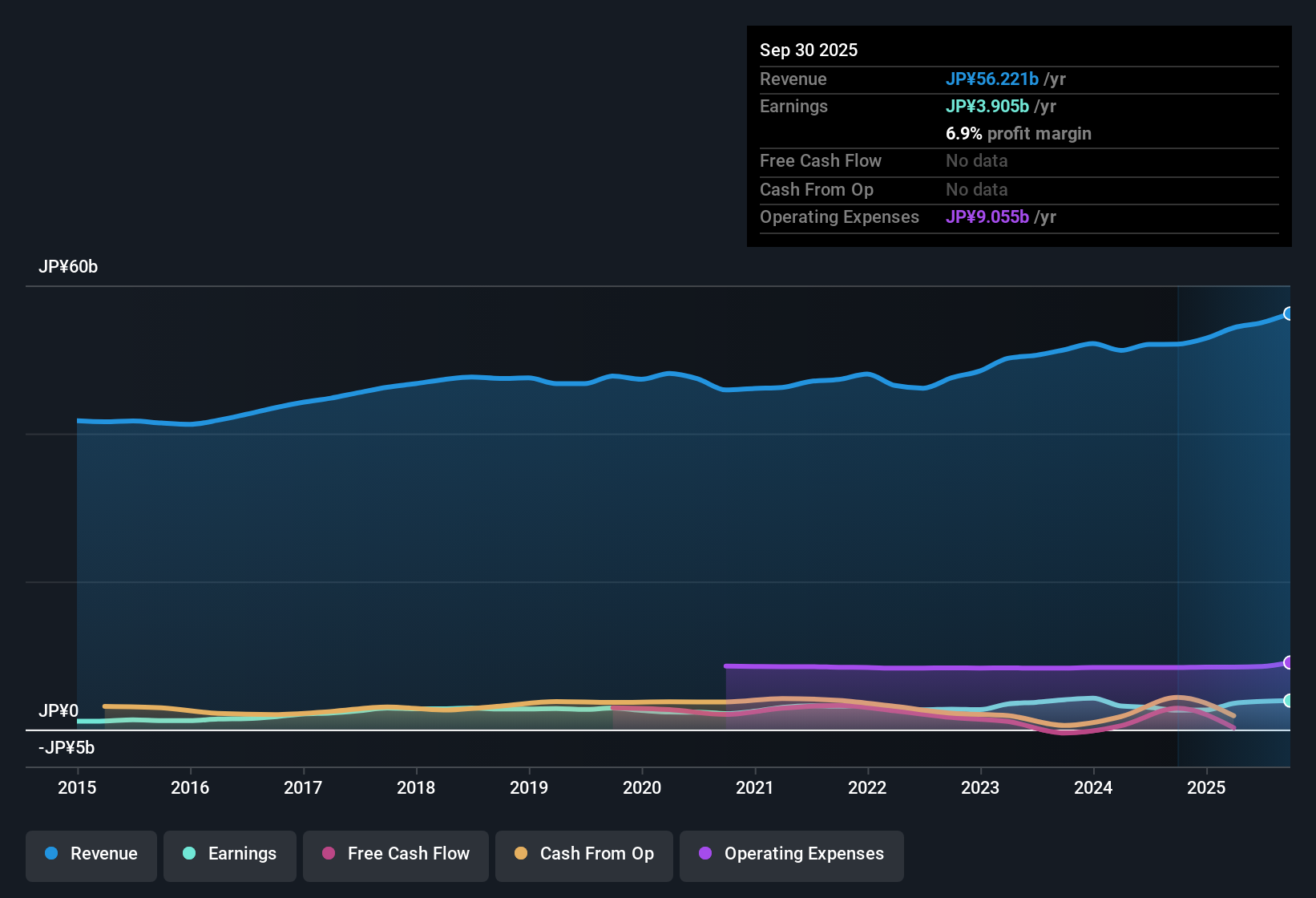

Aichi Tokei Denki (TSE:7723) delivered earnings growth of 27.2% over the past year, far exceeding its 5-year average pace of 5.2% per year. Profit margins climbed to 6.9% from 5.7% last year, signaling improved net profitability for shareholders.

See our full analysis for Aichi Tokei Denki.Now, it’s time to see how these headline results measure up against the current narratives. Are the stories around Aichi Tokei Denki holding up, or do the numbers challenge conventional wisdom?

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Strengthen to 6.9%

- The company’s net profit margin rose to 6.9%, up from 5.7% last year, pointing to improved profitability per yen of revenue compared to historical trends.

- Despite relatively modest earnings growth averaging 5.2% annually over five years, the most recent jump in margin fits the prevailing market view that Aichi Tokei Denki is benefiting from steady operational improvements rather than relying on outsized or volatile drivers.

- This script of gradual progress is reinforced by consistently high-quality earnings, as mentioned in the EDGAR summary.

- With no major negative headlines or acute cost spikes flagged, bulls might be encouraged by how operational stability is now translating directly into shareholder returns.

Dividend Sustainability Remains a Watch Point

- Dividend stability is raised as the only key risk, despite the company delivering above-average earnings growth in the latest period.

- Bears argue that even with profit margins improving and industry standing intact, the sustainability of dividend payouts is not guaranteed. This is a vital point for investors seeking predictable income.

- This skepticism comes amid generally stable results and operational strengths, but reminds investors to scrutinize payout ratios and cash flow rigorously rather than assuming dividends will keep pace with net income.

- Shareholders focused on yield and consistency may prefer continued evidence of cash discipline before relaxing on this front.

Price-to-Earnings Ratio Offers Industry Discount

- Aichi Tokei Denki’s price-to-earnings ratio sits at 10.7x, firmly below the wider Japanese electronics sector average of 15.3x, signaling relative value at the current share price of 2646.0.

- The prevailing market view highlights how this valuation, while only a small discount to immediate peers (peer average 10.1x), may appeal to investors seeking a combination of earnings quality and sector resilience without paying industry-topping multiples.

- The low multiple reflects a market that rewards steady performance but remains hesitant to pay up for slow-moving growth.

- This blend of reasonable value and consistent results may be attractive to conservative buyers who prize both predictability and a modest entry price.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Aichi Tokei Denki's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Even with stronger earnings and margin gains, ongoing uncertainty about the reliability of future dividend payouts remains a key concern for income-focused investors.

If you want peace of mind that your dividends are more likely to keep flowing, consider these 1984 dividend stocks with yields > 3% as a smarter way to find reliable income opportunities right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7723

Aichi Tokei Denki

Engages in the provision of water and gas meters, and related equipment in Japan and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives